As a seasoned crypto investor with a few years under my belt, I’ve experienced market downturns like the one we’re currently witnessing on Solana and other major cryptocurrencies. It’s disheartening to see billions in market cap evaporate within days, but I remain cautiously optimistic about the future.

As a researcher studying the cryptocurrency market, I observed that Solana, a leading memecoin and L1 blockchain network, experienced a significant loss in market capitalization amounting to billions of dollars on Monday. The overall crypto market witnessed a slide of around 4% during this period.

Approximately $3 billion worth of Solana (SOL) value was wiped out, bringing its price down to about $128 – a 10% decrease over the past week and over 50% lower than its all-time high ($259.96) reached in the peak of 2021.

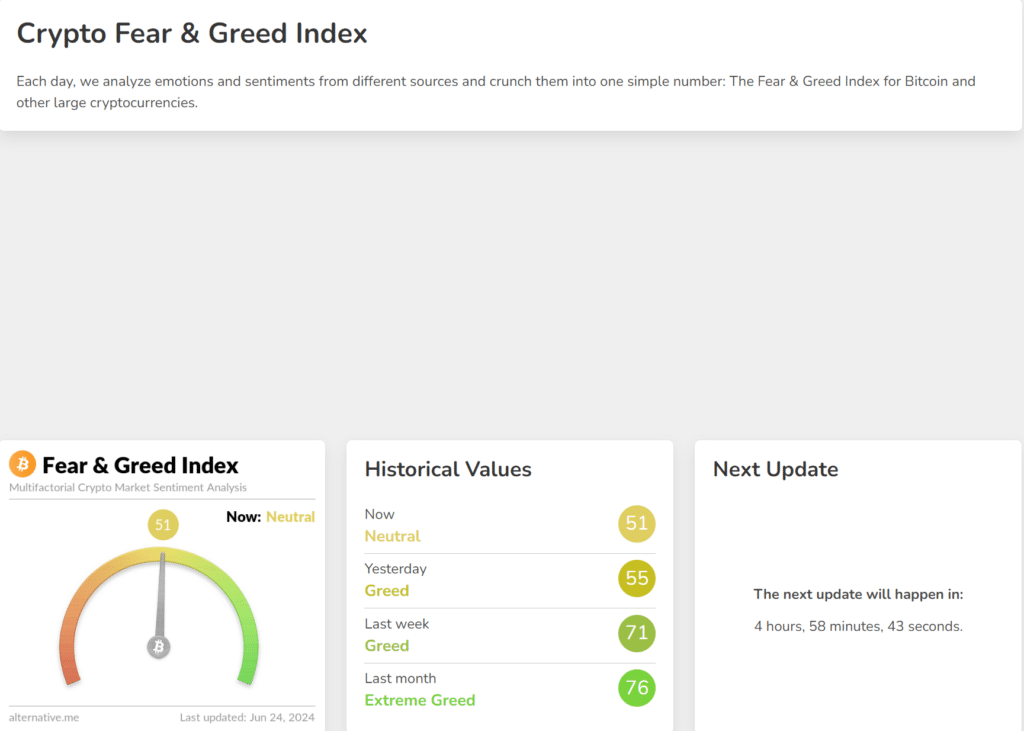

As a researcher studying the cryptocurrency market, I’ve observed a significant decline of up to 10% within the past week for major coins like Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), Ripple (XRP), Toncoin (TON), and Dogecoin (DOGE). This downturn follows a broader market trend. The Crypto Fear & Greed Index recently recorded a neutral level of approximately 51, indicating that the crypto community is uncertain about the future direction of the market – whether it will continue to rise or experience further declines.

Where is the market heading?

As a seasoned crypto investor, I’ve witnessed historical market corrections reaching approximately 30% to 40%. These corrections often occur post-Bitcoin halvings. Consequently, the current market fluctuations come as no shock to me.

According to TradingView’s data, the overall value of the cryptocurrency market has expanded by more than 35% so far this year. In contrast, the S&P500 index has only increased by approximately 15% during the same timeframe.

According to crypto.news, there were inflows into altcoin investments last week. This might suggest that investors and traders with a taste for risk assets are seizing opportunities during market dips to make purchases.

When considering the economic regulation strategies of the Federal Reserve, take into account the following: In spite of the latest FOMC sessions suggesting a more aggressive monetary policy stance, there’s still anticipation for a reduction in interest rates by September.

As a crypto investor, I’m keeping a close eye on the anticipated Securities and Commission (SEC) approval for a spot Ethereum Exchange Traded Fund (ETF). Many industry experts believe that this approval could lead to significant growth in the Ethereum market. However, I understand that some decentralized finance (defi) enthusiasts are skeptical about how an ETF tracking the spot price of Ethereum will benefit the on-chain ecosystem. Instead, they may prefer the decentralized and autonomous nature of defi platforms.

As a researcher studying the cryptocurrency market, I’ve observed that the Bitcoin halving has introduced dynamics that could lead to a supply shock. With the block rewards being reduced in half and an increasing demand for spot Bitcoin Exchange-Traded Funds (ETFs), there may not be enough Bitcoin available to satisfy potential buying pressure. This scarcity is expected to push prices upward according to analysts’ assessments.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-06-24 22:34