As a researcher with experience in the cryptocurrency market, I believe that Bitcoin’s recent price drop is a normal correction within an overall uptrend. The selling pressure started after Bitcoin reached its peak of $72,000 on June 7th, marking a loss of more than 15% of its value over a few weeks. This weakness has also triggered significant declines in altcoins like Turbo, Solana, and Cardano.

As a crypto investor, I’ve noticed that Bitcoin faced significant downward pressure on Monday, extending a bearish trend that began on June 7th when its price reached an all-time high of $72,000.

Bitcoin reached a roadblock at the $60,000 mark, representing a significant drop of over 15% in its worth during recent weeks. This downturn in Bitcoin set off a substantial decline among alternative coins. For instance, Turbo, Solana, and Cardano experienced drops exceeding 20%.

The bullish case for Bitcoin

In the cryptocurrency sector, a pervasive feeling of doubt and apprehension has arisen as the fear and greed index has dropped to 49, a significant decrease from its yearly peak above 90.

Despite some analysts expressing caution, crypto analyst Rekt Fencer remains hopeful in a recent post that Bitcoin will rebound by the end of this year.

He identified several factors that could cause Bitcoin to increase in value. Initially, he pointed out that Bitcoin typically experiences a period of consolidation following a halving event. This consolidation may occur due to the phenomenon called “buying the rumor, selling the fact.”

After the Bitcoin halving in early 2021, when the price was already quite high due to the approval of spot Bitcoin ETFs in January, a period of consolidation has ensued. During this time, investors are holding back and watching for the next significant event or catalyst before making any major moves. In comparison, after previous Bitcoin halvings in 2016 and 2020, the digital currency experienced consolidation periods lasting four and five months respectively.

Rekt pointed out three primary factors contributing to the recent market consolidation: first, the summer season is typically a time of sluggish activity; second, the Ethereum ETF’s uncertainty casts a shadow over the market; and third, there seems to be a lack of clear direction in the market. Furthermore, the market sentiment has been quite pessimistic, with news stories like Germany allegedly offloading $3 billion in Bitcoin and ETF investments experiencing nearly $1 billion in withdrawals.

As a researcher, I hold the conviction that Bitcoin’s price will rebound in due time. Several factors could potentially trigger this recovery. Firstly, the upcoming US election could serve as a catalyst, with President Trump expressing his support for digital currencies. Secondly, key central banks are expected to implement interest rate cuts, which historically has led to increased investor appetite for higher-risk assets like Bitcoin. Lastly, the approval of Ether ETFs could provide an additional boost to the cryptocurrency market as a whole, including Bitcoin.

“Experts in cryptocurrencies” have declared that Bitcoin and altcoins are facing their demise. However, they’re overlooking a significant factor. I’ve delved deep into the data, and what I’ve uncovered is bound to astonish you. 🧵: The timeline and reasons for Bitcoin and altcoins’ massive surge ahead.

— Rekt Fencer (@rektfencer) June 22, 2024

Altcoins like Ethereum, Solana, IOTA, and Hedera Hashgraph to benefit

As an analyst, I’ve observed that Rekt holds the conviction that various altcoins, including meme coins such as Bonk, Pepe, and Floki, will experience growth parallel to Bitcoin’s rebound. Historically, altcoins have often displayed superior performance during bull markets compared to Bitcoin itself.

The SEC’s indication that it will approve most, if not all, ETF applications for Ethereum could significantly boost its price. This approval is expected to cause an influx of funds similar to what Bitcoin experienced a few months ago. Notably, the amount of Ethereum held in exchanges is currently decreasing, suggesting that investors are holding onto their assets rather than selling them on the open market.

The approval of Ethereum ETFs by the SEC could positively impact Solana’s price. Given its size and liquidity among altcoins, it’s anticipated that businesses will pursue Solana ETF filings. Just recently, 3iQ Digital Asset Management applied for North America’s first Solana ETF in Toronto.

As an analyst, if his assessment holds true, it implies that coins such as IOTA, Hedera Hashgraph, and Zilliqa will bounce back in value.

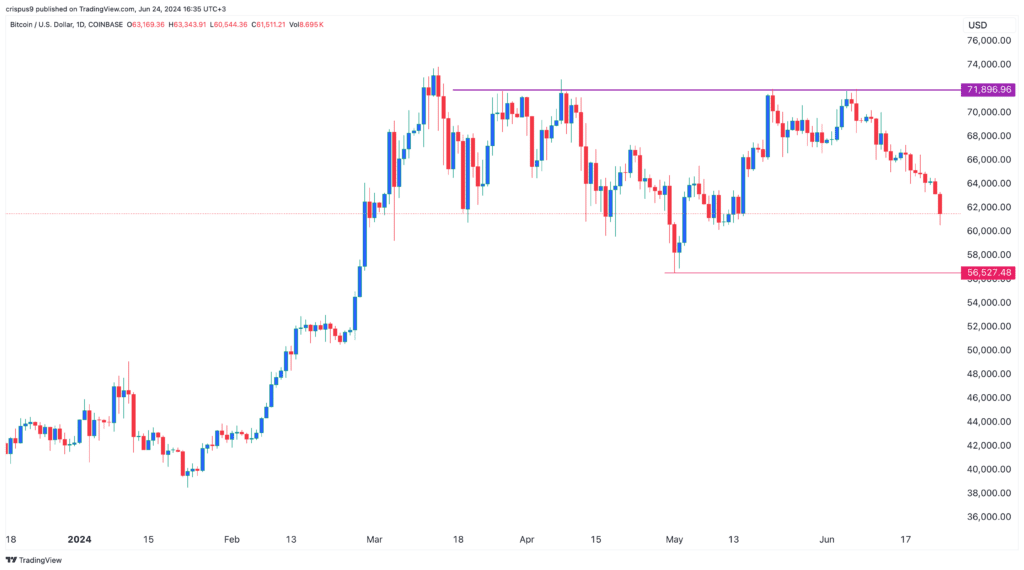

Bitcoin price chart

As a researcher studying the cryptocurrency market, I must acknowledge that there are potential risks to my bullish outlook on Bitcoin (BTC) and altcoins. A significant concern is the triple-top chart pattern that has formed for Bitcoin around $72,000. Historically, this pattern has often been a bearish indicator. Should Bitcoin break below the neckline at $56,520, it could be a sign of further price declines.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

2024-06-24 16:58