As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market recoveries and bearish patterns. The recent Toncoin price surge has caught my attention, and it appears to be following a classic hammer candlestick pattern on the weekly chart.

The price of Toncoin experienced a robust rebound following its drop to a significant low point over the past few months, observed on Monday. This upswing seems to be due to investors unwinding their Japanese yen carry trades.

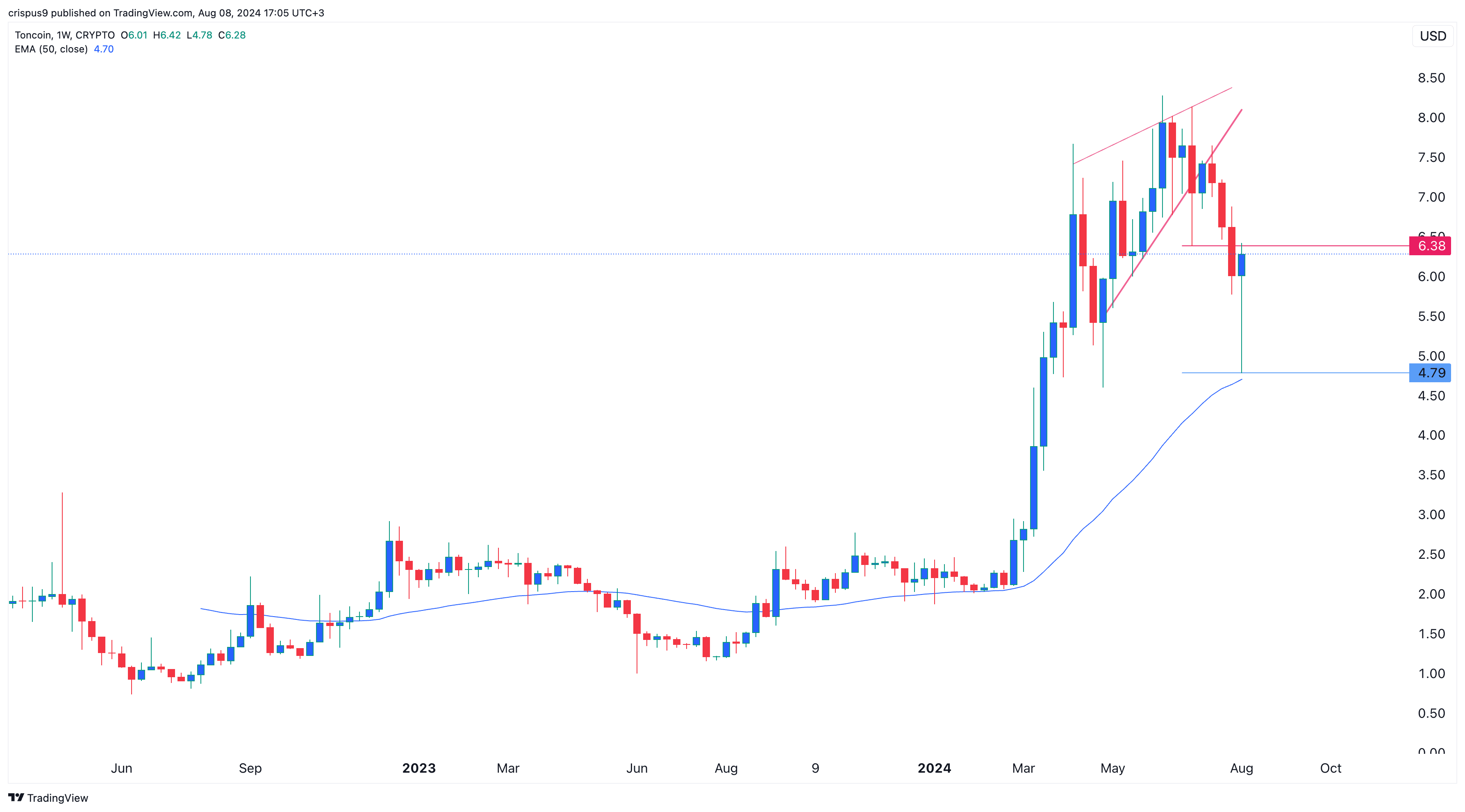

1. In a bustling market, the price of Toncoin (TON) reached an impressive $6.38 peak. Compared to its lowest point this week, it surged more than 35%. Remarkably, the coin managed to recover even with some subpar on-chain performance. According to TonStat, the daily burn rate of Toncoins decreased significantly from the yearly maximum of 28,000 to 5,766.

As a researcher studying Toncoin, I’ve noticed an intriguing trend: The total number of on-chain activated wallets has surged to nearly 12 million. However, the daily active wallet count has dipped to 459,230 from its July peak of 700,000. This suggests that, despite the hype surrounding tap-to-earn platforms like Hamster Kombat and Notcoin (NOT), Toncoin may not have experienced significant growth in user engagement as a result.

Toncoin’s recovery has happened as the sentiment among crypto and stock traders has improved.

On August 8th, the Dow Jones index largely recuperated from its losses incurred on Monday, gaining approximately 300 points. Similarly, other international stock indices have bounced back as well. In the cryptocurrency market, Bitcoin (BTC) and various altcoins have surged significantly, demonstrating a remarkable recovery over the recent days.

Toncoin’s resurgence is particularly significant because it’s taking place within a bustling trading environment. As reported by crypto.news, its 24-hour trading volume surpassed $1.3 billion, marking a higher figure than its usual average. Moreover, this surge occurred at a time when the open interest in the futures market reached an all-time high of $236 million since August 2nd.

Toncoin price hammer pattern

The Toncoin event occurred following the creation of a rising wedge shape in its price chart, often interpreted as a bearish indicator. On the weekly scale, the token was displaying a hammer candlestick formation, recognized by a long lower wick and a short body. Typically, this pattern is associated with a bullish reversal, suggesting a potential change in trend from bearish to bullish.

To ensure a potential Hammer or Dragonfly Doji pattern in Toncoin, it needs to meet certain conditions. Firstly, if Toncoin manages to close above the low of $4.80 established on Monday, that would be a positive sign. Secondly, the lower shadow (the area between the open and the low) should ideally be at least twice as large as the body (the space between the open, close, high, and low). If not, it might transition into a Dragonfly Doji pattern instead. Lastly, a small upper shadow (the area between the high and the close) is indicative of this bullish pattern. However, if the body size becomes very small, the pattern may shift to a Dragonfly Doji, which is still considered somewhat bullish.

If these patterns prove effective in the current high-demand situation, it suggests further growth potential, with bullish traders aiming for the resistance level around $7.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-08 17:47