As an experienced analyst, I believe that Solana’s price stabilization above the crucial support level of $120.50 is a promising sign for investors. The emergence of bottoming signs before the spot Ethereum ETF approval could potentially lead to significant price appreciation.

The price of Solana has found stability above a significant support point, with indications of a potential market floor arising before the anticipated approval of the Ethereum spot ETF.

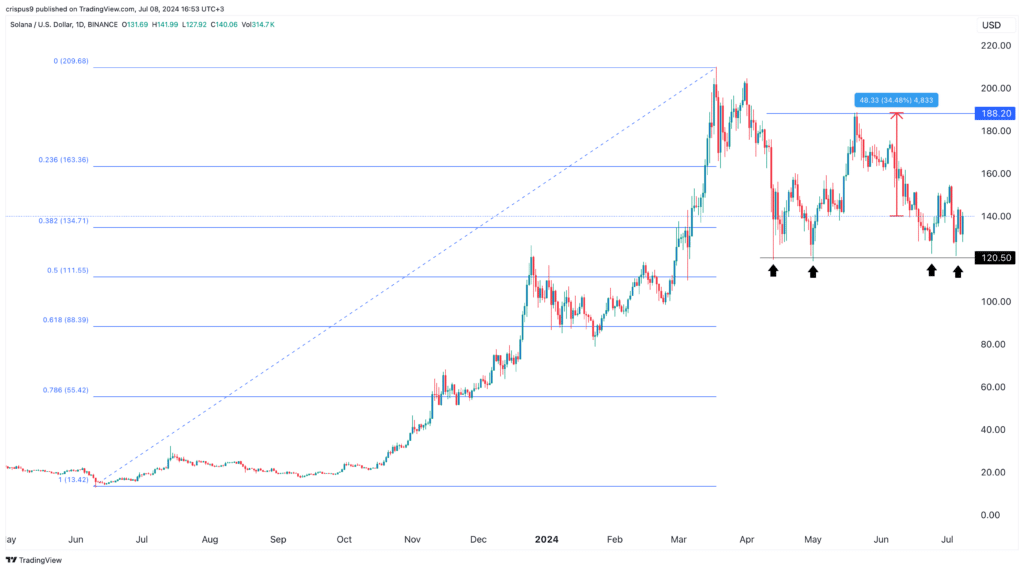

On Monday, the price of a SOL token hovered around $140, just above the significant support mark of $120.50. The token’s market capitalization surpassed $65 billion, and its staking reward increased to a generous 7%.

Spot Ethereum ETF approval

As a researcher studying the cryptocurrency market, I’m excited about the potential impact on Solana if an Ethereum-backed Exchange Traded Fund (ETF) is approved imminently. Similar to what occurred with Bitcoin earlier this year when large institutional investments poured in due to ETF approval, billions of dollars could potentially flow into these Ethereum funds, which could in turn benefit Solana as it’s increasingly being adopted as a popular Layer 1 platform for decentralized finance (DeFi) and non-fungible tokens (NFTs).

For those keeping a close eye on Ethereum-linked Exchange Traded Funds (ETFs), here’s significant news:

— Lark Davis (@TheCryptoLark) July 8, 2024

As a crypto investor, I’ve been keeping an eye on the regulatory landscape, and based on current analysis, it seems that the Securities and Exchange Commission (SEC) may soon shift its attention towards approving or denying proposals for Spot Solana Exchange-Traded Funds (ETFs).

As a crypto investor, I’m excited to share that VanEck has taken the lead in filing an application for a Solana Exchange-Traded Fund (ETF). With its growing popularity, it’s no surprise that other major players like Blackrock, Franklin Templeton, and Ark Invest are also considering jumping into the Solana bandwagon by applying for their own funds.

A fund of this kind holds merit given Solana’s position as the fifth most valuable cryptocurrency, after Bitcoin, Ethereum, Tether, and Binance Coin. Furthermore, its significant daily trading activity, totaling over $4 billion, underscores its importance within the crypto market.

In the realm of Decentralized Finance (DeFi), Solana ranks as the third-largest blockchain, following Ethereum and Tron. With assets valued at more than $5.4 billion and a robust user base of over 836,000 active addresses, Solana maintains an influential presence in this sector.

Solana has emerged as a preferred choice among developers for its swift transaction processing and affordable fees. Consequently, it has gained significant traction, particularly within the meme coin community. Notable Solana meme coins include Dogwifhat (WIF), Bonk, and Book of Meme (BOME).

Solana price bottoming signs

Solana price chart

The graph indicates that the SOL price has discovered robust support at the $120.50 mark, which it has unsuccessfully attempted to drop beneath on four occasions since April 13th. This figure is slightly above the 38.2% Fibonacci Retracement level. This suggests that bears are reluctant to sell short the coin below this price point.

As an analyst, I’d observe that reaching this price once more after previously hitting a resistance level at $188.20 indicates a potential double-top chart formation. This neckline represents approximately a 35% price increase from the current level.

From another perspective, if the price falls just short of that support level, it could indicate that bears have taken control, potentially resulting in further declines.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-08 17:40