As a long-term Bitcoin investor with a decade of experience under my belt, I’ve seen the market ebb and flow like the tides of the ocean. The recent news about dormant Bitcoin addresses coming back to life after years of inactivity is intriguing but also a reminder that this asset class is anything but predictable.

Sleeping Bitcoin addresses are becoming active once more, despite the cryptocurrency market experiencing a decline during an unusually bullish month for Bitcoin.

A Bitcoin (BTC) account that had been inactive for over a decade, last seen transferring 2.98 BTC or approximately $15,000 at the time in February 2012, suddenly moved tokens valued at around $6.9 million based on current prices, as reported by Whale Alert and data from mempool.space.

The last two bitcoin transactions involved transferring different amounts: the initial transaction consisted of 76 BTC, while the subsequent one was for 43 BTC.

I’ve uncovered an inactive Bitcoin wallet holding approximately 119 coins, equivalent to around 6,992,389 USD, which has suddenly become active after a 12.4-year slumber. This sum represented just 599 USD back in 2012.

— Whale Alert (@whale_alert) July 4, 2024

Large cryptocurrency investors, referred to as “whales,” possess vast amounts of digital assets, ranging from tens of millions to billions of dollars. Their activities can significantly influence market trends and public perception, as onlookers ponder the reasons behind their sudden transactions. However, since whales maintain anonymity, the motivation behind today’s specific BTC transfers remains a mystery. Nevertheless, both transactions were directed to a new wallet, indicating that the same individual is gathering their holdings in a fresh address.

This year, Bitcoin addresses holding dormant balances have become active and transferred significant amounts of cryptocurrency. Specifically, on May 6, a Bitcoin billionaire moved $43 million worth of coins to a new wallet after a decade-long hiatus. Similarly, another large-scale investor shifted 1,000 BTC, or approximately $60 million, in late March.

Bitcoin whale dumps $206m at a loss

In the midst of a slumping Bitcoin market and an increase in wallet activity, one large investor is also selling off their Bitcoins in large quantities, incurring a loss. According to LookOnChain, this whale transferred 3,500 BTC or approximately $206 million worth of Bitcoin into Binance within a five-hour timeframe.

Whales typically transfer their cryptocurrency tokens to major exchanges to sell them publicly. According to our data source, this particular whale incurred a $20 million loss when selling Bitcoins and has been actively depositing funds on these exchanges over the past few weeks.

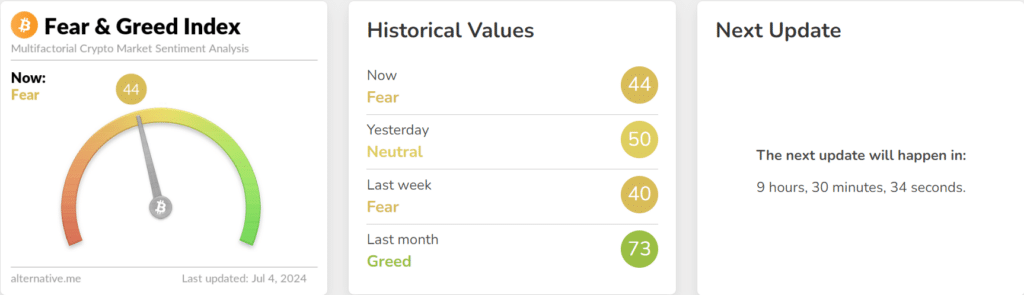

Currently, Bitcoin experienced a significant drop, losing approximately 5% of its market worth and dipping below $57,500 according to CoinGecko data. Simultaneously, the crypto “fear & greed” index underwent a shift from ‘greed’ in the previous month to ‘fear’ as of now.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-07-04 17:46