As a seasoned crypto investor with several years of experience under my belt, I find myself leaning strongly towards the bullish side of the current market sentiment. The post-halving pullback and the recent price drop below $56,000 have undoubtedly caused some uncertainty among the community. However, I believe that this is a temporary setback, and the long-term trend remains positive.

As a researcher studying the cryptocurrency market, I’ve noticed that Bitcoin‘s post-halving price decline has sparked disagreement among various sectors of the crypto community. Investors, in particular, remain optimistic and are expressing a bullish outlook for the digital currency.

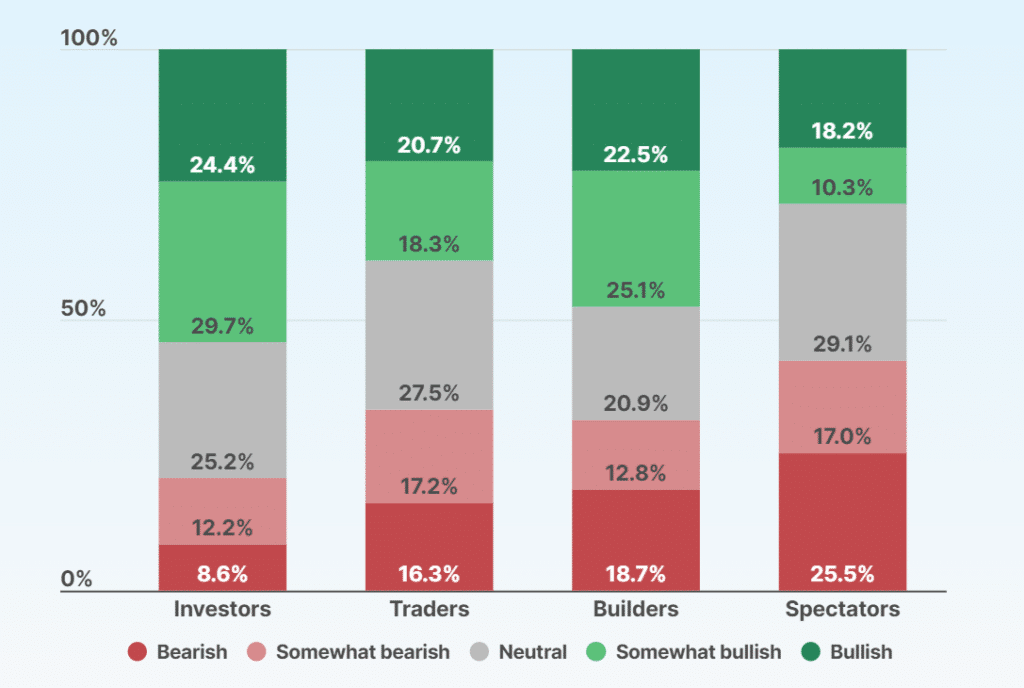

There’s a lack of clear agreement among cryptocurrency investors, developers, speculators, and traders regarding the current market condition, according to CoinGecko, a platform that tracks crypto prices.

As a researcher conducting a study for CoinGecko between mid-June and July 8th, I assessed the market sentiment by surveying 2,558 participants. Among these respondents, approximately a quarter (26.1%) considered themselves to be moderately optimistic about the market, while the smallest segment (11.8%) identified as strongly pessimistic. Notably, nearly half (49.2%) of the participants exhibited a bullish leaning, even after Bitcoin’s recent decline below $56,000.

According to CoinGecko’s survey results, a neutral sentiment was the second most popular response, implying that some participants may be holding back on forming a definitive market view, as they are likely anticipating more information or developments before making their decisions. Contrastingly, investors exhibited the most optimistic stance, with over half (54.1%) expressing bullish sentiments, while fewer than one in five (20.7%) expressed bearish views.

As an analyst, I would interpret the data by saying that approximately four out of ten traders held a positive view towards the crypto market, expressing optimism and intending to buy. On the other hand, around one-third of them exhibited a negative sentiment, indicating their intention to sell due to pessimistic views on the market’s future direction. The remaining percentage likely represented neutral or uncertain traders.

CoinGecko

Among speculators, only 28.5% expressed a bullish outlook while a larger number, 42.4%, held bearish views. According to CoinGecko’s analysis, these investors might have cashed out and temporarily withdrawn from the market.

Around the beginning of July, Bitcoin’s (BTC) value took a sharp downturn when German authorities started transferring approximately 50,000 BTC they had confiscated from the unlawful film site Movie2k onto cryptocurrency exchanges. In an interview with CNBC, crypto entrepreneur Anthony Pompliano expressed concern that many individuals are reluctant to purchase Bitcoins due to the sudden influx of coins into the market. He further stated that the current Bitcoin market is highly illiquid, and these large-scale German sell-offs have noticeably affected its price.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-07-11 12:11