As a researcher with a background in cryptocurrencies and finance, I’ve been closely monitoring the recent downturn in the Bitcoin (BTC) market. The consistent price declines over the past two weeks have put BTC in an undervalued zone, with the asset dipping by 3.2% in the last 24 hours to trade at $62,300. This is the first time in six weeks that Bitcoin has fallen below the $63,000 mark, and its market cap has dropped down to $1.22 trillion.

Over the last fortnight, the value of Bitcoin (BTC) has been dropping steadily. This decline has caused the price to fall below its usual market value, making Bitcoin an attractive buy for potential investors.

In the previous 24 hours, Bitcoin experienced a 3.2% decrease and is currently priced at $62,300. This marks the first time in six weeks that the digital currency has fallen below the $63,000 threshold. It’s important to note that the cryptocurrency’s market capitalization now stands at $1.22 trillion, a figure last reached on May 15.

In contrast, the daily Bitcoin trading volume experienced a significant increase of 91%, reaching over $17 billion.

As a crypto investor, I’ve observed that U.S. spot Bitcoin exchange-traded funds (ETFs) have experienced six straight days of withdrawals. This trend has intensified the prevailing fear, uncertainty, and doubt (FUD) in the cryptocurrency market.

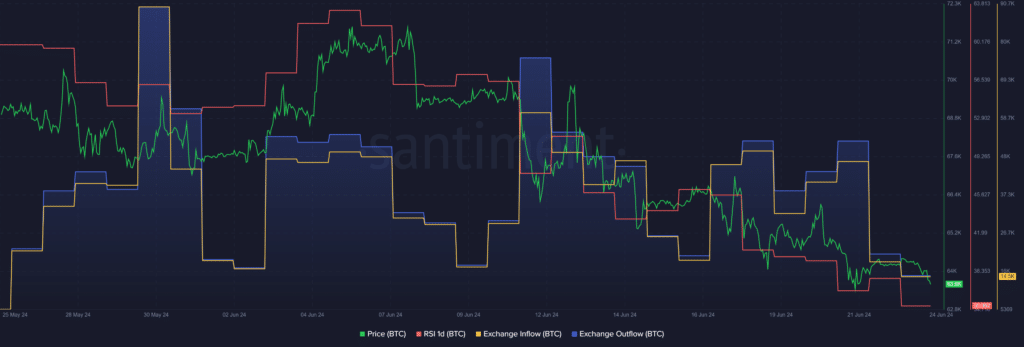

Based on the data I’ve analyzed from Santiment, I’ve found that the relative strength index (RSI) for Bitcoin is now at 35. This figure indicates that Bitcoin has experienced three consecutive weeks of decreases, and according to the RSI, it is currently oversold. The implication of this finding is that a potential price rally for Bitcoin could be on the horizon.

As a crypto investor, I’ve noticed the decreasing Relative Strength Index (RSI) of Bitcoin, which is often seen as a bearish signal. However, I can’t ignore the substantial increase in its daily trading volume. This surge could be an indication that significant price fluctuations are on the horizon. So, while the RSI may be suggesting a downturn, the heightened trading activity could lead to unexpected price movements.

The market intelligence platform’s data reveals that the number of Bitcoin coins entering exchanges decreased from 18,726 to 14,547 within the last 24 hours. Additionally, the number of Bitcoin tokens leaving exchanges dropped from 20,344 to 14,648 during the same period.

At the current price level, investors could be actively purchasing Bitcoin, interpreting the $62,000 price tag as a temporary low for the dominant cryptocurrency.

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2024-06-24 10:12