As a seasoned crypto investor with a few years of experience under my belt, I’ve learned that market declines often bring opportunities for smart investors. The recent dip in Bitcoin (BTC) prices below $60,000 has been no exception, as whales and long-term holders have taken advantage of the situation to stockpile more BTC.

Whales have been taking advantage of Bitcoin‘s price dip below $60,000 by amassing larger holdings in anticipation of future price increases.

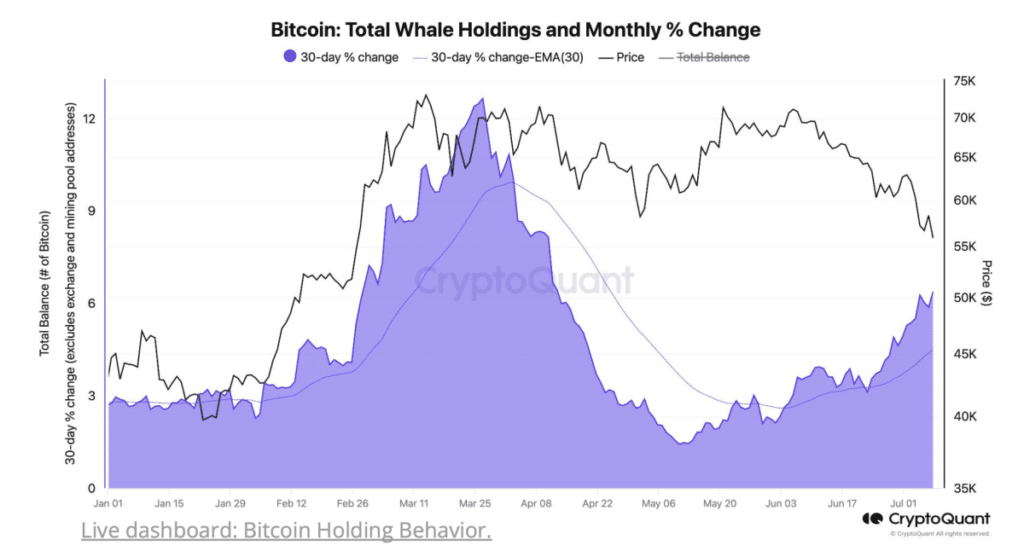

Analysts from CryptoQuant have revealed that the holdings of Bitcoin (BTC) large investors, including whales and long-term investors, are growing at a rate of 6.3% per month. This trend suggests that there is continued demand for Bitcoin even as its price declines in the market. Currently, Bitcoin’s price is more than 21% lower than its peak value of $73,373 reached in March. Astute investors are taking advantage of the lower prices.

As a crypto investor, I’ve noticed an impressive acceleration in Bitcoin accumulation since late April 2023, when its price hovered around $30,000. A recent report from a reputable blockchain analytics firm underscores this trend as the fastest build-up since then. Furthermore, the report brought to light the significant role of whales in supporting Bitcoin’s price amidst the sell pressure that emerged over the past two weeks.

Thousands of new Bitcoins entered the market recently, as federal authorities in Germany and the United States transferred large quantities of tokens to exchanges such as Coinbase and Kraken. The value of Bitcoin dipped when it was announced that the defunct exchange Mt. Gox would begin making customer repayments – more than a decade after one of the most significant crypto heists occurred.

On-chain indicators to watch for Bitcoin pump

According to CryptoQuant’s analysis, large Bitcoin investors, or “whales,” have become less inclined to sell their holdings since the price dipped below $60,000. The fluctuations between $56,000 and $59,000 might indicate an early sign of a market bottom. However, for a potential rebound from this proposed local minimum to occur, there must be an increase in liquidity stemming from increased stablecoin production.

According to CryptoQuant’s analysis, Bitcoin tends to have higher prices when the minting of stablecoins, with a focus on Tether (USDT), increases. However, USDT’s market capitalization has recently decreased. The resumption of regular minting for USDT and other stablecoins, which involves generating new coins pegged to fiat currencies and enhancing crypto liquidity, remains uncertain at this time.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-10 19:22