As a seasoned researcher with over a decade of experience in the crypto market, I’ve seen my fair share of rollercoaster rides. The current state of Hedera Hashgraph (HBAR) is no exception – it’s like watching a slow-motion car crash in real time.

Over the last five days, Hedera Hashgraph has seen a substantial drop, hitting a key level of resistance due to difficulties within its ecosystem.

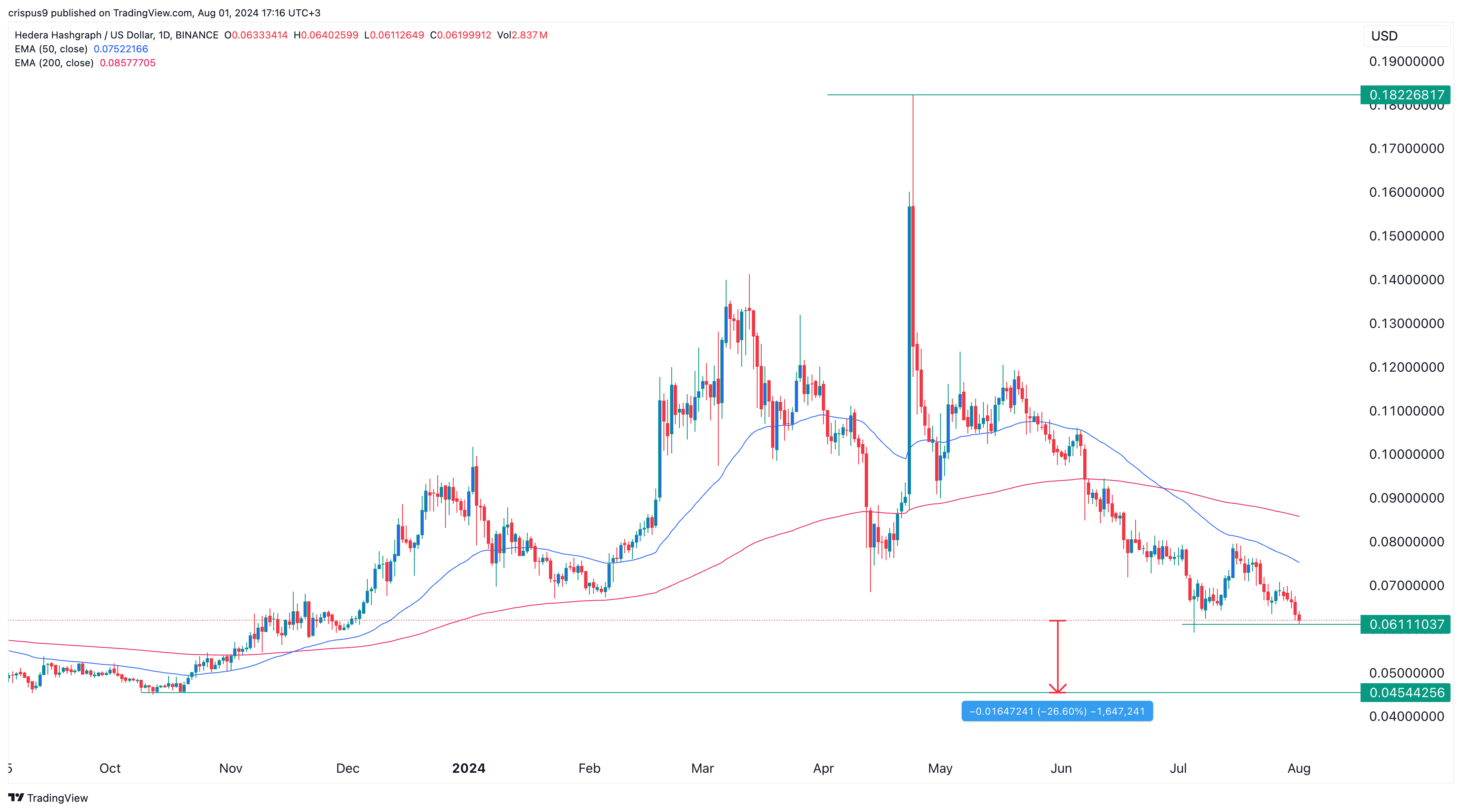

Over the past few months, the value of Hedera Hashgraph (HBAR) has seen a significant drop following a peak at around $0.1825 in April. This decline has resulted in a decrease of approximately 65%, and currently, it’s reaching its lowest point for the year.

Hedera’s ecosystem challenges

More recently, Hedera has encountered difficulties primarily due to complications within its own ecosystem, specifically in sectors such as gaming and decentralized finance.

Although Hedera is among the larger cryptocurrencies, it has a relatively smaller ecosystem in comparison to its counterparts like Solana (SOL) and Arbitrum (ARB). In terms of Decentralized Finance (DeFi), Hedera’s total value locked amounts to only $58 million and it hosts just 6 decentralized applications (dApps).

In comparison, the biggest decentralized exchange on SaucerSwap maintains under 60 million dollars in total assets, whereas Stader boasts 29 million dollars worth of staked assets and a market capitalization of 10 million dollars for its stablecoins.

Instead, let’s consider Tron (TRX), which boasts a staggering $8.13 billion in assets, an impressive $58 billion in stablecoins, and approximately 2.2 million active addresses. On the other hand, Solana, another notable blockchain platform, has about 1.23 million active addresses and $3.4 billion in assets.

Hedera Hashgraph boasts a diverse group of influential businesses as part of its governing body, including the likes of IBM, Nomura, Deutsche Telekom, Mondelez, and ServiceNow, who have all joined their ranks.

Various businesses are creating business-oriented products leveraging the technology provided by Hedera. For example, Aberdeen Standard Investments, a financial institution managing over £496 billion in assets, is developing a tokenized asset akin to BUIDL or Franklin Templeton’s FOBXX.

Australian Payments Plus is exploring ways to simplify money transfers with the help of Hedera’s technology. Yet, many council members have yet to disclose specific details about their Hedera-based projects.

Hedera Hashgraph price nears a make-or-break level

In June, the crossing of Hedera’s HBAR token’s 50-day and 200-day Exponential Moving Averages created a “death cross” pattern. This usually signals potential future price decreases, which could explain why the value of HBAR has fallen by approximately 25% since then.

HBAR’s current trading price is close to a crucial support point around $0.061, which marks the lowest it has been this July. If it falls below this level, it might suggest more drops ahead, possibly disrupting the bullish double-bottom chart pattern. It’s essential to keep an eye on $0.045, as that was its lowest point in October of last year, indicating a potential 27% decrease from where it stands now.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-08-03 01:55