As a researcher with a background in finance and experience following the cryptocurrency market, I believe that the move by VanEck to file for a Solana ETF was not only expected but also inevitable given the current trends and regulatory climate.

VanEck Wealth Manager broadens its cryptocurrency product lineup by launching a Solana trust.

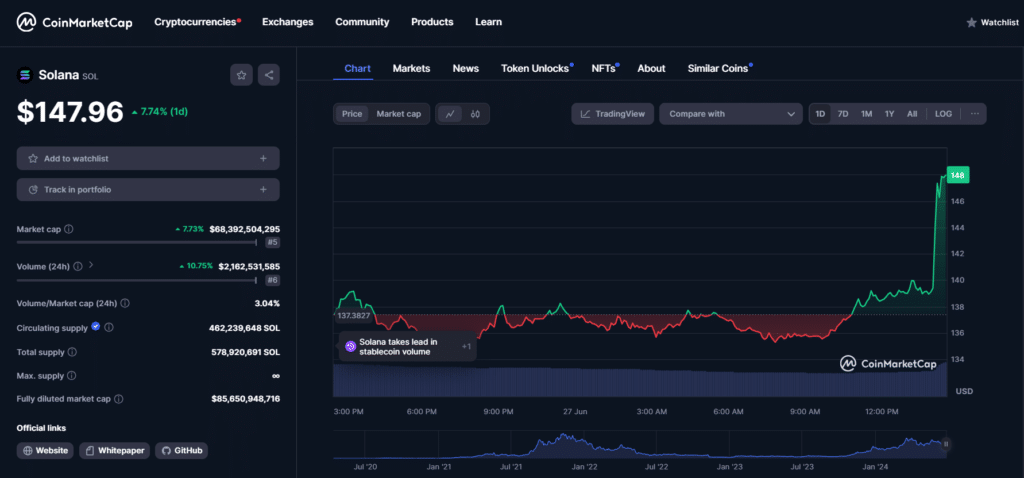

As a crypto investor, I’m always on the lookout for potential new investment opportunities in the digital currency space. Recently, exciting news emerged when VanEck, a well-known Bitcoin ETF issuer and asset manager, submitted the first application for a Solana exchange-traded fund (ETF) to the U.S. Securities and Exchange Commission (SEC). This announcement caused quite a stir in the crypto community, as evidenced by CoinMarketCap data showing an approximate 8% price increase in Solana’s value shortly after the news broke. As an investor, this potential new ETF is something I’ll be closely monitoring for further developments.

Based on the information in the document, the VanEck Solana Trust is designed to mirror the price movements of Solana (SOL) without actually investing in the cryptocurrency itself. VanEck, as it explores new avenues for crypto-based investment funds, has made it clear that this trust will not include staking – a process where investors earn rewards by supporting the network and validating transactions. This disclosure is reminiscent of prospectus filings for Ethereum (ETH) spot ETFs.

In the June 27th SEC filing, it is stated that neither the Trust itself nor the Sponsor, Solana Custodian, or any related parties will participate in any activity where they utilize the Trust’s SOL to collect staking rewards, acquire extra SOL, or generate income or other gains.

As a crypto investor, I’d like to share my perspective on Matthew Sigel’s statement concerning the application at hand. Although indirectly, he took issue with the SEC’s assertions and Michael Saylor’s viewpoint that Solana (SOL) qualifies as an unregistered security. In my opinion, Solana is comparable to Bitcoin and Ethereum in nature and should be categorized as a commodity.

Another one. First to file for a Solana exchange-traded fund.

— VanEck (@vaneck_us) June 27, 2024

Was a Solana ETF inevitable?

VanEck included this language to ensure regulatory compliance, as SEC’s stance suggests that staking activities may fall under the purview of federal securities laws. The filing precedes anticipated approvals for Ether spot ETFs, following successful launches of Bitcoin counterparts in January.

Additionally, VanEck’s application echoed the views of industry experts such as Raj Gokal, co-founder of Solana, and Brad Garlinghouse, CEO of Ripple, who have previously expressed that a Solana ETF was just a matter of when, not if.

The news reports suggest that asset managers are becoming more optimistic due to the political climate in the United States before the winter elections. Both major candidates have shown supportive views towards cryptocurrencies, with Trump taking a firm stance and Biden’s team open to discussing regulatory frameworks for digital assets.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-27 17:04