As an analyst with extensive experience in the crypto market, I believe that the recent sell-off of JasmyCoin (JASMY) is a result of ongoing headwinds in the industry, including the German government’s move to sell Bitcoins and concerns about Bitcoin liquidations by Mt.Gox. These events have created a negative sentiment that has affected JASMY and other altcoins.

The value of JasmyCoin has experienced a significant decline and is now in the midst of a prolonged downturn, having fallen approximately 50% from its peak price reached in June.

As an analyst, I’d put it this way: On Tuesday, JASMY was priced at $0.0230 for me, representing a significant leap of 20% compared to its previous bottom hit on Friday, when the broader cryptocurrency market experienced a downturn.

The value of the cryptocurrency token has dropped due to persistent challenges in the crypto market, with the German government’s transfers of Bitcoins to exchanges being one such factor. Additionally, apprehensions surrounding potential Bitcoin liquidations at Mt.Gox have further fueled a pessimistic outlook throughout the industry.

The crypto fear and greed index has experienced a notable decrease as a result of these recent events, shifting from its yearly maximum of 90 to the “greed” zone at 38. Generally, altcoins such as Jasmy tend to decline when trader sentiment is fearful.

Analysts are still bullish on Jasmy price

JASMY price chart

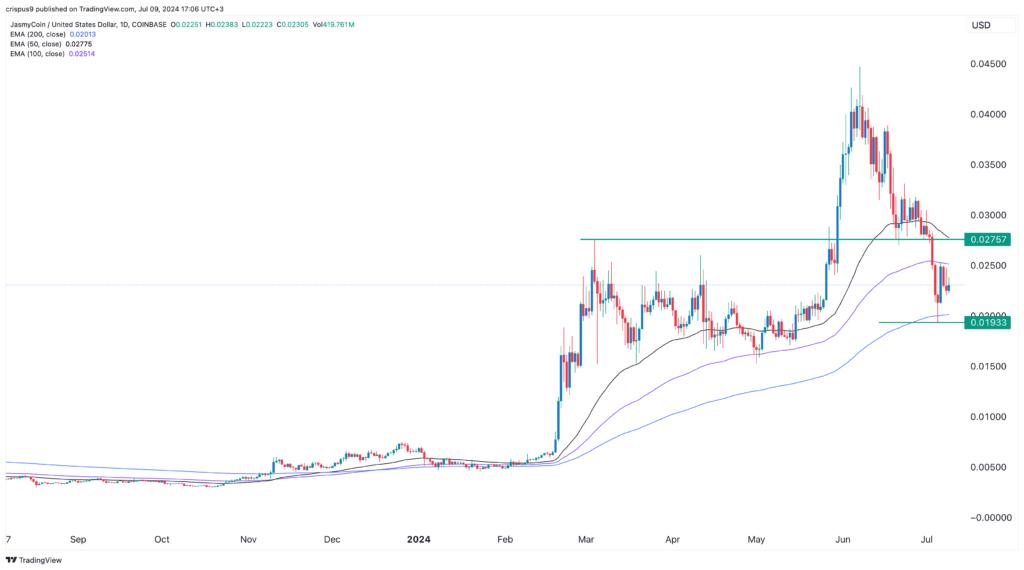

As a market analyst, I’ve observed that Jasmy’s sell-off has left many investors in disbelief, as its price dipped beneath crucial support thresholds. Notably, it fell below both the 50-day and 100-day Exponential Moving Averages (EMAs).

The price fell beneath its major support point at $0.0275, which marked its peak in March, indicating that bears are growing more powerful.

Bears indicate that Bitcoin’s price formation resembles a double-top chart pattern, suggesting a possible decline to the $44,000 support level imminently. This drop could negatively impact Jasmy and other altcoins as well.

As a crypto analyst, I’ve observed that the JASMY community remains optimistic about the coin’s recovery in the short term despite recent setbacks. In a Reddit post, I highlighted some past occurrences, such as Germany’s regulatory actions, Mt. Gox hacks, and more recent events like the FTX collapse, which have temporarily impacted the crypto market. Historically, these events have proven to be temporary in nature.

As a seasoned crypto investor, I want to remind my fellow Jasmy community members that the bull market isn’t finished yet. It’s natural to feel uneasy during market fluctuations, but these are opportunities we’ve seen many times before – from China bans and MtGox to hacks and other incidents. But here we are, with Bitcoin at 57k and a thriving crypto space. Jasmy is part of this journey and will continue to be a significant player. Let’s seize the moment!

— westcoast LA (@westcoast_la) July 9, 2024

As a market analyst, I’ve observed Ki Young Ju’s perspective on Bitcoin’s market situation. He believes that the current liquidity in the market can accommodate a potential dip in Bitcoin’s price. According to his prediction, Bitcoin may hit a bottom around $47,000 and $48,000 before resuming its bullish trend. This anticipated recovery could positively impact Jasmy as well.

From a broad viewpoint, your analysis is insightful. The Bitcoin market has the capacity to manage potential sell-offs from the German government and Mt. Gox creditors, estimated to cause a decrease of around 10.5%. This could mean a price range of $47-$48K. However, these sales will not terminate this market cycle.

— Ki Young Ju (@ki_young_ju) July 8, 2024

As a researcher studying the JasmyCoin market, I would keep a close eye on the price point of $0.019. This value is significant because it aligns with the 200-day moving average and the bottom of the hammer formation that emerged on Friday. A decline below this level could be an ominous sign, potentially indicating further price decreases.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-09 17:28