As a seasoned crypto investor with a keen interest in AI-related projects, I’ve noticed an intriguing development in the market over the past day. Despite a 6.6% drop in Nvidia stocks, which often serves as a barometer for AI token trends, FET, AGIX, and OCEAN have all experienced significant gains.

The cryptocurrencies linked to artificial intelligence, specifically FET, AGIX, and OCEAN, experienced noteworthy growth in the previous day’s trading session, despite a 6.6% decline in Nvidia’s stock price – a significant player in AI technology that draws close attention from crypto observers.

As I analyze the current crypto market trends, Fetch.ai’s native token, FET, has experienced a significant surge at the time of my assessment. The token’s price has risen by approximately 22% and was trading at $1.66 in the last 24 hours according to CoinMarketCap data. Additionally, there has been a substantial increase in trading volume for FET, reaching over $311.6 million during this period, marking a more than 170% rise. Consequently, FET’s market capitalization has grown to $1.41 billion, placing it as the 60th largest cryptocurrency on the market.

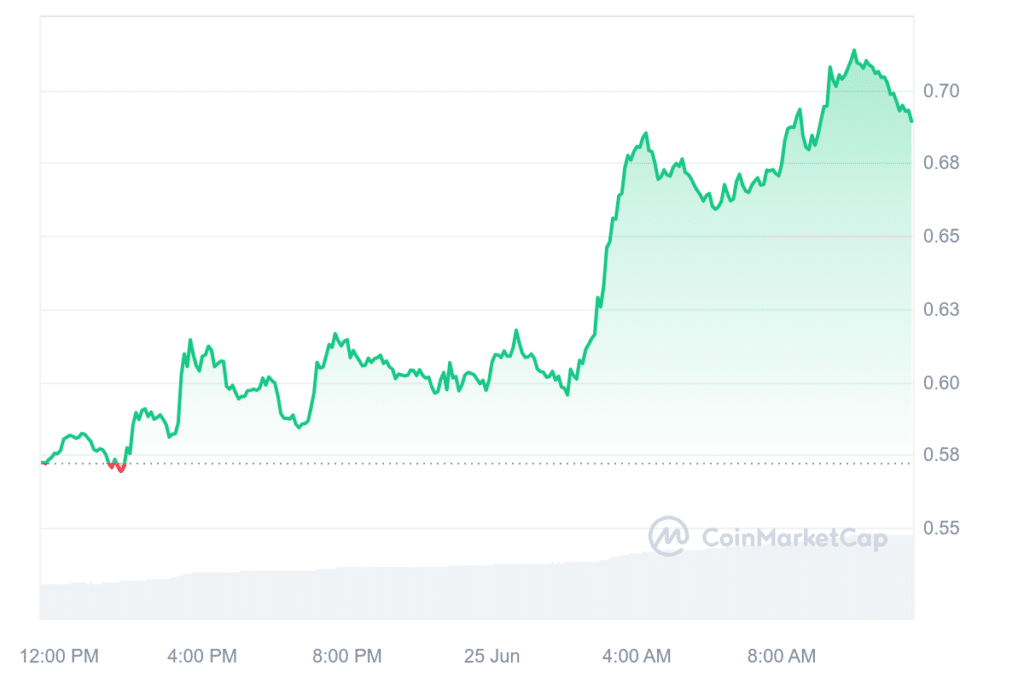

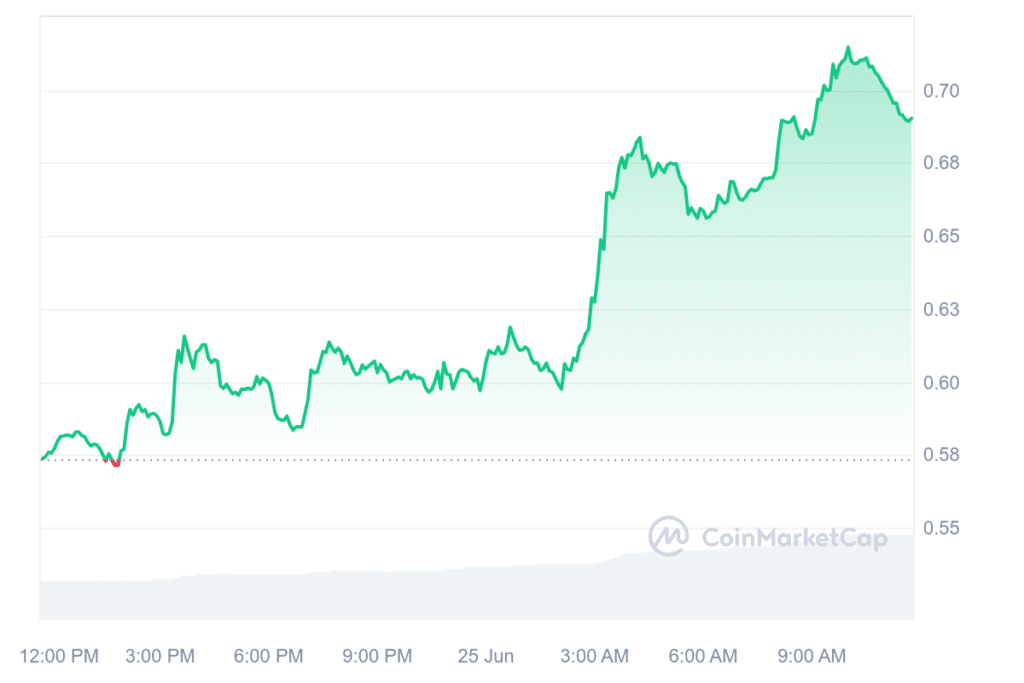

In the last 24 hours, AGIX, the token from SingularityNET, experienced a notable surge, rising by approximately 20.5%. The current price sits at $0.68, while its market capitalization hovers around $890 million. Daily trading volume amounts to $148 million.

The cryptocurrency Ocean Protocol (OCEAN), a component of the Superintelligence Alliance’s token trio, experienced a significant gain of 21% in the past day, reaching a price of $0.69. Its market value currently amounts to $394 million. Notably, the trading volume for OCEAN has increased by an impressive 120% within the last 24 hours, amounting to a substantial $89 million.

As a crypto investor, I’ve noticed that some alternative AI tokens like Render (RNDR) and The Graph (GRT) experienced declines between 12% and 10% respectively, in contrast to my holdings.

As a crypto investor, I’ve noticed an intriguing development: while Nvidia’s stock took a hit, losing 6.68% and ending the day at $118.11 on Monday, the AI token market has experienced a significant surge. This disparity between traditional tech stocks and crypto assets underscores the unique nature of the digital currency realm.

According to Google Finance, the major provider of computer chips for artificial intelligence firms saw a decline of 11.08% in its stock value over the past five business days.

MarketWatch identifies Nvidia, a graphics processor company based in California, as one of the three key players in the field of artificial intelligence. Impressively, Nvidia is working on creating a robust AI platform for businesses.

The surge in AI token prices overlapped with a market adjustment on June 24, triggered by Mt. Gox’s announcement of a planned $9 billion creditor payback in July following the exchange’s collapse.

As a researcher studying the cryptocurrency market, I’ve observed that news relating to Mt. Gox has historically resulted in significant market reactions. For instance, just last month, the price of Bitcoin took a hit, dropping from $70,000 to $68,500 following the revelation that a wallet linked to Mt. Gox had transferred around 140,000 BTC, worth roughly $9 billion, to a new wallet. This action was generally perceived as a preliminary step towards addressing creditor repayments.

The price of Bitcoin dipped below $59,000 after the recent announcement. Currently, BTC is back above $61,000, but it experienced a 2% decrease in value over the last day. Over the past month, Bitcoin has seen a decline of approximately 11%.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-25 10:46