As a seasoned crypto investor who has navigated through the wild west of digital assets for well over a decade, I can’t help but feel a mix of excitement and caution when observing Helium’s (HNT) recent price action. While it’s thrilling to see such impressive gains, my experience tells me that every bull run must face the possibility of a pullback or correction, and HNT seems to be no exception.

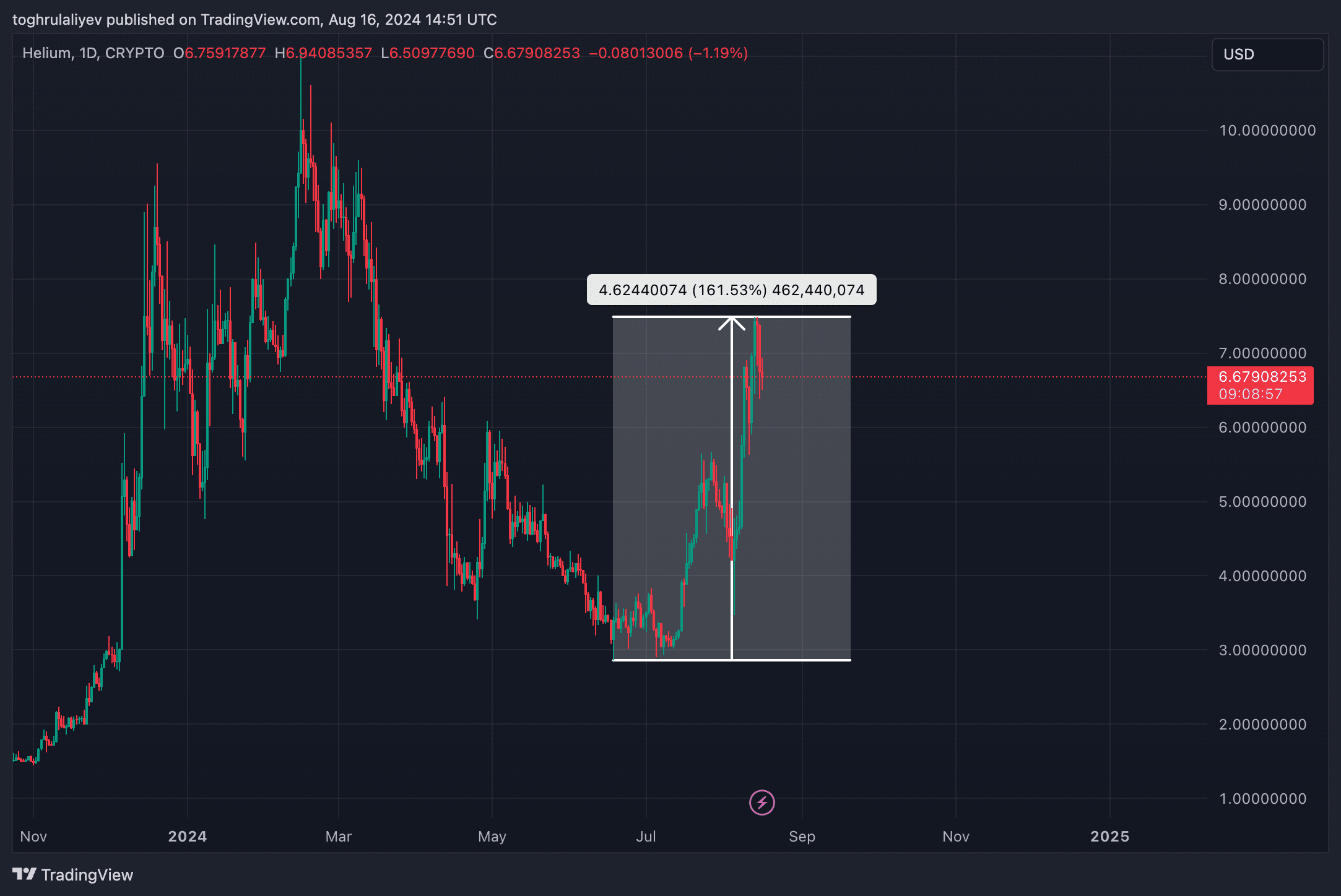

Since the start of July, Helium (HNT) has experienced a significant surge, rising by 158.15%. This upward momentum raises an intriguing question: Will this upward trend persist, or is a downturn imminent in the near future?

Table of Contents

As a crypto investor, I’ve been thrilled with Helium’s (HNT) bullish surge, but there’s a growing sense of unease. The fact that we haven’t seen any significant consolidation or pullback during this rally has me worried that one could be just around the corner. Here’s my take on why a correction might be looming.

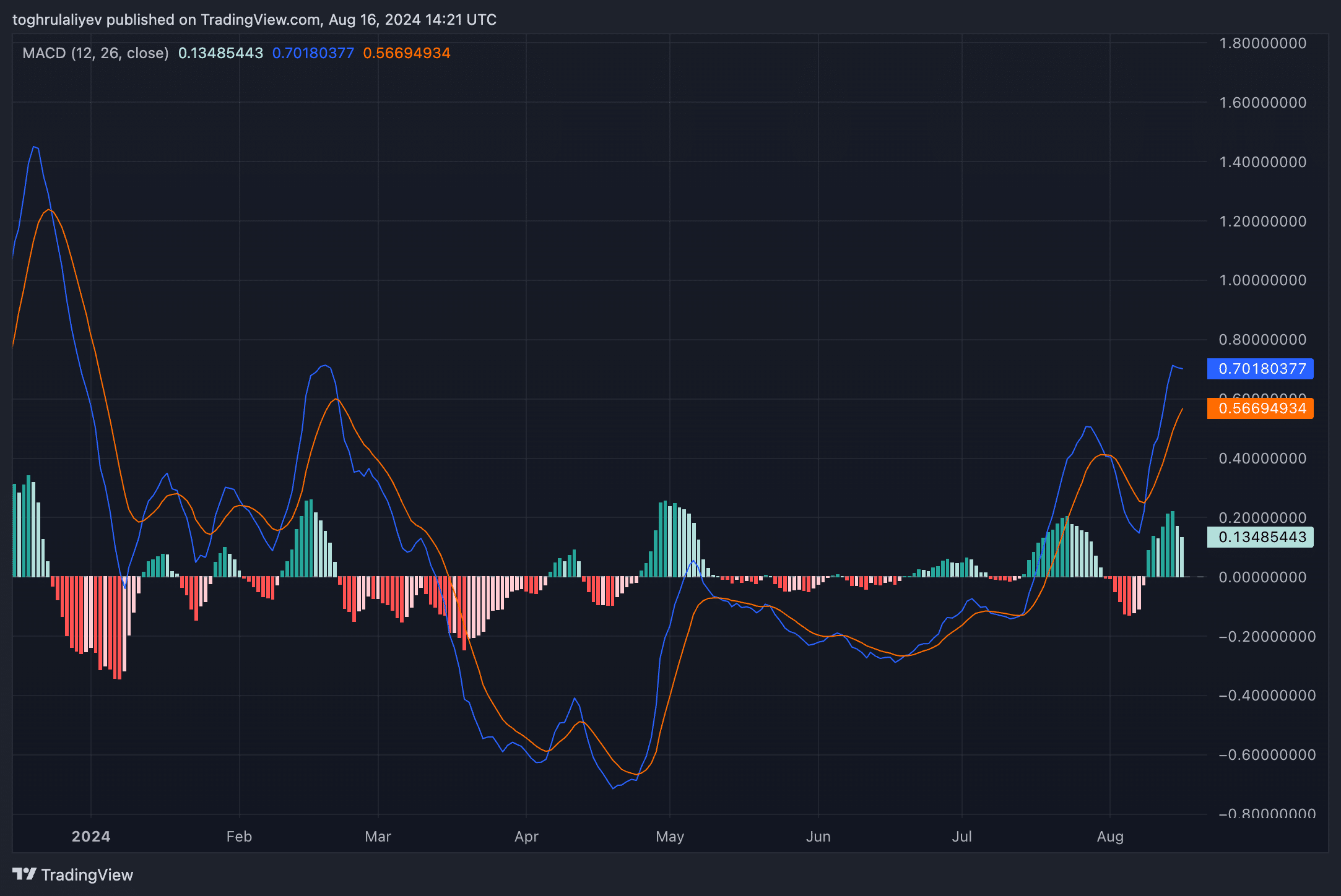

Moving Average Convergence Divergence

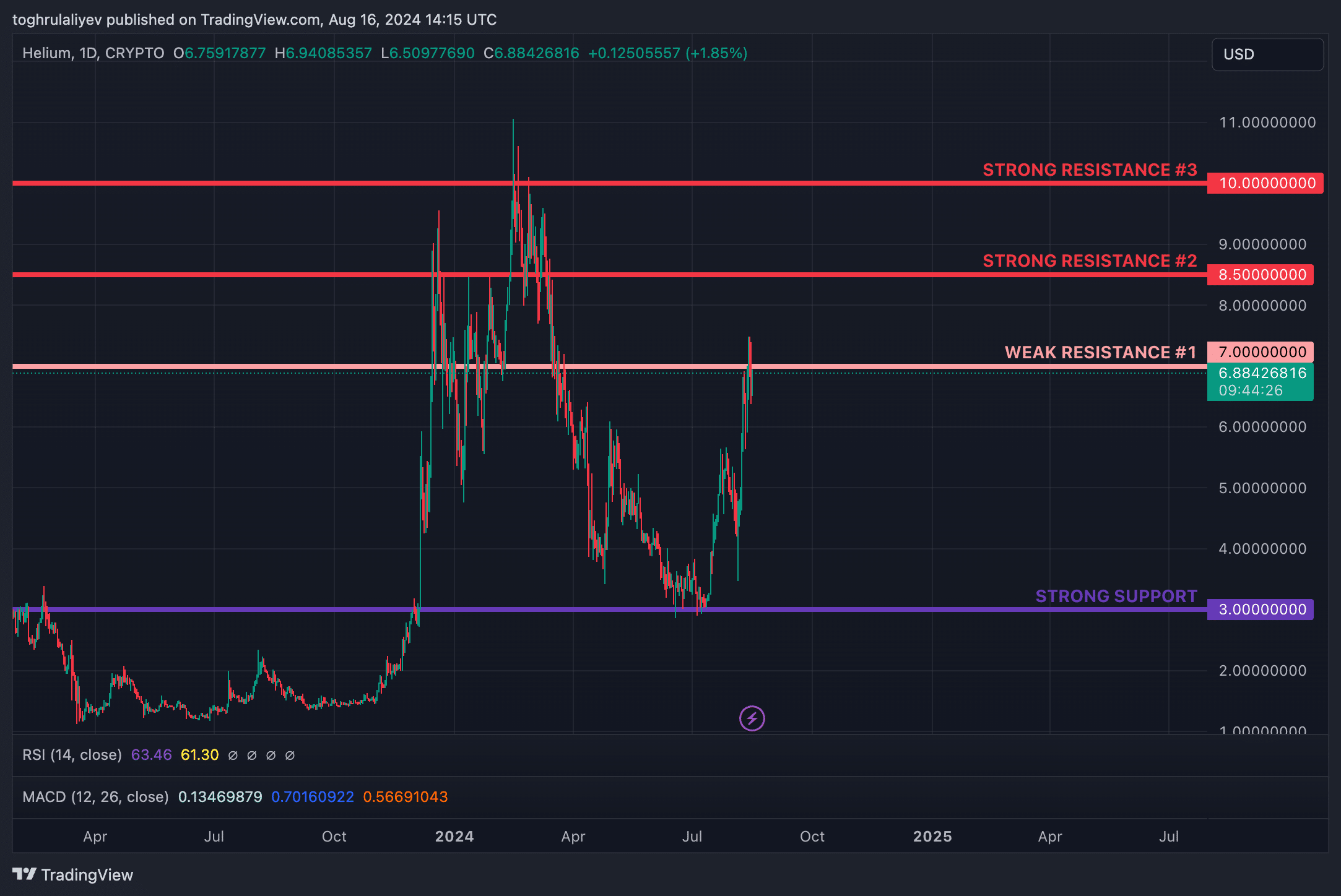

By looking at the Daily Moving Average Convergence Divergence (MACD), we see the histogram changing from a deep green to a lighter shade of green, which typically means a decrease in bullish strength. Moreover, the MACD lines are coming closer together, hinting that the ongoing uptrend might be slowing down. If a bearish crossover occurs, it could possibly signal a shift in trend direction.

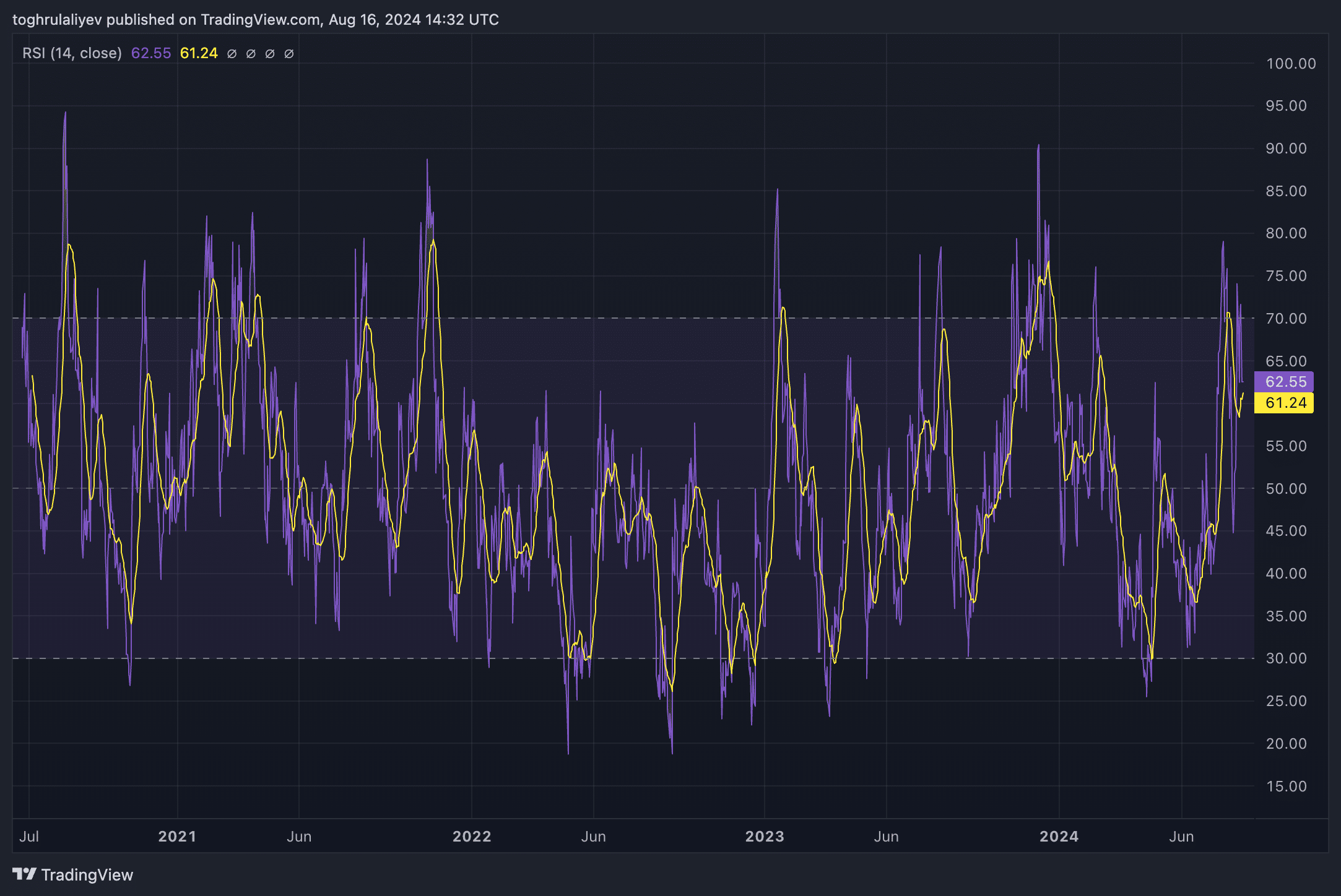

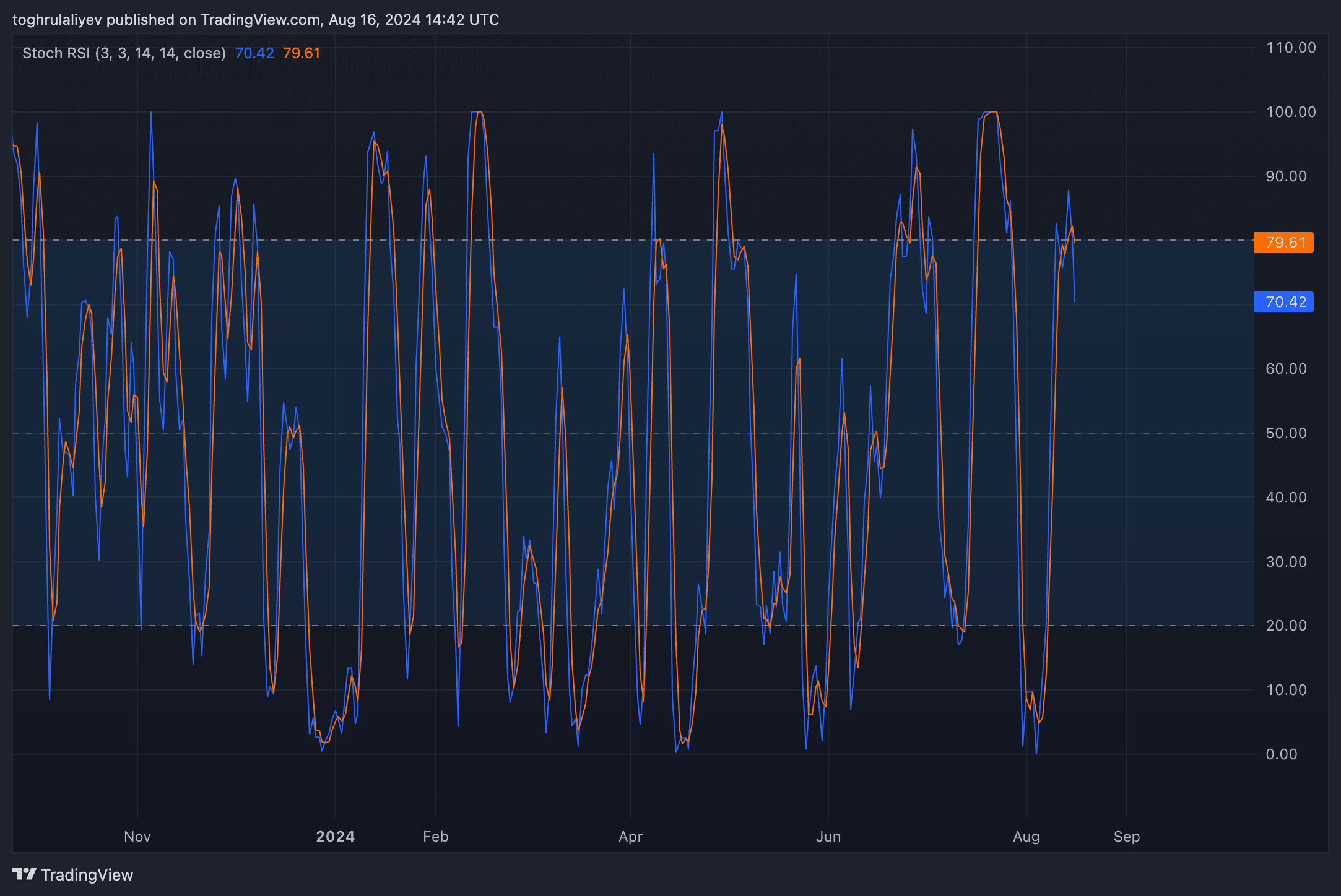

RSI and Stochastic RSI

In simpler terms, both the Relative Strength Index (RSI) and its variant, Stochastic RSI, are currently overvalued, as their readings surpass 60. Typically, when these indicators exceed 60, they tend to pull back substantially, often coinciding with a steep drop in price.

Support and resistance levels

Presently, the pricing trend indicates robust barriers at $8.5 and $10. These levels have previously proven challenging to overcome or functioned as sturdy foundations. At the moment, $7 presents a less formidable region. It has thus far served as resistance, but could potentially switch roles if HNT manages to rise above it. However, if the price is unable to surpass $7, a more pronounced decline might ensue.

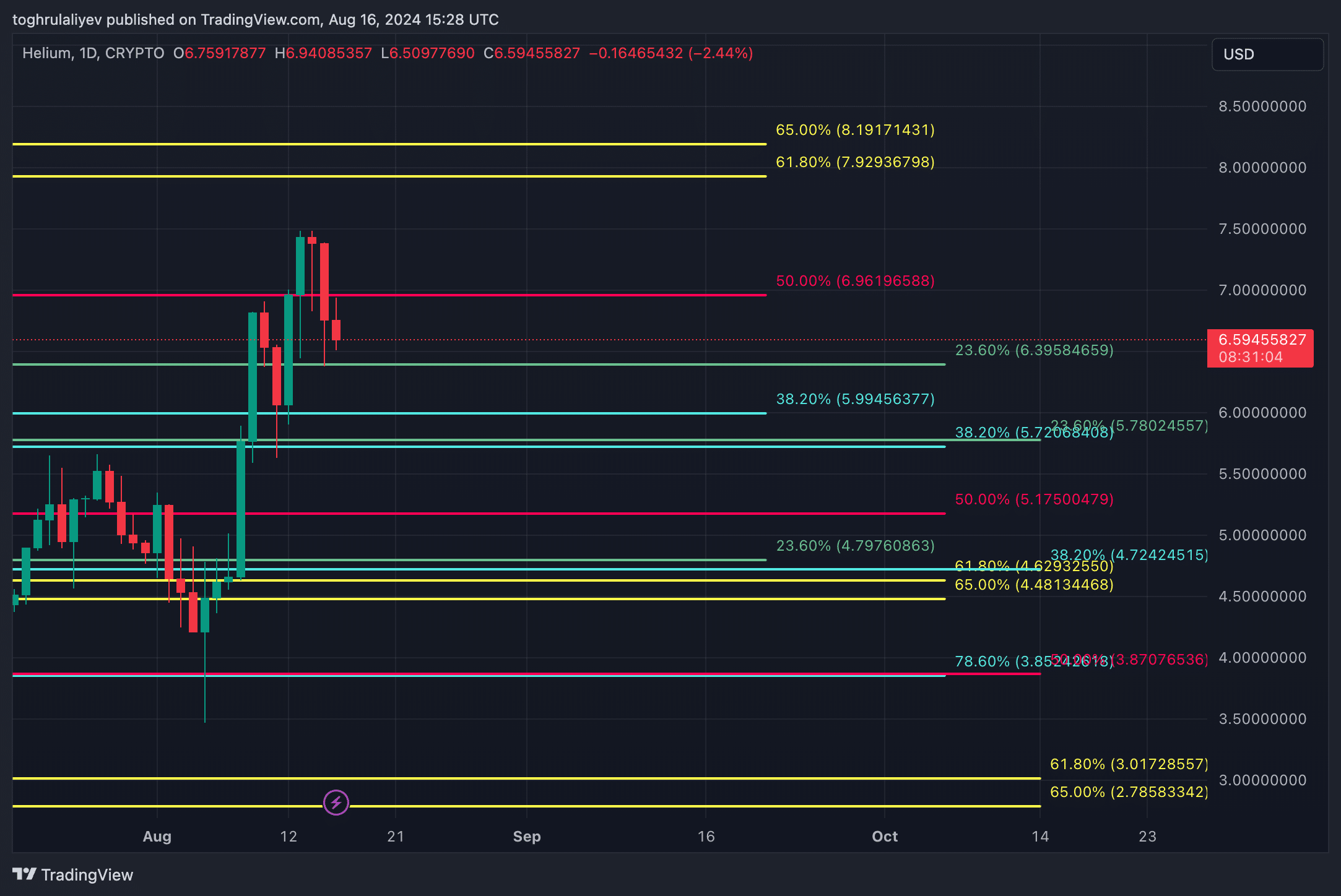

Fibonacci confluence levels

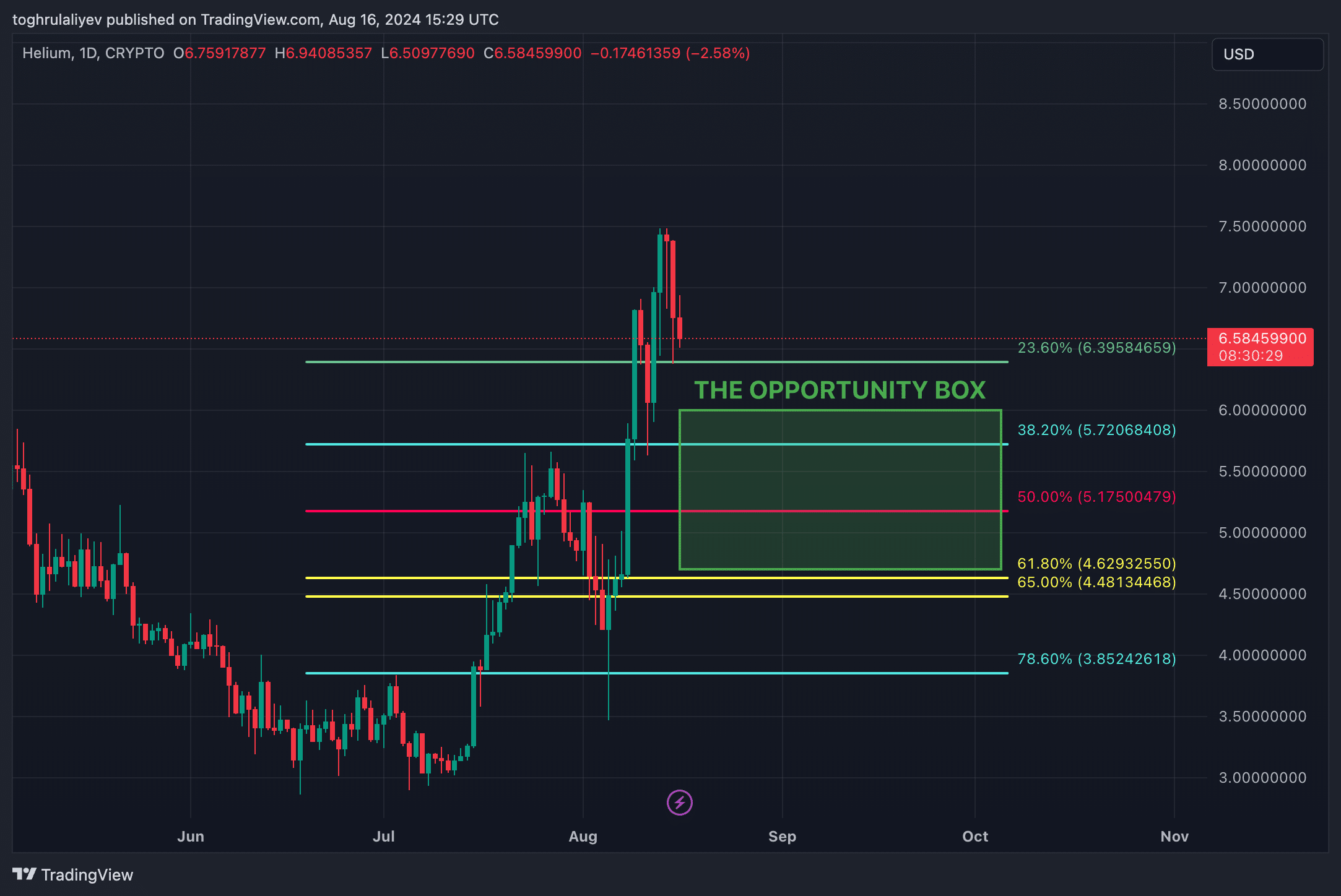

To find potential significant price points, we analyze Fibonacci retracement levels across three distinct time frames. Firstly, the initial trading day’s high to the recent peak, secondly, the low of June compared to the recent high, and finally, the March high to the June low. This analysis leads us to discover several potential convergence points at approximately $6 and $4.7.

In simpler terms, the space between $4.7 and $6 is often called an “opportunity zone.” If the downward trend persists, it’s believed that HNT might return to this region, making it a possible target for short positions.

Historical data suggests that the price level of $3 might be a support. However, it’s highly improbable for the price to drop to this point unless there are significant unfavorable occurrences in the wider market, much like Japan’s unexpected interest rate increase and Jump Trading’s intense selling spree in late July and early August.

Strategic Considerations

Before initiating a short position, it’s important to confirm the downtrend. Although the trend has recently shifted, there’s always the possibility of a bear trap. To minimize risk, we recommend waiting for HNT to fall below $6.3958, which is the 23.6% Fibonacci retracement from the June low to the August high. Once HNT breaks below this level, and it acts as resistance, the shorting opportunity becomes much safer.

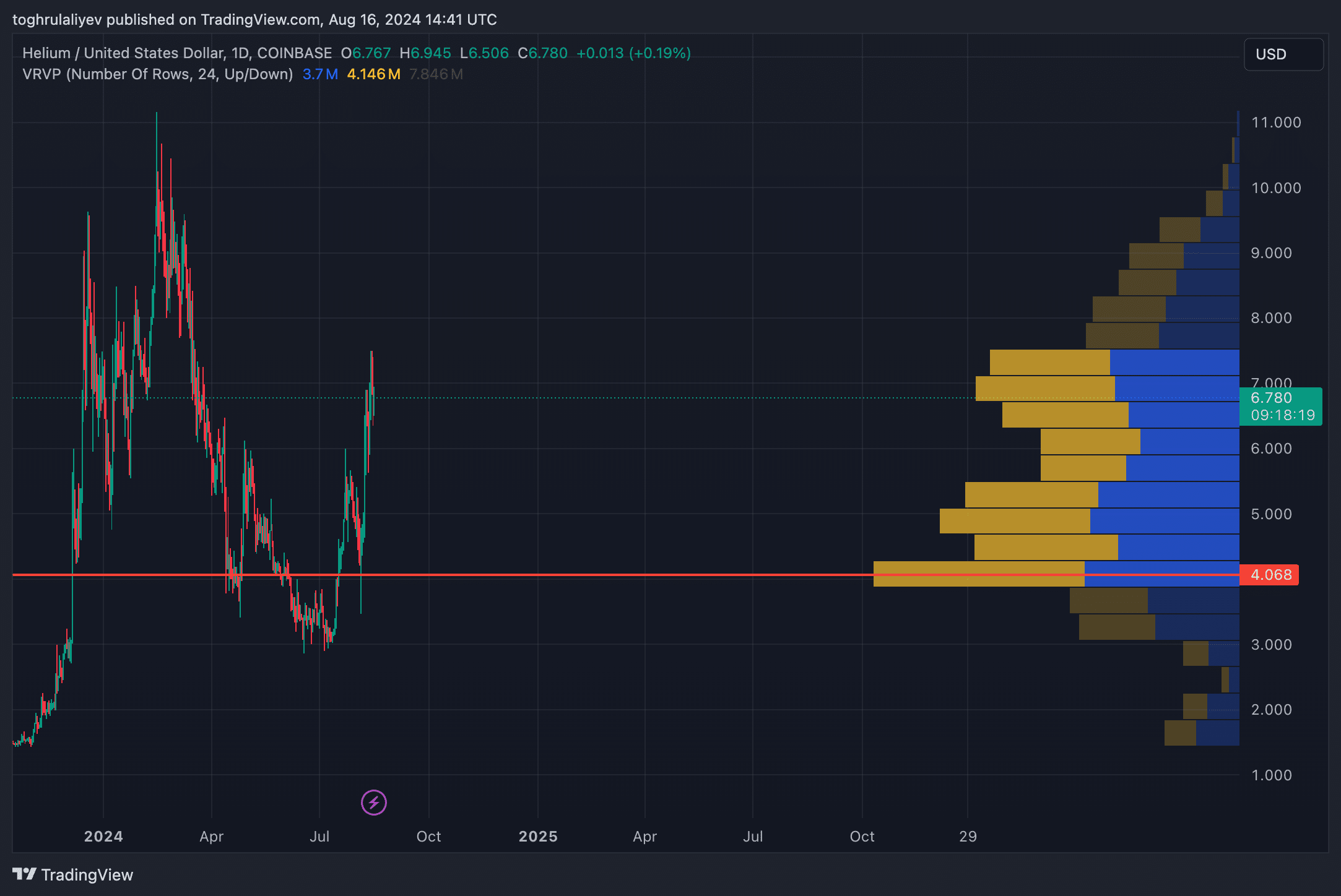

Another factor to consider is the Visible Range Volume Profile, which shows a weak volume area between $5.5 and $6.5. Prices tend to move quickly through such low-volume zones, further supporting the likelihood of a downward move. However, currently, HNT is within a high-volume zone, which could potentially serve as a consolidation area.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-08-16 21:53