As a seasoned crypto investor with a keen interest in the DeFi space, I’ve been closely monitoring the recent developments surrounding ALEX, the native token of Bitcoin layer-2 bridge ALEX Lab. The past 24 hours have been particularly noteworthy for this promising asset.

As a researcher studying the cryptocurrency market, I’ve noticed an intriguing development: ALEX, the native token of Bitcoin layer-2 (L2) bridge ALEX Lab, has outperformed all other crypto assets in the top 500 over the past 24 hours.

The impressive surge in Bitcoin (BTC) and the altcoin market is fueling this trend, following the broader campaign for recovery. Despite continuous selling pressure from the German government, Bitcoin bounced back on July 9, mirroring a similar price hike for ALEX.

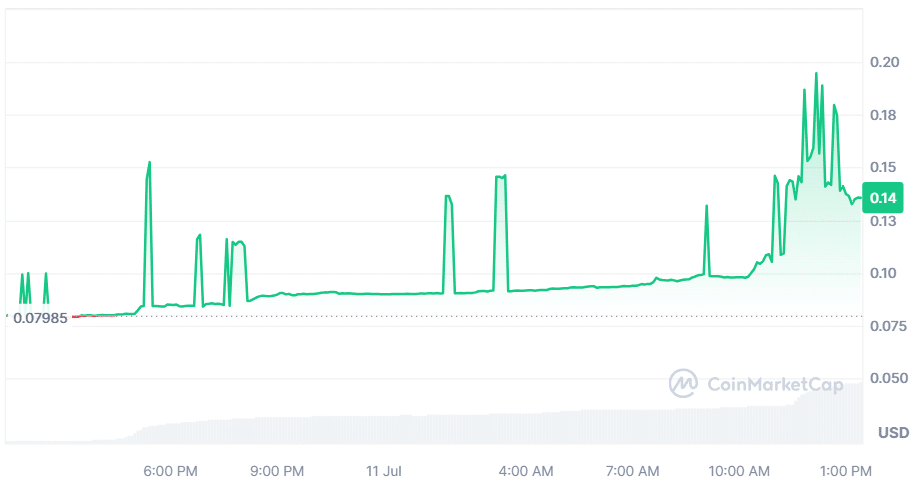

Despite a correction in the leading cryptocurrency on July 10, ALEX continued its upward trend. The token surged by 21.72% the previous day, adding to its gains and recording a 57% rise in value this morning.

Impressively, ALEX has surged by 108% since last week, taking advantage of the broader market upswing to break past significant resistance levels. During this uptrend, the asset has managed to rise above the 50% Fibonacci retracement mark at $0.1379, turning it into a support level. Looking ahead, ALEX aims for the next resistance at the 61.8% Fibonacci retracement point, which is located at $0.1566.

Among the top 500 cryptocurrencies, ALEX experienced a significant surge, increasing by approximately 70% within the past 24 hours. Currently, the asset is priced at $0.14. Notably, there has been a substantial rise in its daily trading volume, which now stands at an impressive $49.91 million – a figure that represents a staggering 1,245% increase, demonstrating heightened market activity.

Two months after experiencing a $4.3 million hack that was linked to the Lazarus Group, ALEX Lab’s bullish momentum has emerged. This event led to a 28% decrease in the value of the ALEX token. Although the hack negatively influenced investor sentiment, faith in the protocol has been restored as evident in the recent surge in demand for its native token.

I initiated the ALEX Lab project in the year 2021, which functions as a layer-2 Decentralized Finance (DeFi) platform built on Stacks smart contracts for Bitcoin. This innovative solution offers a launchpad, a decentralized exchange (DEX), and a lending and borrowing marketplace, all aimed at enhancing the DeFi ecosystem within the Bitcoin network.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-07-11 13:07