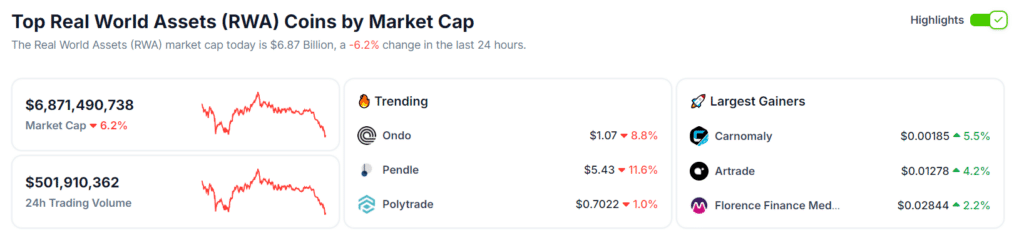

As a researcher with a background in finance and experience following the blockchain industry, I find McKinsey’s projections on the potential market value of tokenized real-world assets (RWAs) intriguing. The projected growth, from around $6.8 billion currently to potentially as much as $4 trillion by 2030, highlights a significant opportunity in this space.

McKinsey, a renowned American consulting firm, estimates that the worth of tokenized real-world assets could grow up to an impressive $4 trillion within the next six years.

In a base scenario, consulting firm McKinsey & Company predicts that the total value of tokenized real-world assets could amount to roughly $2 trillion by the year 2030. However, if market conditions are particularly favorable, this figure could potentially double, reaching a staggering $4 trillion.

In a recent blog post, a New York City-based firm expressed optimism about the widespread adoption of a particular financial trend. They identified mutual funds, bonds, exchange-traded notes (ETNs), loans, securitization, and alternative funds as key drivers. However, I, as an analyst at McKinsey, would approach this with a more cautious perspective. We are less bullish on the projection put forth by the firm.

Analysts predict that the pace and timing of adoption will fluctuate among different asset classes. This disparity is attributable to distinct anticipated advantages, practicality, swiftness of results, and investor risk tolerance.

“Classes of assets with greater market worth, complex value transfer processes, less advanced conventional systems, and reduced trading fluidity stand a higher chance of realizing significant gains through tokenization.”

McKinsey

As an analyst at McKinsey, I acknowledge the possibility that RWAs ( Renewable Energy and Water Assets) might not achieve the expected growth. However, even in this scenario, the market capitalization could rise to approximately $1 trillion from current levels due to the industry’s ongoing development and expansion during its early stages of adoption.

By mid-June, the aggregate value of Real World Assets (RWAs) in the market reached around $6.8 billion based on CoinGecko’s latest figures. A number of newcomers to this domain, like Propy and ONDO Finance, have entered the scene after 2020. Given their relatively recent entry, these startups are currently in their infancy and may witness substantial growth and developments in the time ahead if everything proceeds favorably.

Centrifuge, a protocol established in 2017 for decentralized financing of real-world assets via the blockchain, raised $15 million in Series A funding in the year 2024. Notable investors included ParaFi Capital, Greenfield, Arrington Capital, and Circle Ventures, among others.

McKinsey issues a note of caution despite the optimistic perspective, reminding us that the present situation is still in a state of flux. The risks, as well as the potential benefits, are significant for those who choose to act early. However, there are several challenges yet to be addressed, such as the absence of clear regulations and legal frameworks in numerous regions. Moreover, the necessary infrastructure for wholesale tokenized cash and deposit settlement is still not widely accessible.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-06-24 10:26