As a seasoned crypto investor with several years of experience under my belt, I’ve seen my fair share of market volatility and price drops. However, the recent sell-off in Milady Meme Coin (LADYS) and JasmyCoin (JASMY) has left me feeling a mix of frustration and caution.

On Monday, the prices of Milady Meme Coin (LADYS) and JasmyCoin (JASMY) dipped down to significant points of stability in the face of a widespread sell-off affecting the cryptocurrency market as a whole.

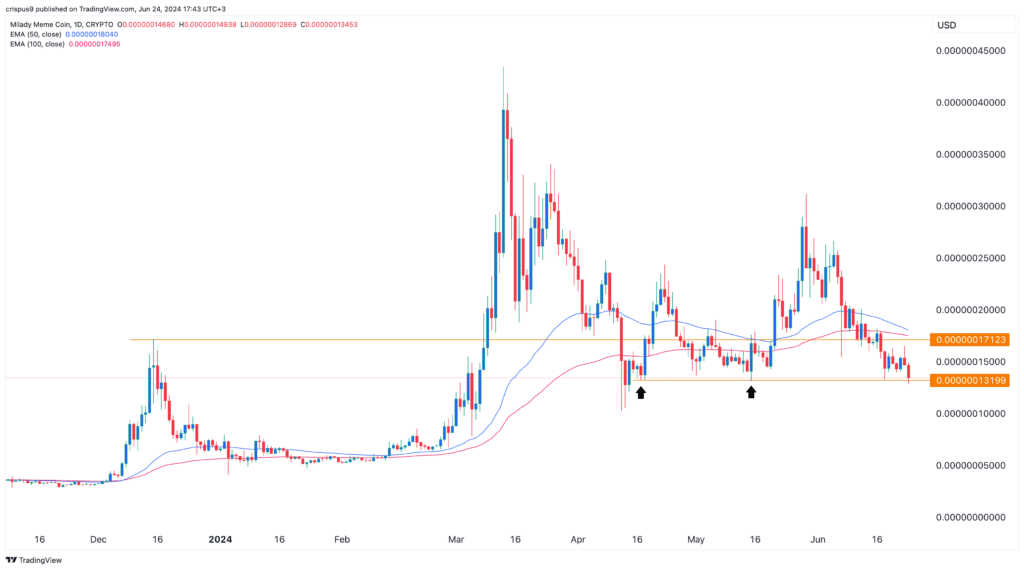

The price of Milady Meme Coin reached a low of $0.0000001292 on Monday, representing a 68% decrease from the year-to-date high. Conversely, Jasmy touched a low of $0.02757. A detailed examination reveals that both cryptocurrencies have plunged to significant support levels. The figure below illustrates that Milady Meme Coin’s lowest point on Monday aligns with its previous lowest points on April 17th and May 15th. Dropping below this level would suggest bearish dominance, potentially leading to further declines.

Milady Meme Coin price chart

Jasmy, often referred to as Japan’s equivalent of Bitcoin, dipped to a significant support point. The lowest it reached at $0.02757 was concurrent with the 50-day moving average and the peak in March when Bitcoin hit an all-time high. A decline below this level could indicate that bears have taken control, potentially leading to further decreases.

Futures open interest has dropped

The prices of JASMY and Milady have shifted during a period when the open interest in their futures markets has decreased. According to CoinGlass, Milady’s open interest was $76,000 on Monday, which is significantly lower than its year-to-date peak of nearly $1 million.

As a researcher studying market trends in the cryptocurrency sector, I would describe open interest as a valuable indicator reflecting the number of outstanding futures contracts currently held by traders with active positions. Generally speaking, a larger open interest figure is perceived favorably within the crypto community.

As a researcher, I’ve noticed that the daily trading volume of Milady Meme Coin on all exchanges according to CoinGecko has decreased significantly, now hovering around $7 million. Previously this year, the token saw an average daily trading volume exceeding $30 million.

Jasmy’s fundamental characteristics are aligning with previous patterns. The open interest in its futures market plummeted to more than $40 million, significantly less than the current month’s peak of over $82 million. This is the lowest level since May 27th. Likewise, the daily trading volume has decreased to $150 million from the highest point of $560 million recorded this month.

Jasmy open interest

The selling of Jasmy and Milady Meme Coin has aligned with the crypto fear and greed index reaching a neutral level, concurrently with most cryptocurrencies experiencing a decline. Bitcoin, leading the pack, dropped by more than 15% from its peak this month, causing altcoins like Jasmy and Milady to follow suit in most instances.

There is debate among analysts about whether the downward trend for Bitcoin and altcoins will persist or if an upturn is imminent. While some experts argue for a rebound, such as those who support Bitcoin’s potential recovery, others like Peter Schiff maintain that Bitcoin may keep declining, triggering further selling of altcoins.

MicroStrategy’s stock has dropped approximately 30% since its March peak. Hedge funds that had bet against MicroStrategy ($MSTR) while simultaneously holding Bitcoin may consider covering their long Bitcoin positions and only maintaining their short position in MicroStrategy. By selling their Bitcoin holdings, these funds could amplify their profits and further contribute to the downward trend in MicroStrategy’s stock price.

— Peter Schiff (@PeterSchiff) June 24, 2024

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD MXN PREDICTION

- Grimguard Tactics tier list – Ranking the main classes

- PUBG Mobile heads back to Riyadh for EWC 2025

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

2024-06-24 18:36