As a seasoned researcher with extensive experience in the crypto market, I’ve witnessed numerous trends and price movements over the years. In recent days, the surge of dogwifhat (WIF) has caught my attention, as it has skyrocketed an impressive 69% in just seven days. This outpacing of many of its peers is a noteworthy development that demands careful analysis.

Over the last week, the value of Dogecoin (WIF) has experienced a significant increase of approximately 69%, surpassing the growth rate of many other coins in the market. This piece aims to provide insights into potential price goals and effective trading methods for the memecoin.

Table of Contents

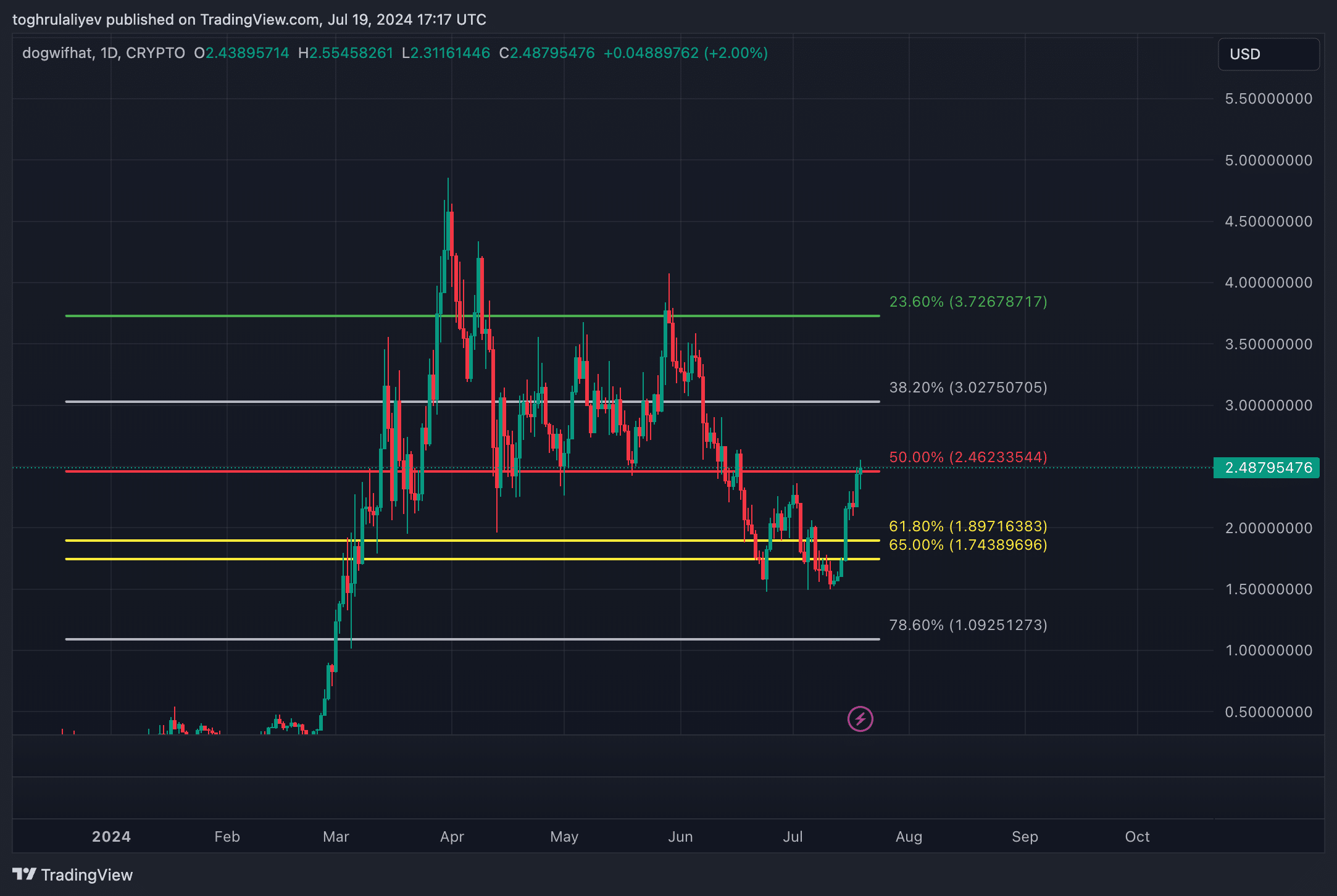

Fibonacci retracements analysis

From the January 8 low to the March 31 high, the larger-scale Fibonacci retracement shows a significant area of potential support or resistance, identified around $1.74 and $1.89. Over the last week, WIF has breached this region and remained above it for four consecutive days. Furthermore, WIF has moved beyond the macro 50% retracement mark at $2.46. The crucial issue moving forward is whether WIF can maintain this progression. Our perspective is affirmative, based on the following reasons:

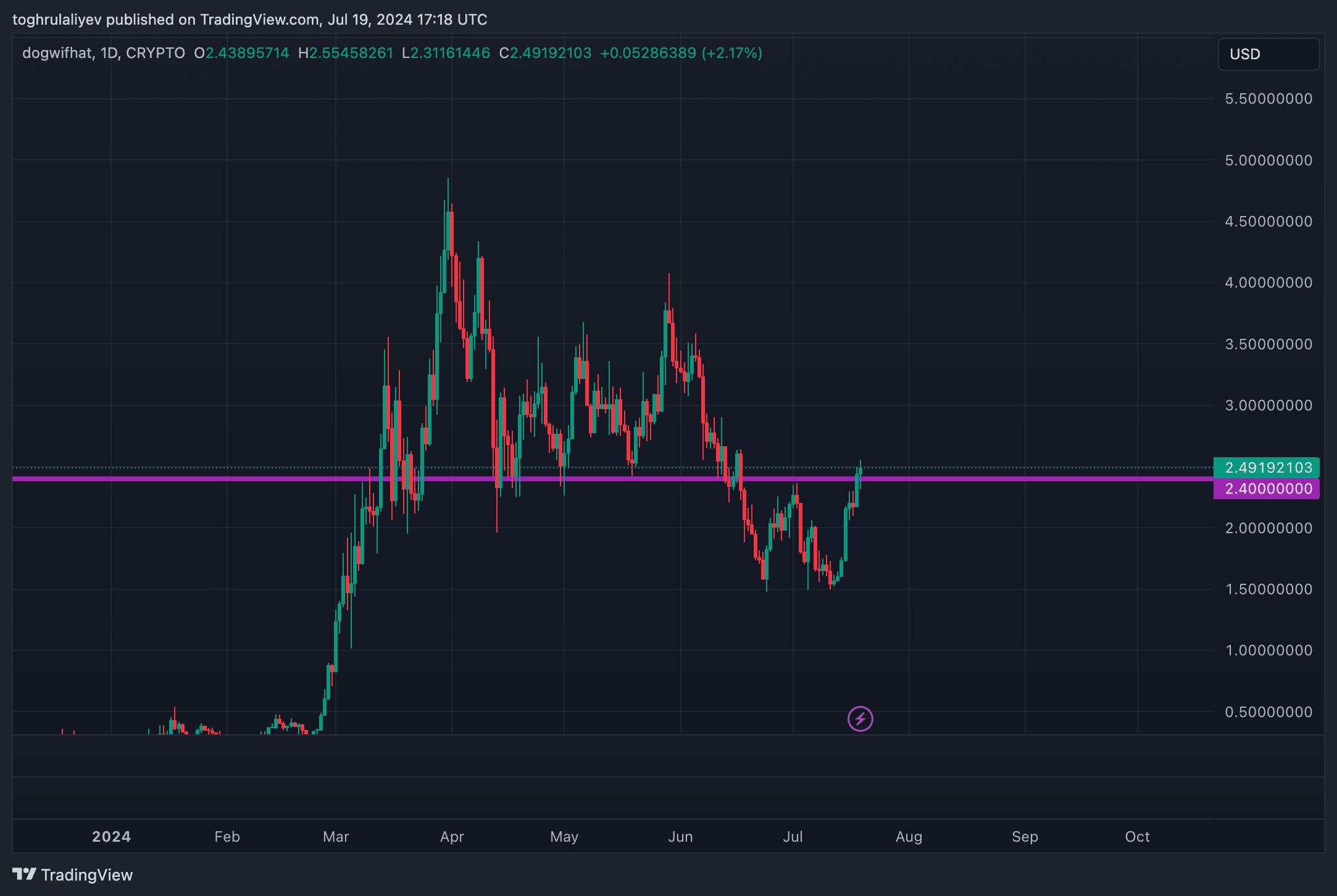

Historical resistance level

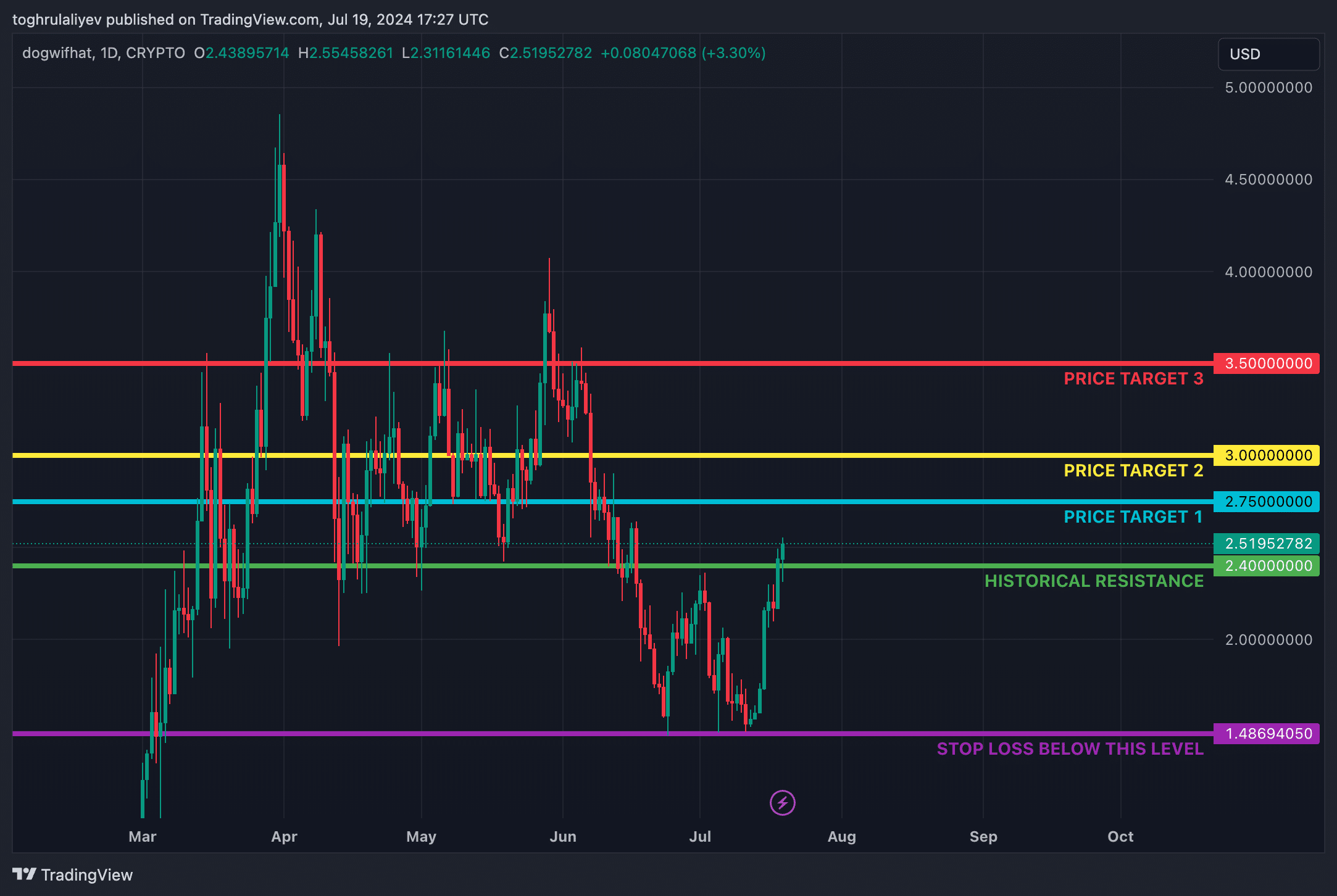

Initially, the price of Dogecoin surpassed its previous significant resistance at $2.4 for the first time. This level has acted as a support in the past. This breakthrough implies a possible continuation of gains if the coin manages to sustain its upward trend above this pivotal point.

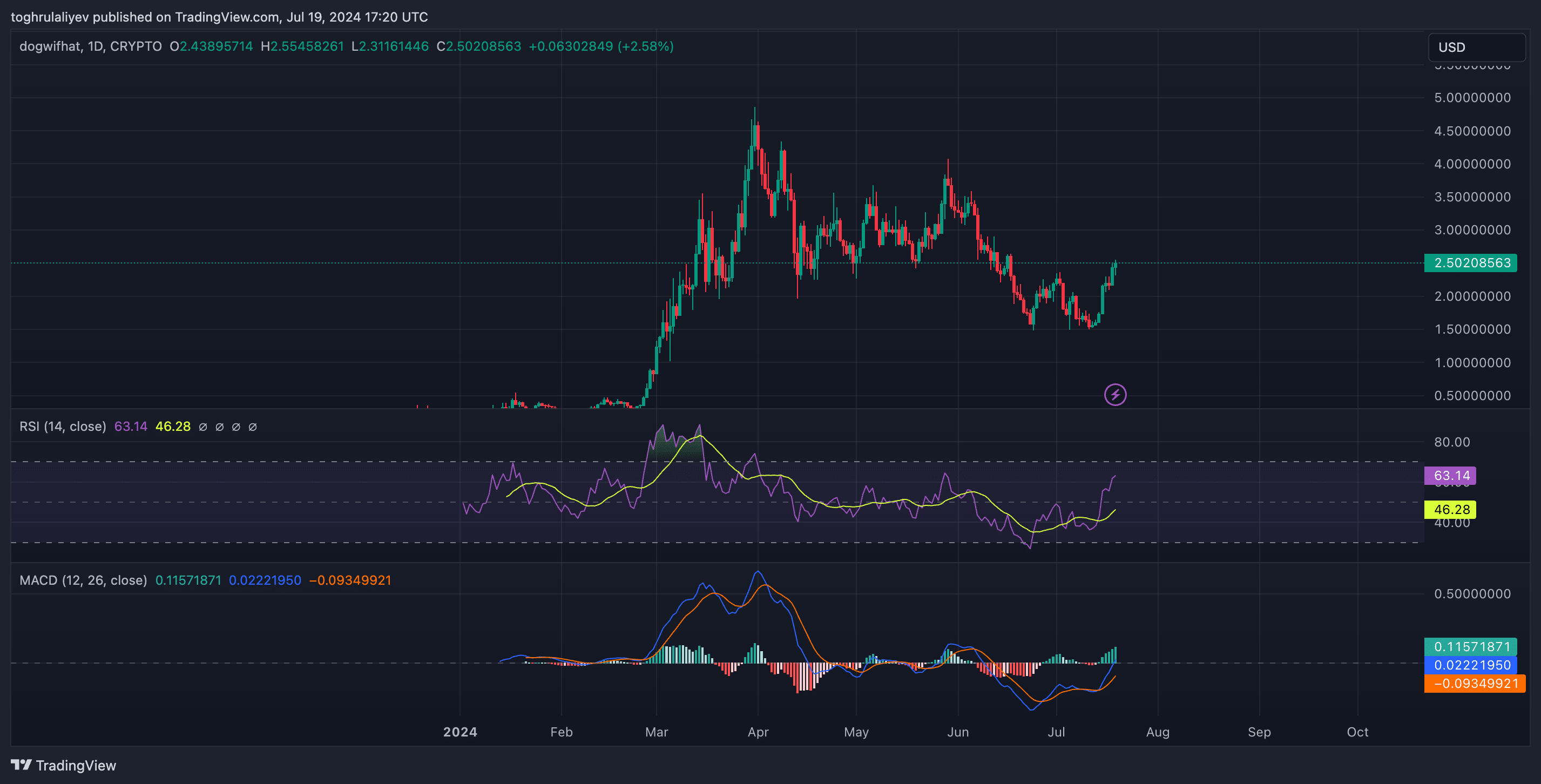

Technical indicators

Based on my extensive experience in technical analysis, I can confidently say that the current readings of the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators suggest a bullish outlook for WIF. The RSI, which measures the magnitude of recent price changes to evaluate overbought or oversold conditions, is currently reading above 60. This finding indicates intense buying pressure and momentum in WIF’s favor.

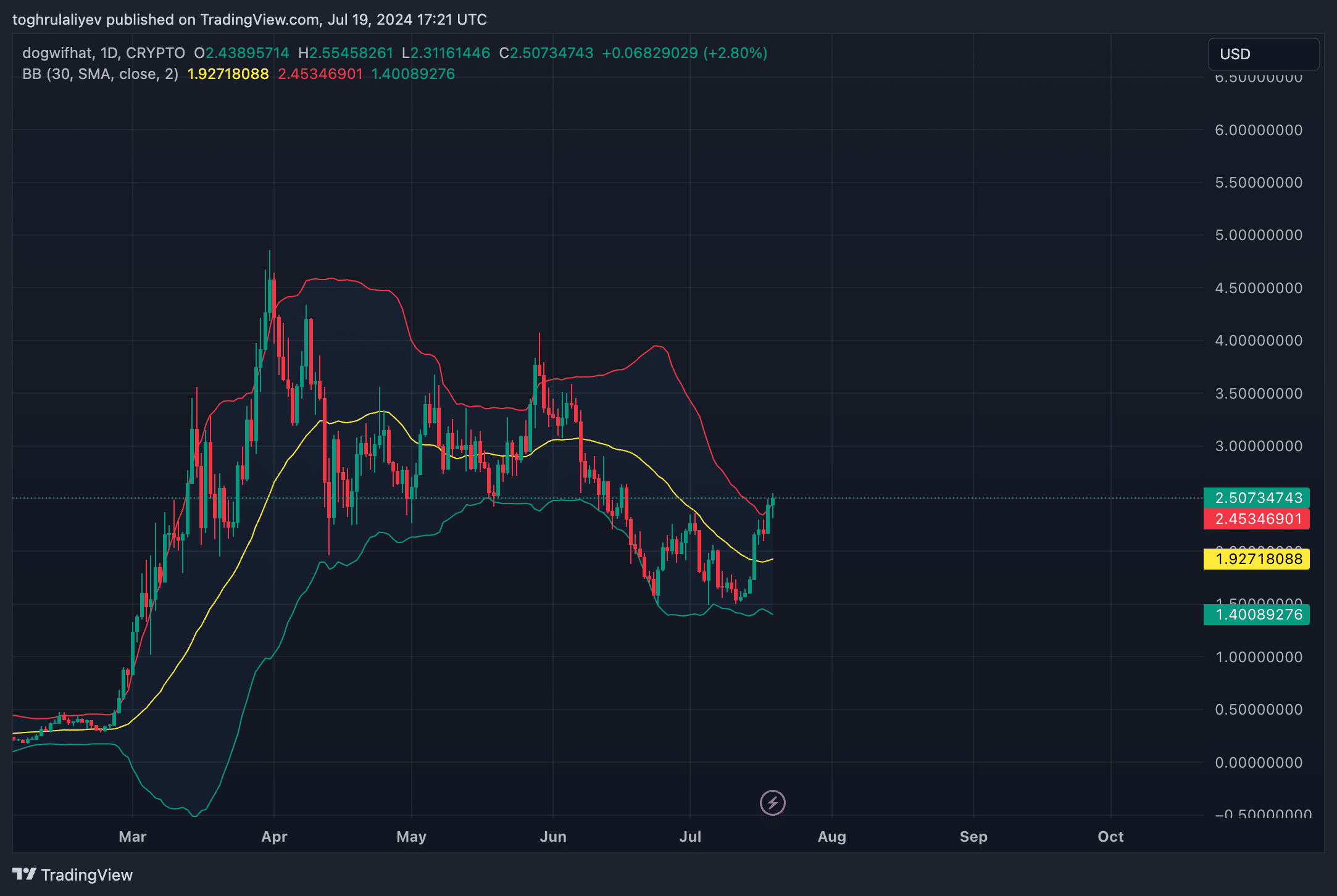

When examining the Bollinger Bands, WIF‘s price has surpassed not just the middle band, which represents the 20-day moving average, but has also breached the upper band. This signifies strong and persistent uptrend.

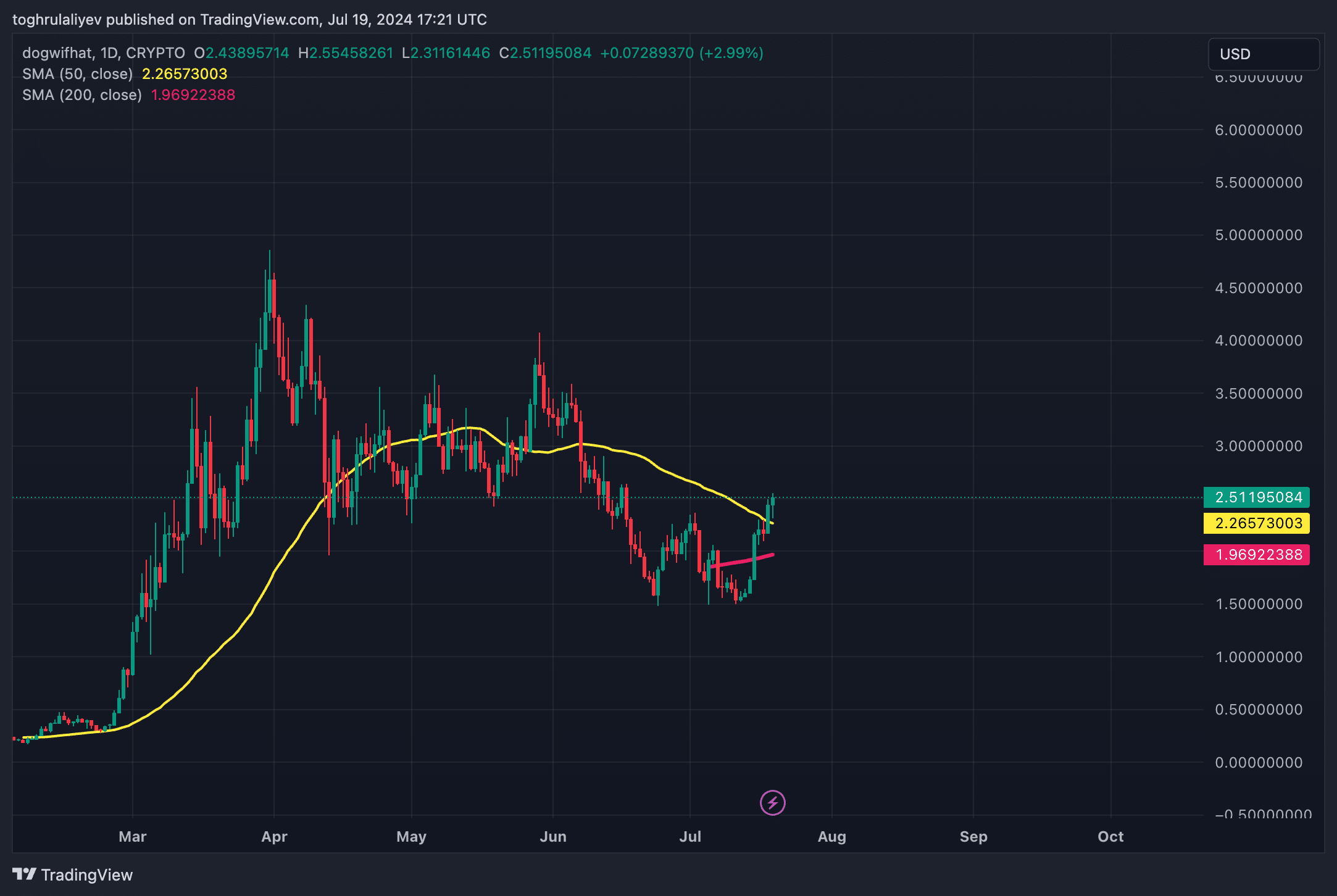

Potential golden cross

Despite WIF being a relatively fresh coin on the market, its 200-day moving average line recently developed offers valuable insights into long-term trends. If current trends continue, a golden cross – with the 50-day moving average surpassing the 200-day moving average – is expected in the near future, making it the seventh bullish sign supporting WIF.

Strategic considerations

In order to unlock the possibility of a prolonged price trend, it’s crucial to keep an eye on the daily candlestick closing price. If the close manages to surpass the historical resistance level of $2.4, it could open the door for additional gains. This development would then bring into view several significant price objectives.

- Price target 1: $2.75

- Price target 2: $3.00

- Price target 3: $3.50

Should the cryptocurrency market as a whole experience a downturn, setting a stop loss at around 5-7% lower than the $2.40 mark can help minimize risks for WIF investors. By employing this strategy, potential losses would be capped if WIF fails to maintain its current price uptrend.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-19 20:50