As a seasoned crypto investor with a keen interest in the latest developments within the blockchain ecosystem, I’ve been closely monitoring Kaspa (KAS) and Marathon Digital’s recent moves. The news that Marathon has started mining KAS, diversifying from Bitcoin, has undeniably piqued my curiosity and optimism.

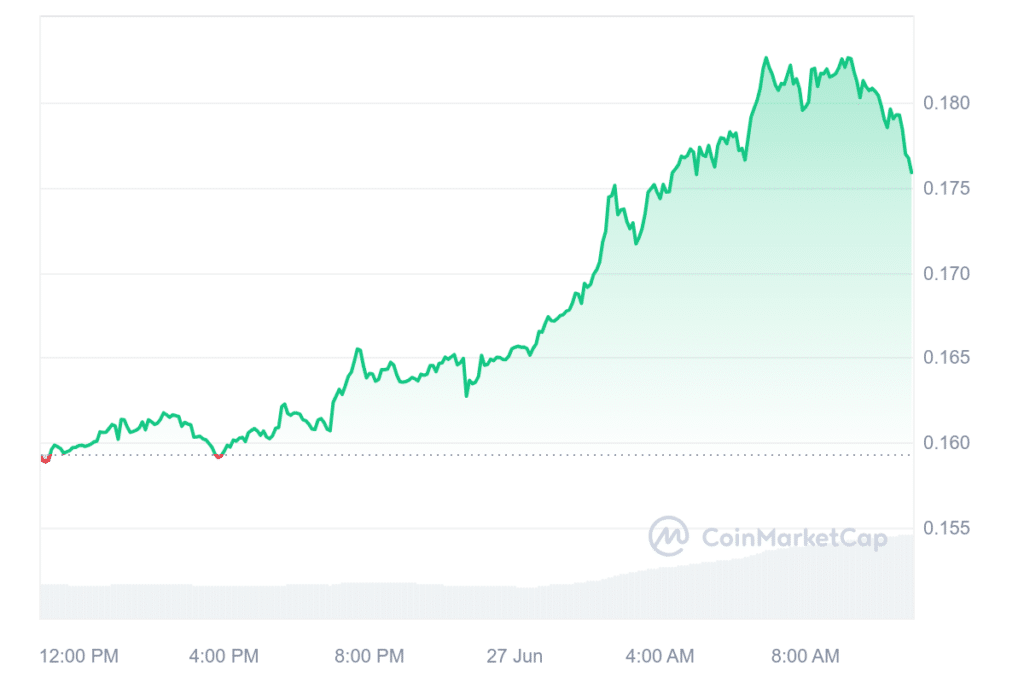

As a crypto investor, I’m excited to share that the value of KAS, the native token of proof-of-work cryptocurrency Kaspa, experienced a significant boost, rising by 13%. This uplift can be attributed to Marathon Digital, a major Bitcoin miner, announcing they have successfully mined over $16 million worth of KAS. By diversifying their mining operations beyond Bitcoin, Marathon Digital’s move is expected to bring more attention and potential demand to the Kaspa project.

Marathon Digital revealed on June 26 that this step allows the company to “take advantage of the increased profitability” offered by Kaspa mining machinery, capable of yielding margins as high as 95% in certain instances.

In today’s announcement, we reveal that we have been aggressively exploring the Kaspa blockchain for its computational potential as part of our diversified approach to energy-focused technology investments. For a comprehensive understanding of this development, please refer to our official press release.

— MARA (@MarathonDH) June 26, 2024

As I pen down this text currently, KAS has witnessed a substantial increase of 145% in trading activity and a 10% hike in value within the past 24 hours. The crypto asset has shown a 20% climb over the last week and a remarkable 26% growth during the previous month. These figures suggest a promising perspective for KAS this month.

I’ve analyzed the latest data from CoinMarketCap and found that Kaspa presently occupies the 24th position in the global cryptocurrency ranking. The current trade price for one KAS token is $0.1759, while its circulating supply hovers around 24.035 billion tokens. Consequently, Kaspa boasts a market capitalization of approximately $4.2 billion.

As a crypto investor, I would describe Kaspa as a digital currency that strives to provide an efficient, expansive, and robust blockchain solution.

The unique aspect of the Layer-1 protocol lies in its implementation of GhostDAG, a proof-of-work consensus mechanism based on the GhostDAG protocol. This innovation results in quicker block times and increased transaction processing capacity compared to standard blockchain systems.

Instead of Bitcoin’s method where only one block can be added to the chain at a time, GhostDAG enables the creation of several blocks simultaneously. This feature enhances transaction processing speed and increases block rewards for miners as suggested by Marathon.

Adam Swick, Marathon’s Chief Growth Officer, highlighted that mining Kaspa provides an alternative income source for the company in relation to Bitcoin. He underscored this point by stating that “it aligns closely with our expertise in handling digital asset computing.”

Marathon began mining Kaspa in September last year after bringing the first mining computer online.

A leading Bitcoin mining company has bought around 60 petahashes worth of KS3, KS5, and KS5 Pro ASICs from Kaspa for mining their tokens. Currently, half of this equipment is in operation, while the remaining portion is planned to be activated during the third quarter.

The company has mined 93 million KAS, which is estimated to be worth approximately $16 million.

The Kaspa token’s price has surged about 50% this year, while Bitcoin’s price has risen by 44%.

As a researcher studying the cryptocurrency market, I’ve noticed that Bitcoin miners have been exploring alternative revenue streams during the crypto winter. With the latest halving event increasing competition among miners, some have chosen to repurpose their existing infrastructure towards supporting artificial intelligence (AI) and other computationally demanding tasks. This approach allows them to generate income even when Bitcoin mining becomes less profitable.

Some miners, like Marathon, have opted to leverage extra aspects of Bitcoin mining to increase their profits.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-06-27 10:52