As a seasoned crypto investor, I’ve seen my fair share of ups and downs in the world of digital assets. Memecoins have always intrigued me with their potential for sudden wealth creation and the risks that come with it. Solana (SOL) has emerged as a leader in this space, offering affordable transaction fees and innovative solutions like pump.fun. Anatoly Yakovenko’s proposal to allocate developer grants for meme projects is an interesting approach to foster growth and transparency in this sector.

As a analyst, I would rephrase Anatoly Yakovenko’s suggestion in this way: “I, Anatoly Yakovenko, co-founder of Solana, propose that creators of memecoins provide developer grants to enhance their projects.”

In the volatile world of memecoins, fortunes can be made almost instantly by the fortunate few, while unfortunate investors risk experiencing substantial losses in a heartbeat. This sector of cryptocurrency is notorious for deceitful practices such as “rug pulls” and “getting rekt,” which are essentially scams that can leave investors with empty pockets.

From the perspective of a financial analyst, I’ve noticed an ongoing discourse surrounding memetic crypto tokens and their potential impact on finance. Amongst these contenders, Solana (SOL) stands out as the leading meme network for several reasons. Firstly, it offers cost-effective transaction fees that make it an attractive choice for those looking to engage with such tokens. Secondly, Solana provides straightforward solutions like pump.fun, which simplifies the process of creating and distributing these tokens.

As a researcher studying the blockchain industry, I’d like to share an intriguing perspective from Anatoly Yakovenko, co-founder of Solana, regarding the advancement of decentralized finance (DeFi) projects, specifically memecoins. He suggested engaging developers to create customer features by inverting the Initial Coin Offering (ICO) process. In simpler terms, instead of memecoins raising funds from investors through ICOs, they should empower and fund developers to build functionalities for them. This approach could potentially lead to more innovative and valuable projects within the memecoin ecosystem.

In the conversation about meme projects, I highlighted the importance of creating a consistent pathway for individual investors to join in, and suggested strategies that could entice larger investors, such as institutions, to invest in cryptocurrencies.

As a researcher examining the retail industry, I’ve come across the observation that in order for retail businesses to thrive and expand, they need to generate profits from their investments. The current trend of investing in infrastructure projects with a valuation exceeding ten billion dollars does not appear to be the solution for increasing revenue for retailers and institutional investors.

— chainyoda (@chainyoda) July 8, 2024

According to Yakovenko’s proposition, meme project teams would receive grant proposals, while developers could then select the most favorable options from projects boasting “fair and transparent dealings.” Similarly, Andre Cronje, a notable Fantom contributor and experienced blockchain engineer, has put forth a related concept to enhance meme tokens and encourage more secure investment, as detailed in crypto.news back in April.

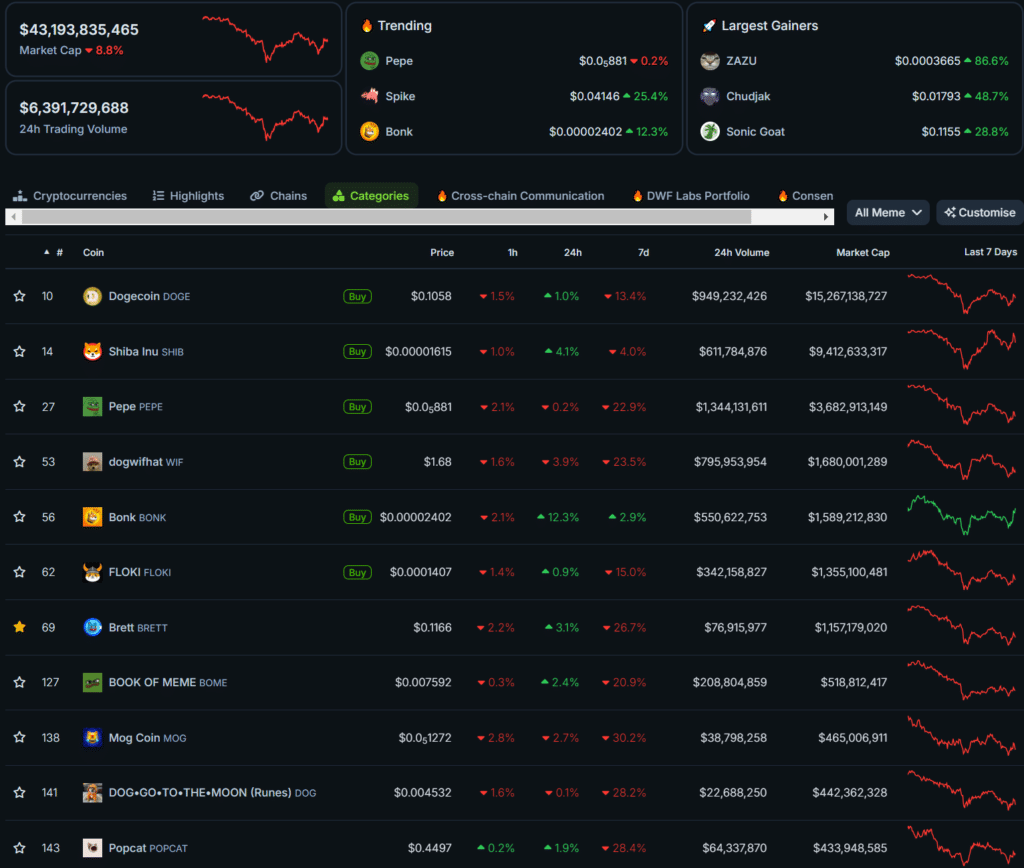

Memecoins tumble with crypto market

As a crypto investor, I observed that the memecoin sector took a hit and experienced a significant loss in value during Monday’s market downturn. According to data from CoinGecko, over 8% of the total market capitalization was shed from this sector alone.

Digital assets have experienced bearish trends for several weeks now, leading to significant drops in popular meme tokens such as Brett (BRETT), Dogewhiz (WIF), and Pepe (PEPE). The volatility inherent in cryptocurrencies has taken its toll on these tokens, causing double-digit percentage decreases within the past week.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-08 20:00