As a seasoned crypto investor with a keen interest in ETFs, I’ve witnessed the ups and downs of the market for quite some time. The recent bearish trend in Bitcoin (BTC) ETFs in the U.S., as evidenced by the net outflows on July 2, is a cause for concern.

On July 2, in the United States, Bitcoin (BTC) ETFs experienced a net outflow of approximately $13.7 million, marking an end to their five-day streak of inflows. This occurred during a generally bearish day for Bitcoin.

Based on Farside Investors’ figures, these investment products experienced a net outflow of $13.7 million on the 2nd of July. Contrastingly, there was a substantial inflow of $129.5 million on the 1st of July, marking the largest capital injection in almost a month.

The downtrend in recent market conditions can be largely attributed to the underperformance of the Grayscale Bitcoin Trust (GBTC). Yesterday marked a notable departure for this specific product, with a total exit of $32.4 million – the largest daily outflow recorded since June 24th.

In addition, the total withdrawals exceeded deposits for the first time after five consecutive days of deposits. It’s worth mentioning that from June 13 to 24, spot Bitcoin ETFs underwent their most pessimistic phase, resulting in a loss of $1.134 billion in capital. This bearish trend culminated in a five-day winning streak, which has now concluded.

As an analyst, I’ve observed that the Bitwise Bitcoin ETF (BITB) was a notable contributor to the overall negative net flow on July 2, with approximately $6.8 million in outflows. In contrast, other investment products either experienced no changes or mild inflows during this period.

As a researcher studying the daily trends in Bitcoin investment products, I can report that the Fidelity Wise Origin Bitcoin Trust (FBTC), VanEck Bitcoin Trust (HODL), and Ark 21Shares Bitcoin ETF (ARKB) helped mitigate the overall net outflow for the day. Specifically, FBTC welcomed inflows totaling $5.4 million, whereas HODL and ARKB experienced inflows of $3.5 million and $2.5 million respectively.

In spite of the downturn in the market, the iShares Bitcoin Trust (IBIT) managed by BlackRock continued to shine with remarkable results.

Yesterday, I observed a noteworthy inflow of $14.1 million into IBIT, effectively balancing out the absence of any inflows on July 1st.

Notably, IBIT recorded a net withdrawal on June 21, marking the third occasion for this product. The previous occurrences were on May 7, with a net loss of $3.06 million, and on May 1, with a significant net loss of $38.68 million.

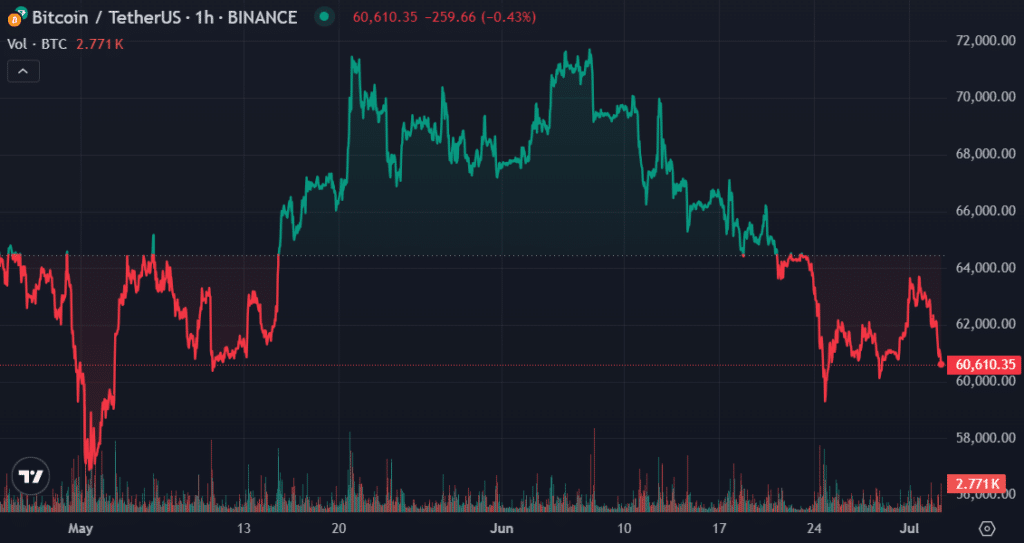

It’s unsurprising that the ETF outflows on July 2 corresponded with renewed selling pressure for Bitcoin. Following three consecutive days of price increases, Bitcoin experienced a 1.22% decrease on July 2, falling below $63,000 once more. This morning, there was an additional decline of 2.09%, resulting in a total loss of 3.12% for the month. Currently, the cryptocurrency is priced at $60,820.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-03 13:36