As a seasoned investor with years of experience in traditional financial markets and more recently, in Decentralized Finance (DeFi), I have come across Polymarket, a platform that offers predictive markets for various events. Having read extensively about it and having engaged with the community, I’d like to share my perspective on this intriguing platform.

The transparency of predictions markets, such as Polymarket, sets them apart from conventional gambling and is a significant reason for their growing popularity.

In this piece, we delve into the mechanisms of the Polymarket predictions market, providing insights on its utilization and discussing the security concerns surrounding the storage and trading of funds within it.

Table of Contents

What are prediction markets?

Prediction markets represent online platforms where individuals engage in peer-to-peer trading of shares linked to the result of upcoming events. These markets share similarities with conventional gambling venues as users can wager on a variety of subjects, including sports and politics. However, instead of merely placing bets, participants purchase shares that undergo value changes based on the prevailing market opinion regarding the event’s outcome.

Having worked as a political analyst for several years, I can attest to the intrigue and unpredictability of elections. One fascinating aspect is the market for prediction shares, where users place bets on candidates’ success or failure in an election.

These markets often accept cryptocurrency in exchange for shares.

What is Polymarket? Polymarket explained

On the Ethereum blockchain, there’s a prediction market called Polymarket. Market participants can easily purchase shares using US Dollar Coins (USDC) for their predictions.

So what is Polymarket used for?

Overview of Polymarket

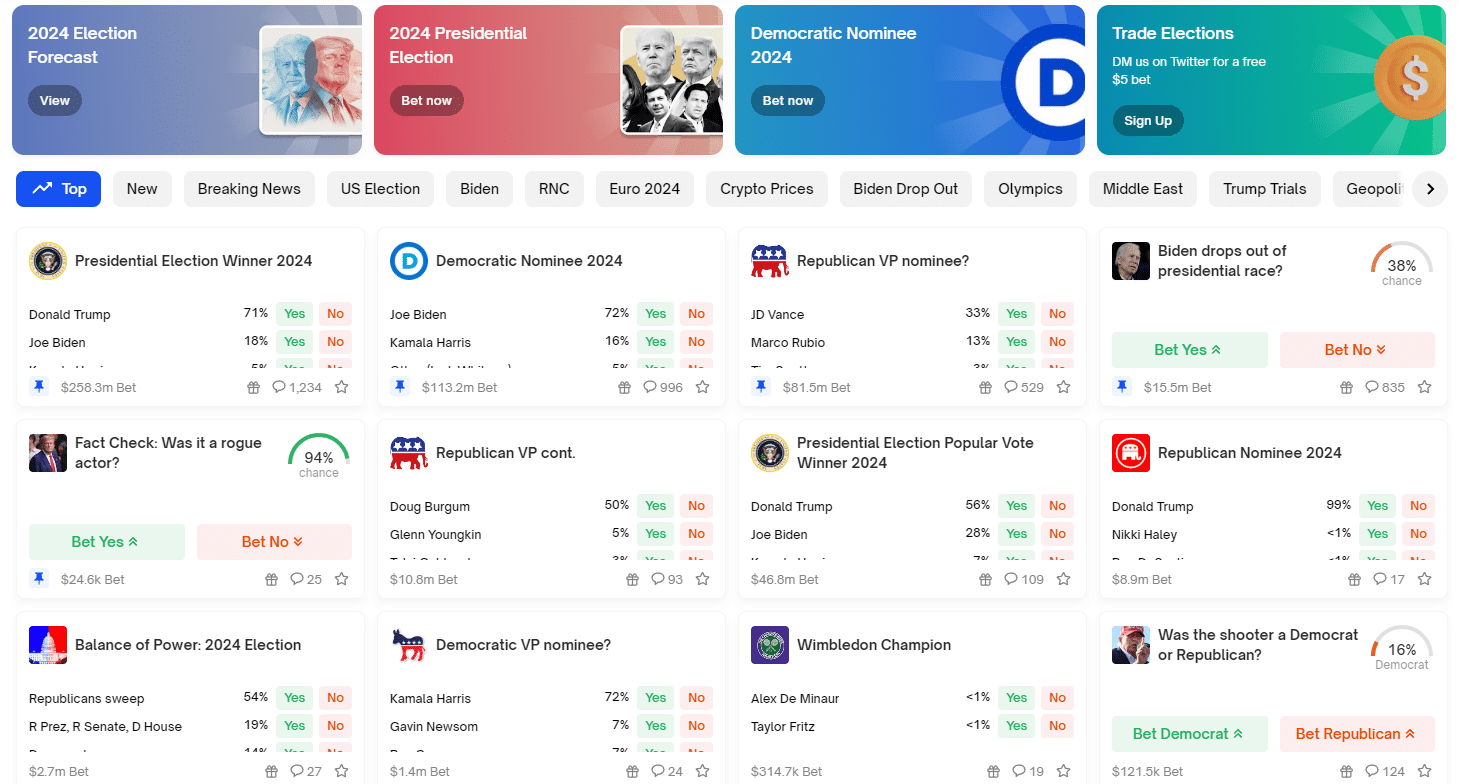

Polymarket enables users to buy and sell predictions on various trending topics, including US politics, crypto prices, sports events, global news, and more.

When you stake your funds in a market, price changes can lead to a phenomenon called “impermanent loss.” This means that more of your staked assets may be required to maintain your position in the market compared to when you initially staked them, effectively consuming a portion of your original investment.

Key features of Polymarket

Polymarket positions itself as a decentralized platform for making predictions, but in reality, there are several areas where Polymarket’s team maintains control. These include managing disputes, creating new markets, maintaining the platform, and making various decisions. True decentralization is challenging to achieve.

Although it’s not completely decentralized, this platform is generally perceived as more equitable and open due to its transparency in predicting future occurrences. In contrast, traditional gambling methods, which are less transparent, rely on bookmakers setting the odds at their discretion.

How does Polymarket work?

On this innovative platform, users contribute liquidity pools that enable trading. Simultaneously, the community determines event share prices through their trading actions and up-to-the-minute market evaluations. Intelligent contracts are employed to streamline various exchange procedures.

As a researcher studying decentralized finance systems, I would describe the CLOB (Centralized Limit Order Book) as follows: The CLOB offers on-chain execution of trades with immediate settlement, while behind the scenes, off-chart matchmaking services operate to ensure decentralization. This creates a hybrid system that combines the benefits of both centralized and decentralized exchanges.

It’s important to note that while Polymarket’s official documentation may indicate that they don’t charge fees for trading, this seems to be a nuanced statement. In reality, Polymarket collects a fee equivalent to a net 2% of the earnings generated from trades on their platform.

Benefits of using Polymarket

Polymarket sets itself apart from other gambling platforms with its implementation of smart contracts and blockchain technology, offering users greater transparency. Instead of just wagering at a bookmaker, users on Polymarket gain deeper understanding into the pricing mechanics of their shares.

Shares function similarly to gamble, distributing returns upon fulfillment of specific prerequisites as publicized. The structured mechanism for assured payouts is considered relatively more dependable compared to conventional gambling.

On Polymarket, a greater variety of tradeable events exists compared to typical gambling platforms, providing more opportunities for various analysts with distinct areas of knowledge and focus.

As a financial analyst, I can tell you that traders now have the advantage of engaging in swing trading with shares, allowing them to maintain a certain level of ambiguity regarding the final result of a potential future event. This is a distinctive trait seldom found in conventional gambling scenarios.

Potential risks and challenges

Polymarket comes with its own set of risks and distinct complexities. To begin with, making money by offering liquidity might prove to be more complicated than it seems, even appearing as a riskier proposition than just purchasing shares. Supplying liquidity and turning a profit from it is an advanced concept that requires some expertise.

The worth of the pledged assets can significantly change, potentially rendering the assets provided for liquidity useless or less valuable.

Certainly, an additional risk exists in the form of potential financial losses from wagering on incorrect market outcomes. The Polymarket user base is recognized for their analytical and meticulous approach, which sets a high standard for novice participants.

In Decentralized Finance (DeFi), there’s an ongoing risk that the platform could experience failure or be vulnerable to hacks, exploits, or malicious acts from either the development team or external entities.

Is Polymarket legit?

Based on currently available information, it’s difficult to definitively determine the authenticity of Polymarket. To date, the company has not been involved in any major public controversies that would call its legitimacy into question.

Based on testimonials from TrustPilot users, there are allegations of some market resolutions appearing unjust or inexact. However, concrete proof to support these claims is currently lacking.

Polymarket review: Getting started with Polymarket

To begin using Polymarket, first create an account with them, then transfer some USDC for funding. You can acquire USDC by purchasing it with fiat or cryptocurrency on leading crypto platforms.

To get started, create an account using your full name and email address. Currently, no ID verification or Know Your Customer (KYC) process is necessary for registration on this platform.

Based on my extensive experience with cryptocurrency platforms, I suggest this simple step-by-step process: Delve into your account settings and locate your profile. Next, proceed to the “Wallet” tab and click on it. Once you’re there, select the “Deposit” option. Now, follow the instructions to make a US Dollar Coin (USDC) deposit. After this transaction is confirmed, voila! You’ll be all set and ready to buy and sell shares in upcoming events.

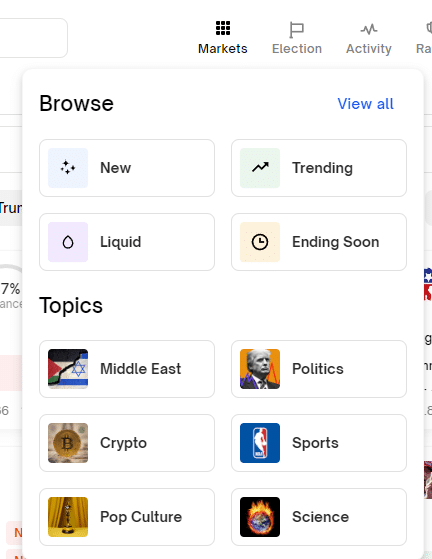

You can navigate the Polymarket interface by filtering the markets based on category.

At present, our menu offers selections dedicated to the Middle East, Pop Culture, Cryptocurrencies, Politics, Sports, and Science.

You can also browse by New, Trending, Liquid, and Ending Soon.

In less formal terms,

Trading profitably in these markets will be challenging if you don’t favor the less likely 1% outcome. Nevertheless, markets nearing their conclusion can provide decent margins worth considering. The advantage lies in having your assets tied up for a shorter duration compared to new markets that might take months to resolve.

Preferably, choose markets with ample liquidity since purchasing stocks in illiquid markets might lead to price discrepancies during trades, resulting in the loss of some funds.

How to trade and stay safe on Polymarket

Newcomers to the Polymarket platform may find it enticing with its diverse selection of events for share purchase. As novices, they’re encouraged to adopt a thoughtful, data-driven strategy when attempting to forecast an event’s result.

Experienced Polymarket traders frequently employ vast amounts of historical data and construct models to estimate the probability of an occurrence, as opposed to purchasing shares solely on a hunch. Swing trading is another viable option, in which traders do not aim for the full market development but instead seize profits before the market concludes.

When engaging in financial speculation, it’s crucial to have a solid risk management strategy in place, including clearly defined entry and exit points. Additionally, thoroughly researching and testing your trading strategy prior to implementing it with real funds is essential for achieving long-term profitability.

You can learn more about risk management here.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-07-15 18:11