As an analyst with extensive experience in the financial industry and a deep understanding of the crypto market, I believe that the recent sell-off in Bitcoin is driven by a combination of factors. The negative sentiment in the crypto industry, German government sales of Bitcoin, and capitulation from miners are all contributing to the price drop.

As a market analyst, I observed that the Bitcoin price dipped on Thursday due to a prevailing pessimistic mood within the cryptocurrency sector. Additionally, news surfaced of the German government disposing more of their Bitcoins further contributing to the downward trend.

As a researcher studying the cryptocurrency market, I’ve noticed that the price of Bitcoin (BTC) dipped to a new low of $59,918, marking its lowest point since May 1st. Moreover, this decline represents a 20% drop from its peak value reached during this week, thereby pushing BTC into a technical bear market.

Peter Schiff, a prominent figure in finance and a known critic of Bitcoin, issued a cautionary statement via Reddit. He predicted that Bitcoin’s value could experience a significant decline should it fail to maintain a vital support point.

From my perspective as a researcher studying the cryptocurrency market, Bitcoin currently finds itself at a crucial point of resistance. A breach below this level could potentially lead to significant losses, as the price may plummet.

— Peter Schiff (@PeterSchiff) July 4, 2024

Peter Schiff is well-known for his bearish views in the financial markets. Throughout his career, he has advocated for investment in gold as a viable hedge against the US dollar.

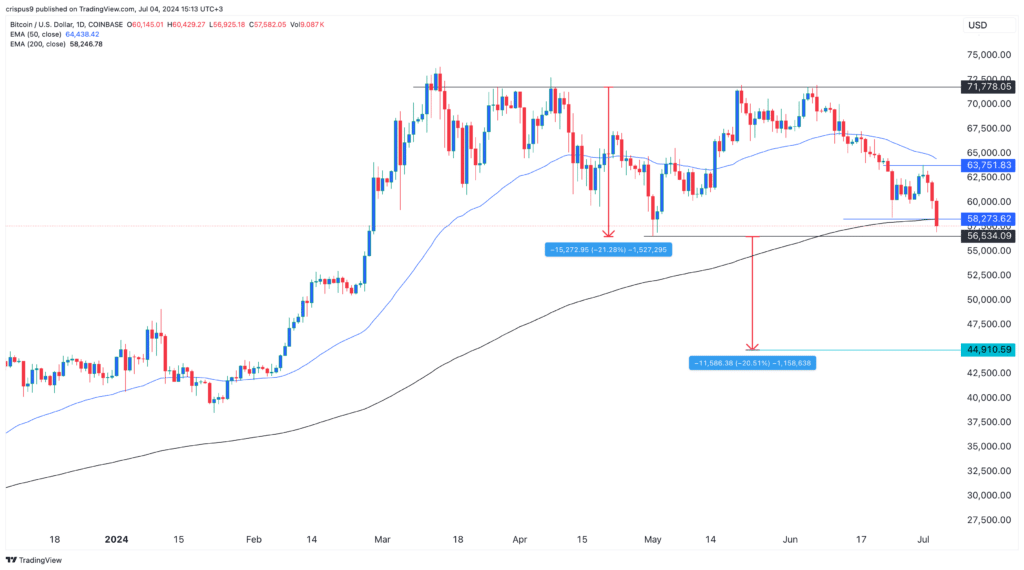

Bitcoin price chart

The perspective aligns with the information disclosed on Wednesday, when the technical analysis indicated $56,534 as a significant support. This price marks both the neckline of the quadruple top formation at $71,780 and the 200-day moving average. Consequently, if this support gives way, there’s a strong possibility for the price to decline to the psychologically important levels of $50,000 and subsequently $44,000.

German sales and miners capitulation

The selling of Bitcoin by the German government picked up pace, as indicated by on-chain data, leading to a faster decline in Bitcoin’s price.

Three thousand coins were moved to Bitstamp, Coinbase, and Kraken, amounting to a value exceeding $174 million at the current market prices. The holdings now consist of 40,359 coins, equivalent to over $2.3 billion in value, which are expected to be sold.

As a researcher studying the cryptocurrency market, I’ve observed that it’s not just Germany dumping its Bitcoins in the market. There are indications that Bitcoin miners have begun selling off their stashes as well. According to Julio Moreno of CryptoQuant, this behavior would emerge if Bitcoin encounters significant resistance.

As a financial analyst, I’ve come across some intriguing indications. The United States authorities are rumored to be planning the sale of approximately $9 billion worth of Bitcoins. These digital coins originate from Mt.Gox, the now-defunct Bitcoin exchange that suffered a catastrophic collapse back in 2014.

As a researcher, I’ve noticed an intriguing trend emerging in the cryptocurrency market. Specifically, data indicates that the number of Bitcoin balances held on exchanges has been steadily increasing over the past few days.

Bitcoin balances in exchanges are rising

The potential danger lies in the realm of US politics, where it’s widely believed that Joe Biden may resign and be succeeded by a more formidable contender. Some names being floated as possibilities include Kamala Harris, Gretchen Whitmer, Gavin Newsom, and Michele Obama.

Among these candidates, there is a strong possibility that one will be able to outperform Donald Trump in terms of cryptocurrency friendliness.

Simultaneously, the open interest for Bitcoin in the futures market has been on the decline, indicating a bearish trend.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-04 15:54