As a seasoned crypto investor with a few battle scars and victories under my belt, I find myself both intrigued and cautiously optimistic about the current state of Bitcoin. The price surge to nearly $57,000 is a welcome sight after the turbulent times we’ve experienced, but it’s important not to get carried away by the short-term fluctuations.

As the overall market anxiety subsides, Bitcoin is approaching the $57,000 threshold. However, a significant number of wallets continue to experience losses.

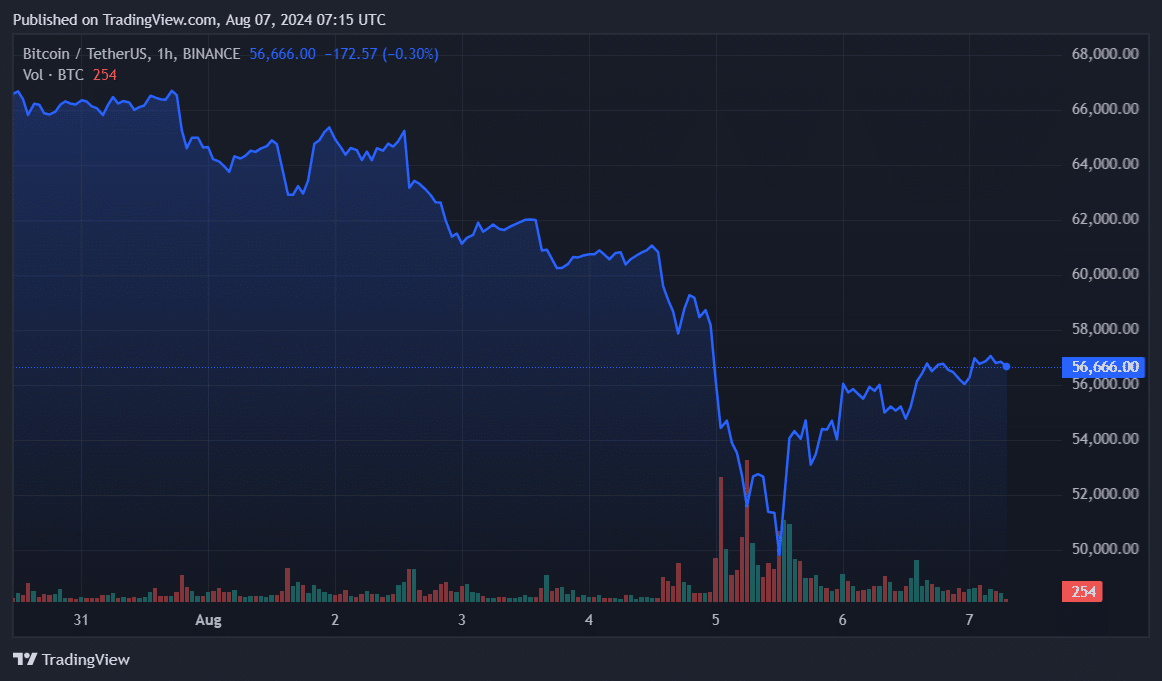

On August 5th, Bitcoin (BTC) bounced back from the $50,000 level as concerns about geopolitical conflicts and economic recession began to ease. Today, it momentarily peaked at around $57,220 before settling between $55,000 and $57,000 over the last 24 hours, indicating a period of stability.

In the last 24 hours, Bitcoin increased by approximately 1.7% and is currently worth around $56,900. This recent price jump has propelled Bitcoin’s market capitalization over the $1.1 trillion threshold, with a daily trading volume of roughly $47.4 billion.

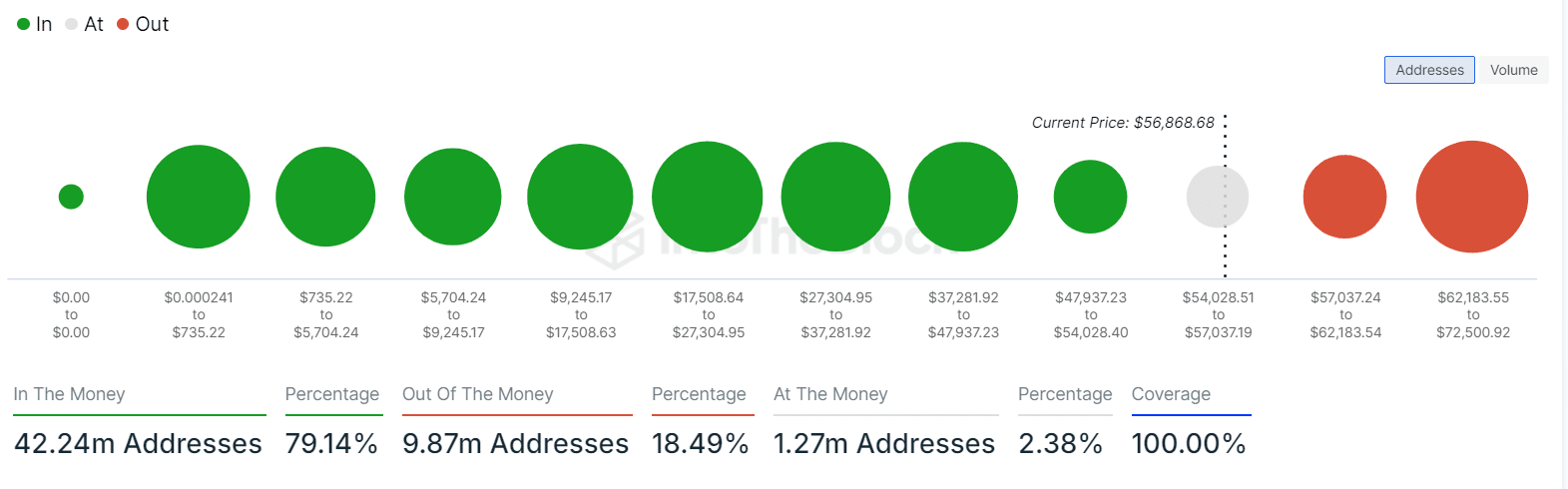

Approximately 9.87 million Bitcoin addresses, as per ITB’s data, are currently showing a loss. Out of these, around 6.88 million wallets have purchased the cryptocurrency at an average price of approximately $66,441 each. Additionally, nearly 2.99 million holders acquired their Bitcoins at an average price of about $59,978.

These addresses have a total trading volume of 4.53 million Bitcoins.

1.27 million Bitcoin holders, who currently own approximately 907,070 BTC tokens, are either seeing a slight gain or break-even at the current market price. On average, they had bought Bitcoin for around $55,776 each.

On the other hand, 42.24 million addresses are seeing notable profits on their Bitcoin holdings.

According to data from ITB, approximately 37.84 million Bitcoin wallets have held the cryptocurrency for more than a year, contrasted with around 2.66 million wallets that are associated with short-term traders.

Given the current situation, it’s likely that sellers who are still in the red will hold back on selling, leading to reduced market volatility. There’s even a possibility of an increase in prices under these circumstances.

Based on a news article from crypto.news, the CEO of CryptoQuant, Ki Young Ju, predicts that the price of Bitcoin could reach a new record high if it maintains its value above $45,000.

In addition, it’s notable that large Bitcoin holders (whales) amassed approximately 404,448 coins, equivalent to around $23 billion, during the last month. This suggests a rise in hoarding as the market was influenced by fear, uncertainty, and doubt (FUD).

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2024-08-07 10:44