As a researcher with several years of experience in the crypto space, I have witnessed firsthand the potential benefits and drawbacks of investing in cryptocurrencies through various vehicles, including spot Ethereum ETFs. While there’s no denying that these funds offer convenience for non-traditional investors, I believe it’s crucial to consider the long-term implications of fees and staking opportunities before making an investment decision.

In recent days, the cost of Ethereum has gradually recovered, with market participants zeroing in on the SEC’s decision regarding the approval of a spot Ethereum Exchange-Traded Fund (ETF).

The cost of Ethereum reached a peak of $3,112 on Tuesday, marking a 10.5% increase from its price at the end of last week. Optimism persists that the SEC will give the green light to ETFs in the near future, as numerous applications are being submitted by companies for their final approval.

On Monday, VanEck submitted an amended filing, while Invesco followed with its filing on Tuesday morning. Bitwise and 21Shares have likewise made their applications. Experts predict that these investment funds could become available for trading as early as this week.

Today, the first S-1 filing from VanEck arrived at the Securities and Exchange Commission (SEC). Since they had already paid their fee, there isn’t much new to observe. Essentially, they are returning the ball to the SEC, expecting further action in the coming days. The remaining applications, excluding Bitwise, which was submitted last week, are anticipated to follow soon.

— Eric Balchunas (@EricBalchunas) July 8, 2024

As an analyst, I would express it this way: Following the SEC’s approval of spot Bitcoin ETFs earlier this year, these investment funds represent recent additions to the market. These ETFs have experienced significant growth, with over $14 billion in inflows.

2 reasons to avoid spot Ethereum ETFs

For individuals new to cryptocurrency investing or institutions unwilling to handle the intricacies of managing Ethereum directly, investment funds offer a simplified solution to monitor Ethereum’s price fluctuations. These funds bypass the need for managing wallet keys and other complexities associated with owning real Ethereum coins.

Two primary justifications exist for investors to contemplate Ethereum investment over ETFs (Exchange-Traded Funds).

As a crypto investor, I find the process of purchasing and holding an ETF to be quite straightforward. This can be accomplished through well-known platforms such as Binance, Coinbase, OKX, crypto.com, and numerous other exchanges. Simply create an account with your preferred exchange, deposit funds, place your order for the desired ETF, and wait for confirmation of the transaction. It’s that easy!

When customers purchase Ether, they don’t incur any fees. However, if they decide to sell their coins to cash out their investment, they will be charged a fee at that point.

As an analyst, I’d rephrase it as: Unlike Ethereum funds, Invesco Galaxy’s fund comes with a sponsor fee of 0.25%, which translates to an annual fee of approximately $250 for every $100,000 invested. Over a decade, this amounts to a total payment of $2,500 in fees if Ether maintains its value.

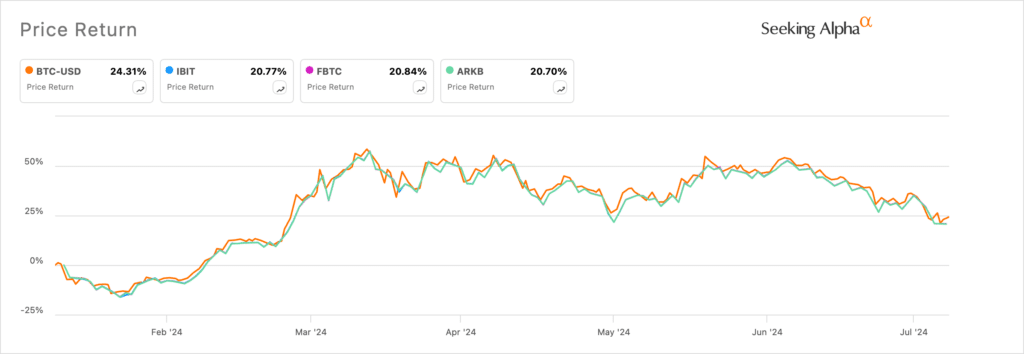

The price gap between Bitcoin and Bitcoin ETFs is responsible for Bitcoin’s superior return in the previous six months. Bitcoin has seen a growth of 24.31% compared to approximately 20.7% for the other ETFs during this period. This difference will accumulate over time.

Bitcoin vs IBIT vs FBTC vs ARKB ETFs

Second, Ethereum funds will not have staking features, which provides steady income to investors. Data compiled by StakingRewards shows that the total staked Ether stands at over $100 billion, giving it a staking ratio of 27.16%. It has a yield of about 3.29% and a $100k investment will return nearly $3,300 a year.

Given that Ether and ETFs backed by ETH are expected to follow similar price trends, staking Ether instead of investing in an ETF might be the more effective choice.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-09 16:04