As a seasoned crypto investor with over a decade of experience navigating the volatile and ever-evolving landscape of digital assets, I have learned to never underestimate the power of innovation and regulation in shaping market dynamics. The recent developments surrounding Tether’s USDT stablecoin and the MiCA regulation in Europe have piqued my interest, and here is my two cents on the matter.

As Europe introduces stricter regulations on Cryptocurrency Markets, there’s speculation about whether Tether’s USDT stablecoin can sustain its leading position in the long run.

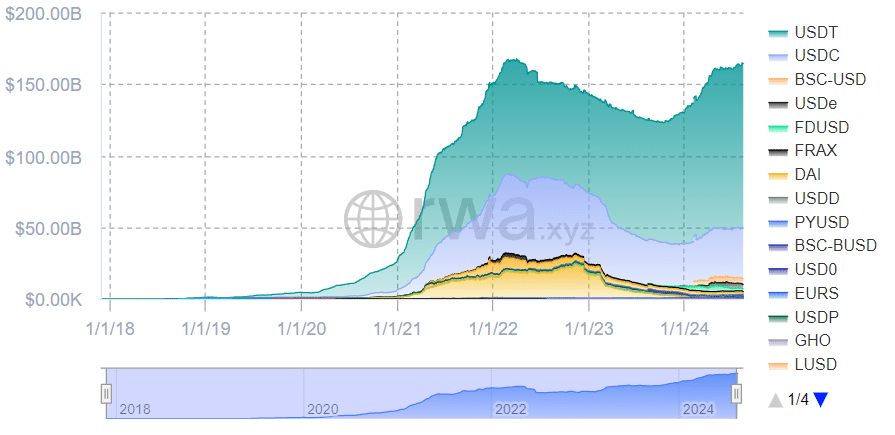

Information provided by rwa.xyz indicates that at present, Tether (USDT) holds approximately 70% of the stablecoin market and boasts a market capitalization of $115.67 billion. Nevertheless, Tether’s CEO, Paolo Ardoino, has voiced apprehensions concerning the recently enacted MiCA regulation, which went into effect on June 30.

As a researcher examining the latest developments, I can share that under the new legislative framework, entities issuing stablecoins such as Tether and Circle are now required to hold 60% of their reserves in banks based within the EU. While some, like Ardoino, express concerns about potential risks this could pose for the stablecoin market, it’s worth noting that some competitors have already embraced this change and adopted the new measures early on.

Stablecoin provider Circle has introduced Euro-linked digital currency, EURC, on Coinbase’s secondary blockchain, Base. According to recent reports, EURC adheres to MiCA regulations and currently boasts a market capitalization of approximately $36.8 million.

Luca Prosperi, the co-founder and CEO of M^0 Labs, stated to crypto.news that the dominance of USDT (Tether) will hinge on its practical applications, such as facilitating retail trades. He further explained that it’s unlikely for a mature market to have one issuer controlling 70% of the market share.

“Though it’s uncertain what the future holds, we anticipate that Tether’s market share might shrink to between 10% and 30%.”

Luca Prosperi, the co-founder and CEO of M^0 Labs, told crypto.news.

Maruf Yusupov, one of the founders of Deenar, shared with crypto.news his view that the use of stablecoins is currently limited and only just beginning to develop. He stated that if these digital assets become more widely accepted, regulation-compliant stablecoins may surpass Tether in terms of performance over the long haul.

Are stablecoins winning?

A significant factor driving the expansion of stablecoins is their role as a secure refuge during market turbulence, as users opt for them. According to rwa.xyz’s data, the total number of stablecoin holders rose by approximately 8.3% over the last 30 days, reaching 114.15 million distinct addresses.

In just under four months following its debut, Etherna USDe (USDe) hit a market value of $3 billion. Meanwhile, Ripple has been quietly testing its RLUSD stablecoin on both the XRP Ledger and Ethereum platform. Ripple’s CEO, Brad Garlinghouse, anticipates that this stablecoin will be launched before 2025.

“Stablecoins stand out due to their adaptability, user-friendly nature, and practicality, making them more appealing than traditional fiat currencies in terms of adoption.”

Maruf Yusupov, the co-founder of Deenar, told crypto.news.

Nevertheless, M^0 Labs’ Prosperi posits that stablecoins lack a universally accepted standard, transparent measurement metrics, robust regulatory framework, and a unified layer for liquidity.

“Using this system, users and holders face substantial risks and it gives a considerable financial edge to the already leading distributors.”

Luca Prosperi, the co-founder and CEO of M^0 Labs, told crypto.news.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-13 11:25