As an experienced financial analyst, I’ve closely monitored the cryptocurrency market over the past week, and the bearish trend that emerged last week was a stark reminder of the inherent volatility in this asset class. Bitcoin (BTC) plunging below $65,000 was a significant blow to the entire market, leading to substantial selloffs and a reduction of over $70 billion from the global crypto market cap.

Last week, bearish forces intensified, causing me to observe substantial selling pressure that pushed Bitcoin (BTC) beneath the crucial $65,000 mark for the first time in over a month. The downward trend reverberated across the market, leading to extended periods of loss.

As a result, the entire crypto market underwent significant selling, resulting in a loss of over $70 billion and causing the global market capitalization to dip below $2.4 trillion, closing the week at $2.35 trillion.

Based on their on-chain activities and social buzz, here are the leading cryptocurrencies worth keeping an eye on this week.

AVAX hits yearly low

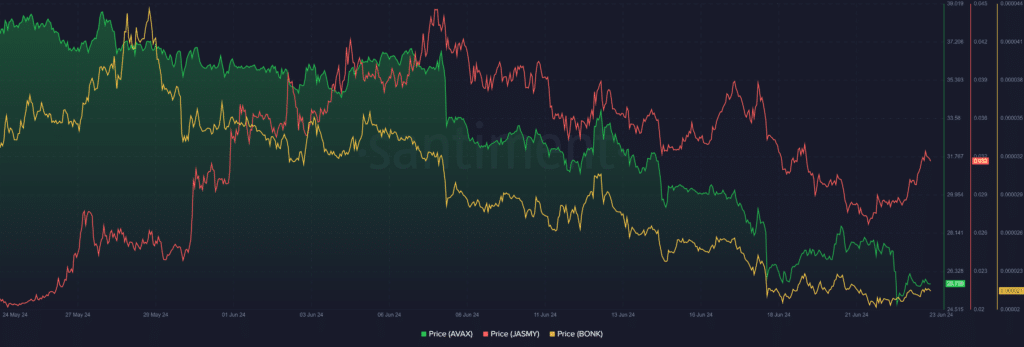

As a researcher studying the cryptocurrency market, I’ve observed that Avalanche (AVAX) endured significant setbacks, most notably on June 17 and 18 when market instability escalated. To begin with, AVAX started the week with a modest 0.23% growth, lagging behind Bitcoin’s minimal increase during that period.

Despite Bitcoin’s price plummet leading to a market downturn, Avalanche experienced a significant decline, dropping approximately 12% in just two days to reach a trading price of $26.60 – its lowest point since December last year.

Last week, AVAX experienced two instances where it reached its lowest price point this year. The first occurrence was on June 18, with a new low of $24.94. Subsequently, on June 22, the price dipped further to reach a new minimum value of $24.52.

Last week, the value of the asset declined by 14.66%, ending the week at $25.61. This represented a significant decrease of 33% since the beginning of the year for Avalanche (Avalanche). Nevertheless, the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (CCI), which stood at 25.15 and -138.2 respectively, indicate that the asset is heavily oversold and could potentially bounce back.

JASMY retests lower Bollinger Band

JasmyCoin (JASMY) experienced more significant price increases than others during market upturns. For example, it surged by 12.33% on June 16, whereas Bitcoin and other assets barely moved.

JASMY experienced a four-day losing streak, resulting in a significant drop of 25%. On June 20, the price dipped down to reevaluate the lower Bollinger Band level at $0.0296.

As a crypto investor, I’ve witnessed an impressive rally from the asset, which managed to break above the lower resistance band with a substantial 8.52% increase on June 22. This uptick was crucial in helping JASMY regain some of the value that had been lost previously. However, despite this progress, last week brought about a setback, resulting in a 7.46% decline.

As an analyst, I observe that JasmyCoin’s price is still beneath the 20-day Exponential Moving Average (EMA) at $0.03540, signifying the asset’s persistent bearish trend, despite any late-hour market recuperation.

BONK collapses

Among the top cryptocurrencies this week, Bonk (BONK) stands alone as a meme coin and has experienced more pronounced price drops compared to other coins due to its greater volatility.

Following a 3% gain on June 16, the bears triggered a 17% crash in BONK’s price on June 17 and 18.

After a significant decline, BONK stabilized but continued to trend downward even after being added to Bitstamp’s platform. The cryptocurrency ended the week with a 15.6% decrease in value. For BONK to shift its trend to bullish, it needs to surpass the 23.6% Fibonacci retracement level ($0.00002543) and move above the 50-day moving average ($0.00002637).

As an analyst, I would interpret a significant breach of this level as potentially granting the bulls sufficient momentum to challenge the resistance at $0.00002909. This resistance aligns with the 38.2% Fibonacci retracement level, making it a crucial hurdle for any upside movement. Overcoming this barrier could pave the way toward reaching the psychologically significant price territory of $0.00003.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-23 23:00