As a seasoned analyst with years of trading under my belt, I’ve seen more market trends than I can count. And while Zcash (ZEC) has been on quite the run lately, I can’t help but feel that we’re standing at a crossroads right now.

Over the last month, Zcash’s value has experienced a notable surge, recovering strongly. However, conflicting indications on both the daily and weekly graphs cast doubt on where the asset’s price might head next.

In just the last month, Zcash (ZEC) has seen an impressive 80% increase, placing it among the top performers during this period. This substantial rise follows a rebound from its lowest point on July 5 at $15.78.

Based on my years of trading experience, I have seen countless instances where a recovery like this one comes on the back of a broader market rebound. However, as a trader who has been through numerous market cycles, I can tell you that it is always wise to be cautious and question whether such an uptrend can be sustained or if it has reached its peak. Technical indicators can often provide mixed signals, and it’s essential to interpret them carefully before making any investment decisions. In my opinion, the key to success in trading is a combination of sound technical analysis and a healthy dose of skepticism.

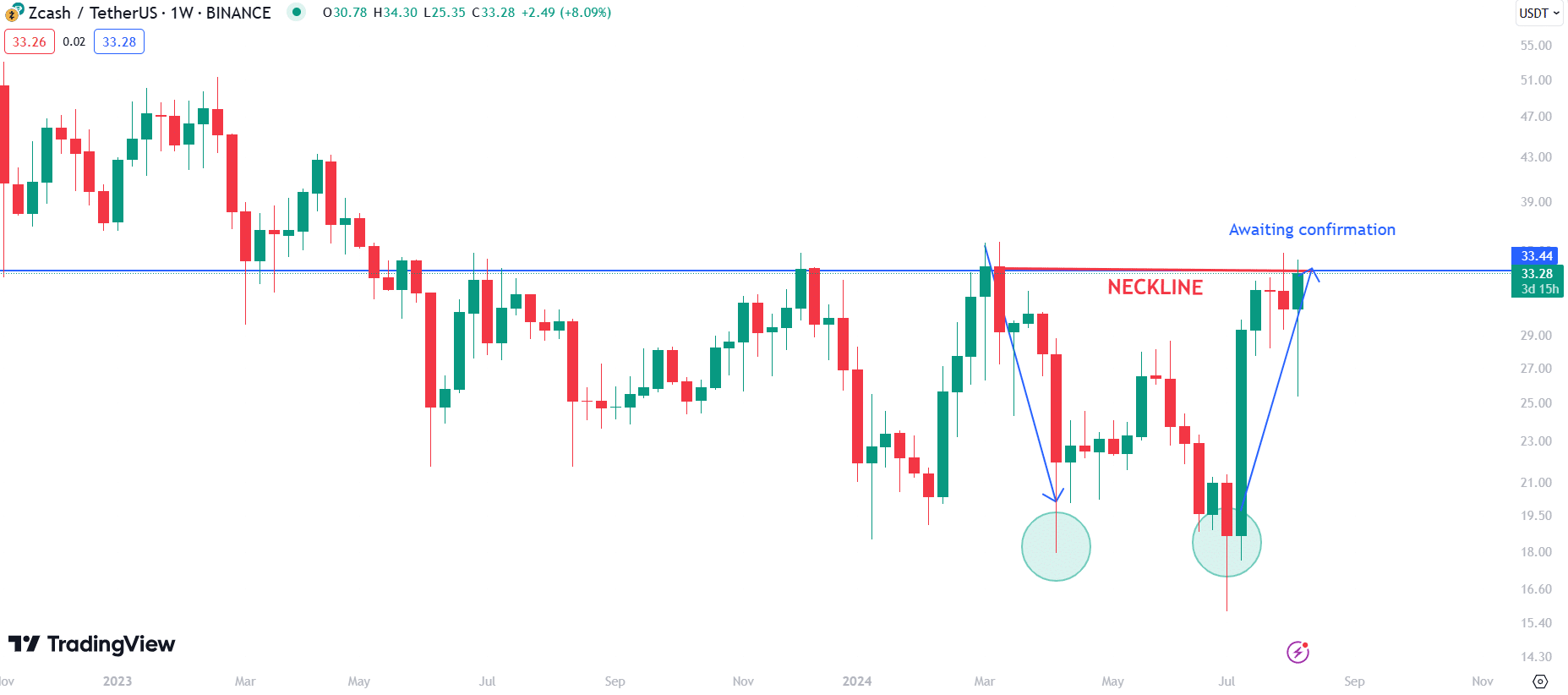

Zcash eyes double-bottom

Looking at the weekly graph, ZEC appears poised to develop a double-bottom structure. Generally, this pattern suggests optimistic signs, meaning a potential increase in price could follow if it’s verified.

As an analyst, I observed two significant dips in the price of ZEC. The first dip happened in April 2024, where ZEC plummeted to a low of $17.94. A second dip followed on July 5, with ZEC crashing down to $15.78. This double bottom formation can be confirmed if ZEC manages to close above the resistance level at $33.50.

A potential surge in Zcash might push it towards its upcoming major resistance points, ranging from $38 to $45. Yet, we’re yet to see official confirmation, so keeping an eye on these levels is important for now.

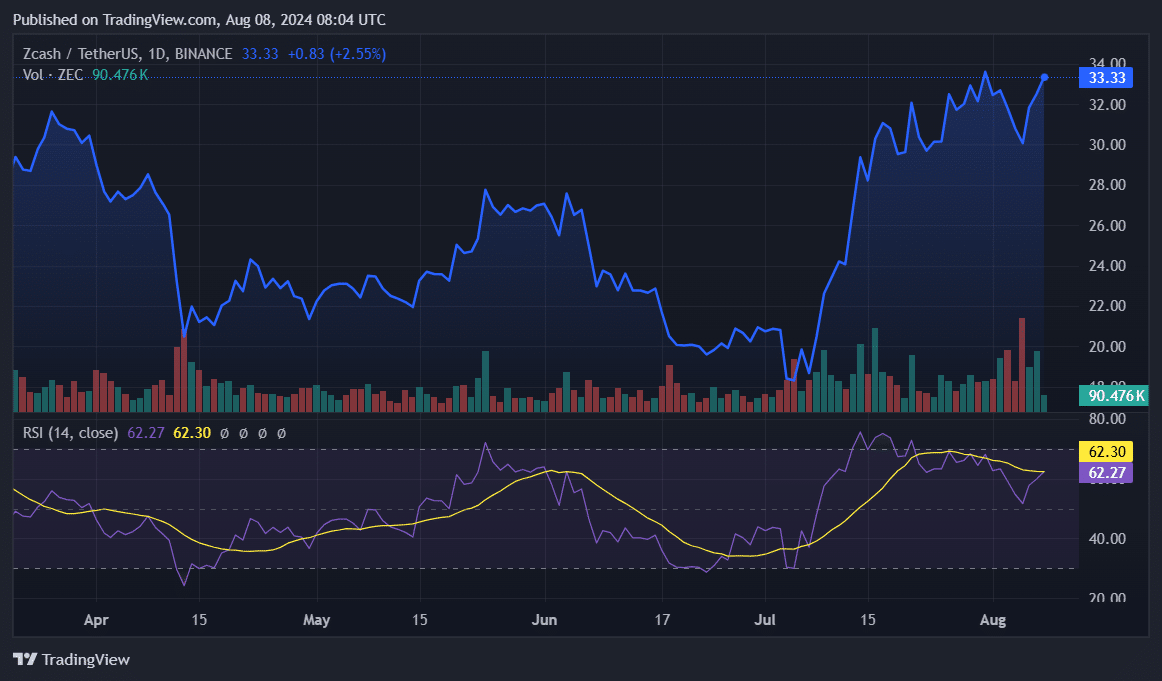

Growing bearish divergence

Currently, the daily graph indicates a possible bearish divergence, suggesting a potential upcoming downtrend. While ZEC‘s price has been hitting new highs since July 26, the Relative Strength Index (RSI) has only formed lower peaks.

The Relative Strength Index (RSI), presently at 62.30, hints that the bullish trend may be weakening. Typically, divergences precede price changes, implying this pattern could signal impending downward pressure. Even with a recent increase, if the RSI drops below 60, it could intensify the bearish trend.

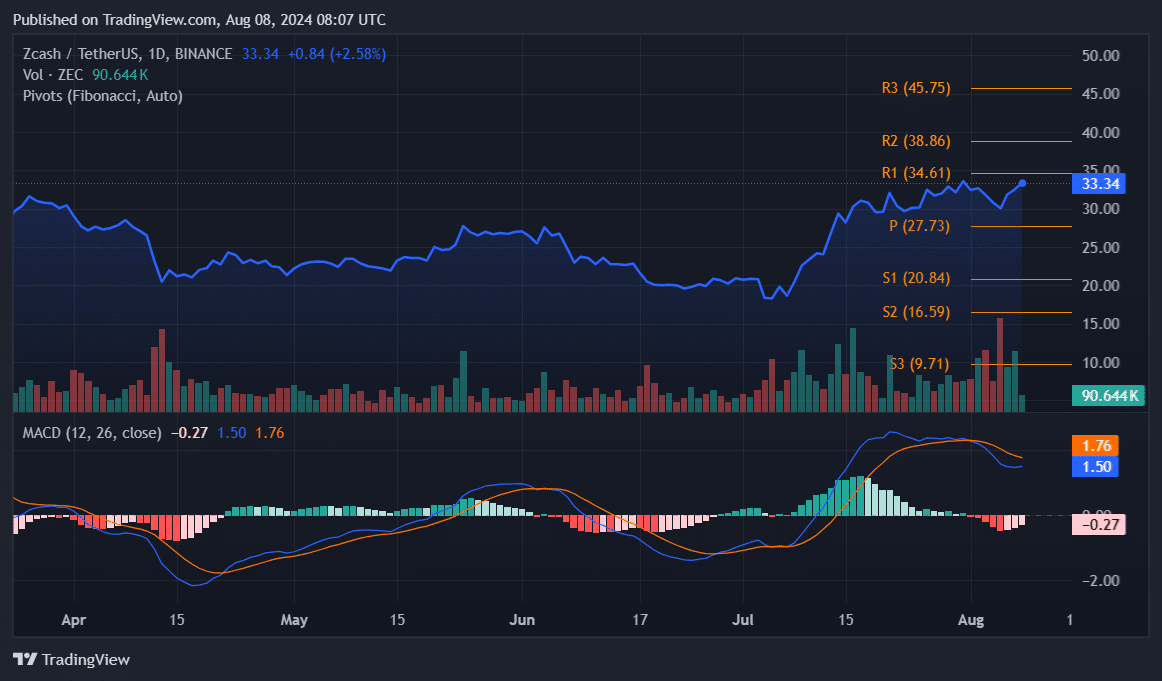

In my analysis of ZEC‘s daily chart, I’ve identified key Fibonacci Pivot Points that signal important levels of support and resistance. The pivot point at $27.73 is particularly significant as a potential support level. If ZEC falls below this price point, the subsequent support levels can be found at $20.84, $16.59, and $9.71.

Instead, it can be said that if we look at things differently, the resistance points have been established at $34.61, $38.86, and $45.75. As of now, ZEC is hovering slightly below the initial resistance. If this level is surpassed successfully, it could potentially aim for the second and third resistance areas, suggesting a continuation of the bullish trend suggested by the weekly double-bottom chart pattern.

ZEC MACD shows mixed signals

In simpler terms, the daily Moving Average Convergence Divergence (MACD) exhibits a conflicting pattern. Specifically, the MACD line stands at 1.50, slightly higher than the signal line at 1.76, suggesting a positive market trend or bullish momentum. Yet, the recent negative bars in the histogram hint that this momentum could be decreasing. If the MACD line crosses below the signal line, it may signal a shift to a bearish trend.

From my perspective as an analyst, Zcash (ZEC) finds itself at a pivotal juncture given its current price level. A weekly double-bottom pattern suggests a bullish scenario if we manage to break above $33.44. Nevertheless, it’s essential to consider the bearish divergence on the daily Relative Strength Index (RSI) and the inconclusive signals from the Moving Average Convergence Divergence (MACD). These indicators hint at a possible correction or pullback that investors should be aware of.

As an analyst, I always emphasize the importance of closely monitoring the crucial support and resistance levels derived from the Fibonacci Pivot Points. A breakout above $34.61 could rekindle the bullish trend, whereas dipping below $27.73 might indicate a more substantial correction, potentially fueling increased fear, uncertainty, and doubt (FUD).

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-08-08 13:07