As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations and trends. The recent bounce back of Ethereum (ETH) seems to be a combination of smart investment strategies and technical indicators.

On Tuesday, August 6, the price of Ethereum rebounded following the formation of a large ‘hammer’ candlestick pattern. Some investors, such as ‘7 Siblings,’ took advantage of the dip and made purchases.

Ether’s current price stood at approximately $2,445, marking a rise of more than 15% from its lowest point this week. This upward trend mirrored the movements of Bitcoin, Cardano, and Bittensor.

Ethereum whales are buying

It appears that some large investors took advantage of the drop on Black Monday to acquire ETH tokens, with expectations that their value would recover. One such investor was ‘7 Siblings,’ a well-known entity boasting assets valued at more than $1.57 billion. This investor purchased approximately 56,093 ETH tokens, worth over $129 million.

Amidst the chaos and panic selling caused by the market crash, the entity known as “7 Siblings” – with assets worth approximately $1.57 billion – stealthily acquired 56,093 Ether (around $129 million) at rock bottom prices! Over a span of 12 hours, starting when the price dipped to roughly $2,600 and ending as it reached $2,191, these shrewd investors seized the opportunity to make strategic purchases.

— Lookonchain (@lookonchain) August 6, 2024

As an analyst, I’ve observed a notable uptick in Exchange Traded Funds (ETFs) purchases, which could be indicative of investors seizing the opportunity presented by a market dip. According to Bloomberg’s data, these investors have collectively invested around $49 million, suggesting a surge in investor confidence and optimism.

Nonetheless, major players within the crypto market are exercising prudence, with some high-value token owners choosing to offload their holdings. For instance, Jump Trading, a notable figure in this sector, has disposed of Ether tokens valued at over $609 million recently. Additionally, an influential holder named Longling Capital, dormant for nearly 2 years, has just moved 20,000 coins.

The potential rebound of Ethereum may encounter extra uncertainties because not all financial analysts are convinced that the Federal Reserve will lower interest rates in September. In a discussion with CNBC, Komal Sri-Kumar, the founder of Sri Kumar Global Strategies, suggested that the Fed should postpone rate cuts until inflation decreases first.

Despite this, it appears that he may be an exception to the rule, as the CME Fedwatch tool indicates a 76.5% likelihood of a 0.5 percentage point rate reduction in September, with additional cuts predicted for November and December as well.

Another positive for Ethereum is that its staking yield has risen by 6.3% in the past 24 hours to 9.46%. This rebound happened as the staking market cap dropped by 26% to $81.95 billion.

Ethereum price has some technical risks

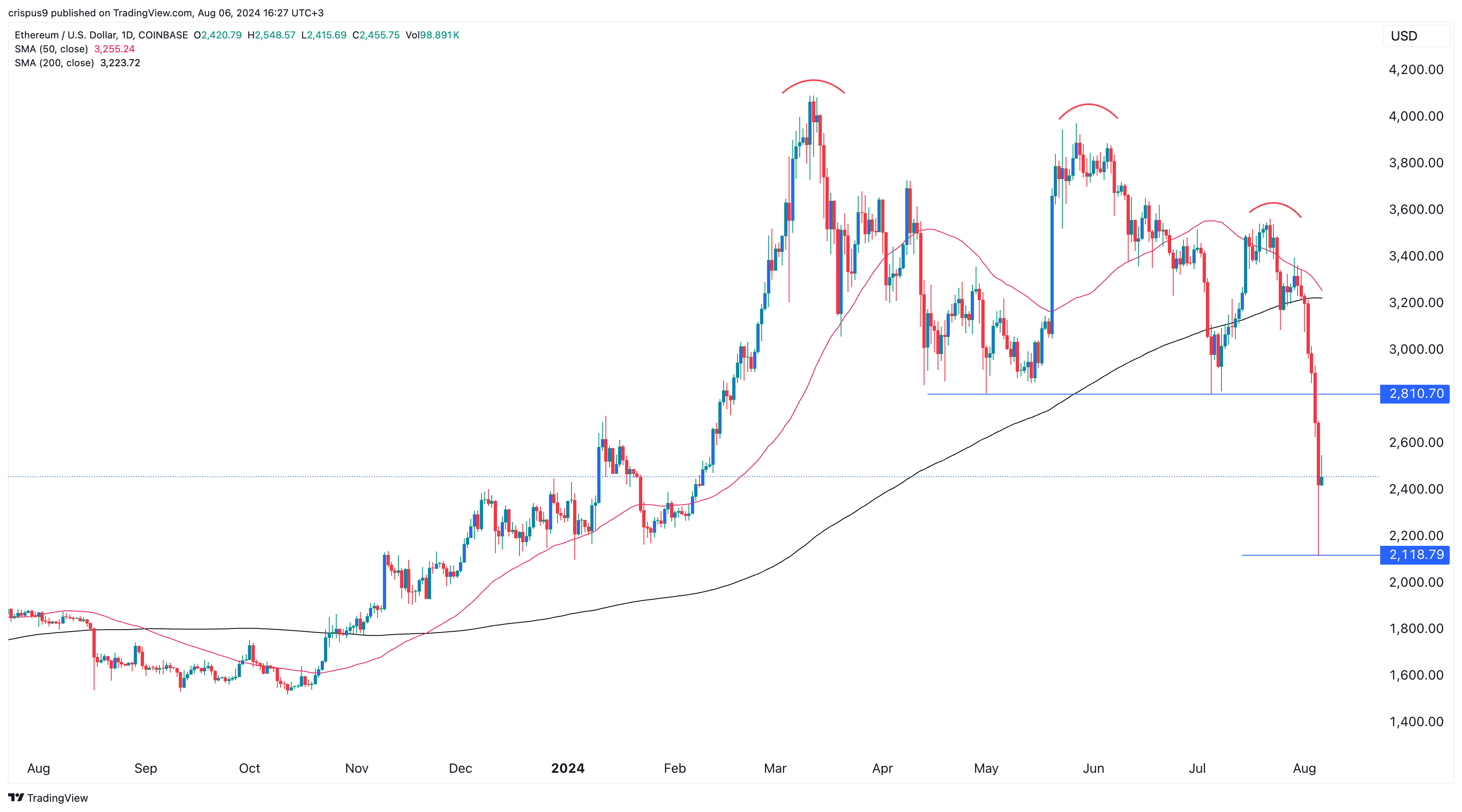

Another possible risk for Ether, technically speaking, arises from its chart structure. On a daily basis, the coin has exhibited a triple-top formation with a neckline at approximately $2,810. A break below this neckline indicates that the bears have taken control, suggesting downward momentum.

As a crypto investor, I’m keeping a close eye on Ether. It seems that the 50-day and 200-day Simple Moving Average are about to intersect in a bearish manner, forming what’s known as a death cross. This could indicate a potential downtrend ahead. Moreover, just as with Bitcoin, any brief recovery after a sell-off might only be a ‘dead cat bounce,’ suggesting a temporary resurgence before the market continues to fall.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-06 17:14