As a seasoned crypto investor with a knack for spotting opportunities and navigating market volatility, I must admit, it’s been quite an intriguing day! The rebound of IOTA, along with other major cryptocurrencies, is indeed encouraging after Monday’s dip. However, as we all know too well in this rollercoaster world of digital assets, a bounce back doesn’t necessarily mean smooth sailing ahead. It could very well be a ‘dead cat bounce’, but who knows? Maybe it’s the start of a new bull run!

On Tuesday, the value of IOTA increased, aligning with other digital currencies that rebounded following their significant drop on Monday.

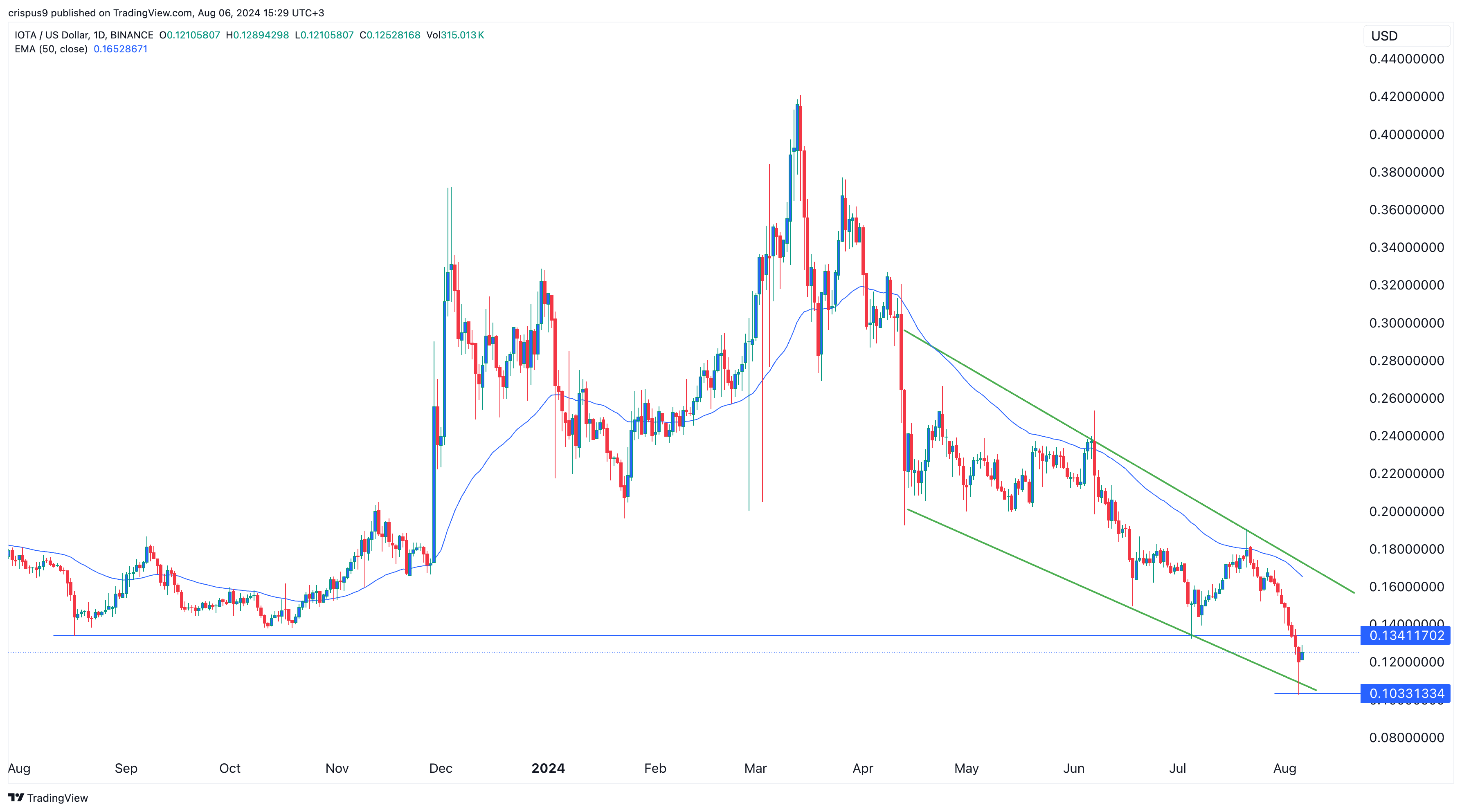

today, the value of the IOTA token reached its peak at $0.1290, which represents a 25% increase compared to its lowest point this week, which was $0.1028.

Cryptocurrencies have recovered

On Monday, I observed that the rebound of the cryptocurrency I’m studying mirrored similar recoveries in other digital currencies. For instance, Bitcoin (BTC), which dipped as low as $49,000 on August 5, surged to $56,000 by the end of the day. Similarly, Ethereum (ETH) saw a significant increase, rising from approximately $2,118 to over $2,500 within the same timeframe.

The economic recovery was consistent with stock market trends, as Japan’s Nikkei 225 increased by 10%, while in the U.S., futures for the Dow Jones, Nasdaq 100, and S&P 500 indices rose more than 0.8%. In simpler terms, the recovery followed the pattern of the stock market, with Japan’s main index climbing by 10%, and the U.S. stock market futures showing an increase of over 0.8%.

As a crypto investor, I observed a surge in the value of my digital assets as anticipation grew among investors about potential Federal Reserve interest rate reductions. Analysts from UBS, ING, along with financial institutions like Jefferies and Goldman Sachs, have signaled that these rate cuts might be imminent soon.

Jefferies predicts that the bank might implement an unexpected reduction in interest rates this month, whereas Jeremy Siegel of Wharton University has recommended a decrease of 0.75 percentage points.

Although it’s showing signs of improvement, there’s a possibility that the current revival could be just a short-term surge before another downturn, much like when a dead cat bounces on impact before eventually falling back down.

IOTA becomes Sharia-compliant

After obtaining a Sharia compliance certificate from the Cambridge Institute of Islamic Finance, the value of IOTA tokens increased as well. This makes IOTA the pioneer within the distributed ledger technology sector to earn this certification.

IOTA anticipates that this certification will boost its appeal globally among Muslim communities. Additionally, they are confident that their network will be chosen by businesses aiming to develop their decentralized apps. For instance, IOTA‘s technology may be utilized in initiatives such as verifying halal meat, thereby expanding its applications.

A few months following the IOTA Foundation’s distinction as the initial entity regulated by the Abu Dhabi Global Markets, we received our certification.

1. The Middle East is swiftly expanding due to an influx of foreign investments, with approximately 6,700 high-net-worth individuals planning to relocate there in 2023, predominantly hailing from nations such as Russia and China. (Reported by CNBC)

Many individuals prefer Middle Eastern destinations like Abu Dhabi, mainly due to their lower tax rates and emphasis on privacy.

IOTA price remains below key support

Despite a recent recovery, IOTA‘s token value hasn’t surpassed crucial support thresholds. Currently, it’s trading below the significant support at $0.1341, which marks its lowest point from August of last year.

It also remains below the 50-day Exponential Moving Average, meaning that bears are still in control. Therefore, the token could resume the downward trend as sellers target this week’s low at $0.103.

From a favorable perspective, the IOTA price appears to have created a hammer-like candlestick formation, a pattern commonly recognized as a potential indicator of a price reversal.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-08-06 16:04