As a seasoned analyst with over two decades of experience under my belt, I’ve seen market cycles come and go, from the dot-com bubble to the 2008 financial crisis. The correlation between Bitcoin and traditional markets is nothing new, but it’s always intriguing to witness the dance these two seemingly disparate entities perform.

On August 1, it became evident that the price movement of Bitcoin mirrored that of traditional financial markets, as the cryptocurrency dropped in value along with stocks and other market indicators.

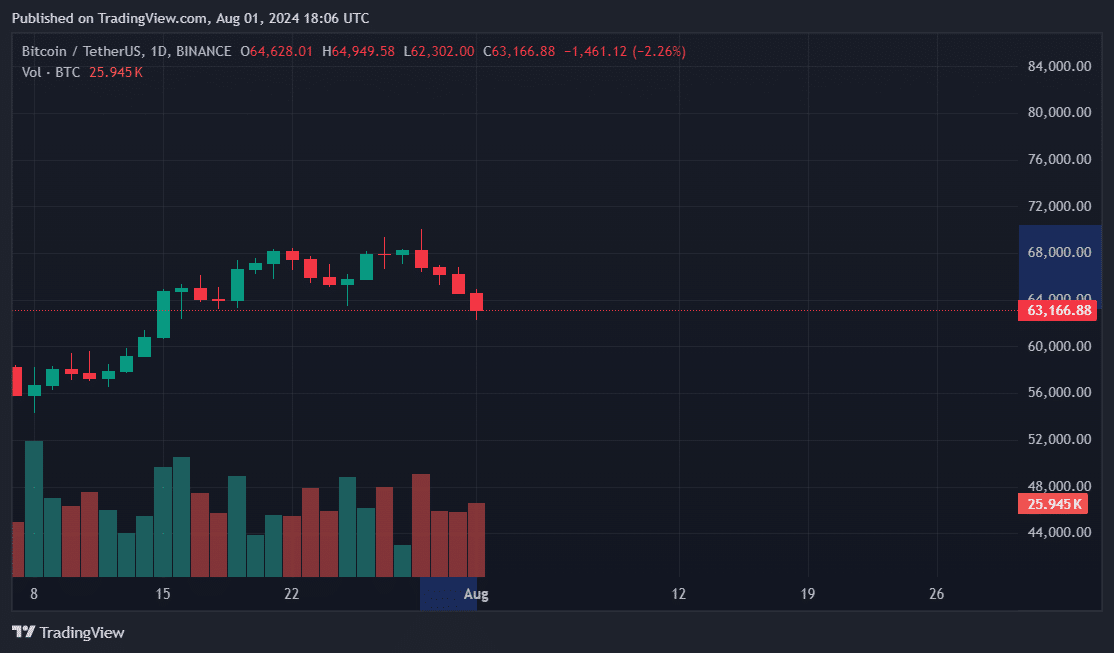

Since July 29, Bitcoin (BTC) has dropped by more than 10% from its peak, which occurred when it approached $70,000 and reached a two-month high following Donald Trump’s comments in Nashville. Currently, the digital currency is being traded at a price below $63,500.

In the last 24 hours, Bitcoin (BTC) experienced a 7% decline, which coincided with substantial drops in the S&P 500 and Dow Jones market indexes. Notably, the Dow Jones Industrial Average plummeted more than 500 points within an hour. Major companies like Amazon and Nvidia also saw their stocks drop on August 1st due to concerns about a potential U.S. recession, as suggested by analysts from The Kobeissi Letter.

The fluctuations in conventional markets and Bitcoin values have rippled through the entire cryptocurrency sector as well. According to CoinGecko, the overall value of the cryptocurrency market dipped by 6% following a rally earlier this week, dropping down to approximately $2.3 trillion.

At the current moment, noticeable drops were observed in the prices of top cryptocurrencies such as Ethereum (ETH), Solana (SOL), and Ripple (XRP), due to a significant outflow of investment from the digital assets market.

BREAKING NEWS: Over a period of 45 minutes, the Dow Jones Industrial Average has dropped by more than 500 points.

— The Kobeissi Letter (@KobeissiLetter) August 1, 2024

Ether, Bitcoin lead crypto liquidations

According to CoinGlass, the volatile market didn’t spare those with margin positions. Over 105,480 traders found themselves liquidated, and a total of $324 million worth of leveraged positions were eliminated due to the downturn.

Ether’s long positions resulted in $72 million worth of crypto liquidations due to traders who had wagered on increased ETH prices being forced to sell. Following closely, Bitcoin recorded $69 million in long liquidations. Subsequently, Solana (SOL), Ripple (XRP), and Dogecoin (DOGE) were the top three assets with the most liquidation events after Bitcoin and Ether.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-03 01:45