As a seasoned crypto investor with a knack for spotting trends and patterns, I find myself intrigued by Solana’s current state. While it’s true that Solana has seen a bear market, its recent 33% surge from its August low is a glimmer of hope. However, the retreat in DEX volume and stalled futures open interest are concerning signs.

The price of Solana has found itself stagnant during a prolonged bear market, with transactions on its decentralized trading platforms and futures contracts seeing a noticeable decrease.

For the past two weeks, Solana (SOL) has shown an upward trend, gaining more than 33% since its lowest point in August. However, it continues to be in a bear market as it has dropped by more than 30% from its highest point this year.

Solana’s DEX volume retreats

The price trends of this cryptocurrency have followed suit with others such as Bitcoin (BTC) and Ethereum (ETH), all of which are currently experiencing a downturn, often referred to as a bear market.

Over the past few weeks, there’s been a decline in trading activity on Solana’s decentralized exchange platforms, as indicated by DeFi Llama’s data. In just the last seven days, the volume of transactions on these platforms dropped by more than 45%. During this timeframe, Solana has processed approximately $7.12 billion in transactions, while Ethereum managed to handle around $8.9 billion.

The trading volume on Solana’s decentralized exchanges has decreased due to the ongoing selling pressure from popular meme coins. Notable Solana meme tokens such as Dogwifhat, Bonk, Popcat, and Book of Meme have all dropped more than 50% in value over the past few months.

Solana has become the most popular chain for creating meme coins, due to fast speeds and low transaction costs. The launch of Pump.fun, a meme coin generator, has made it easier for people to launch Solana meme tokens.

The data indicates that the total market value of these tokens exceeds $425 million, and among them, Michi, Daddy Tate, Mother Iggy, and Billy are the ones with the highest values.

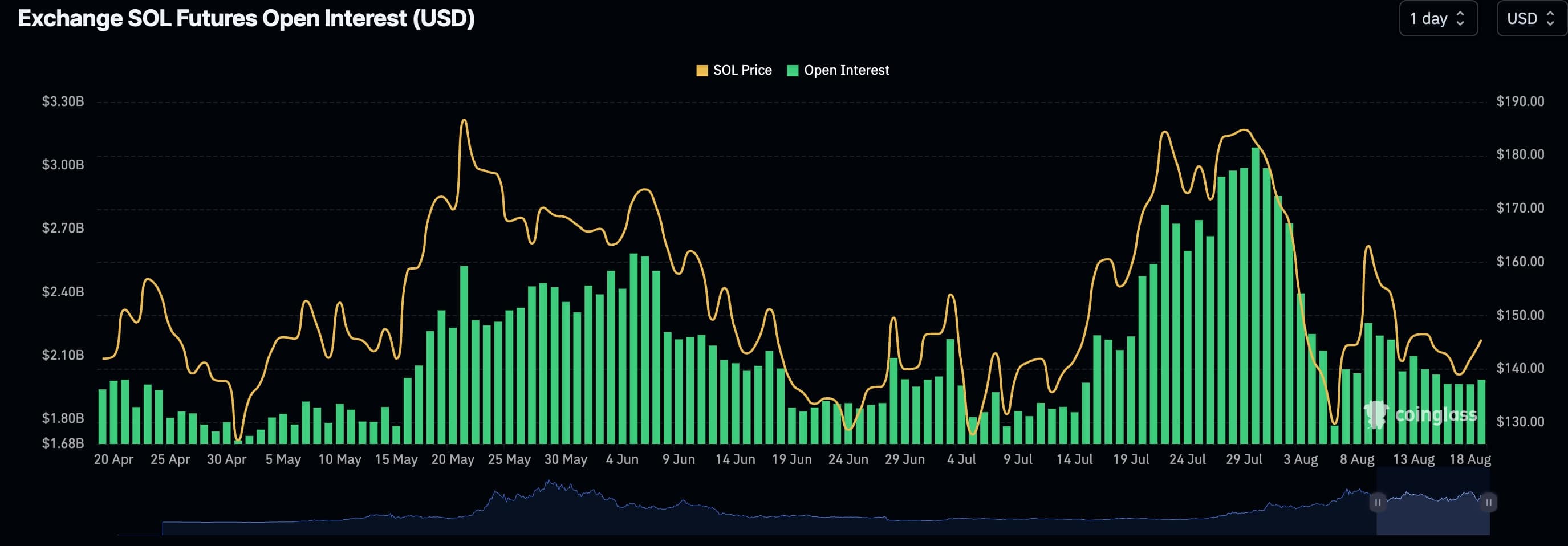

Meanwhile, Solana’s open interest in the futures market has stalled.

As reported by CoinGlass, the total value of open futures contracts on August 18 was close to $2 billion, a figure that has remained consistent over the last five days. However, this amount is significantly lower than the peak of $3.08 billion reached on July 30.

It’s possible that the decrease in active contracts (open interest) is due to large-scale sell-offs (liquidations) that occurred this month, as the value of cryptocurrencies fell sharply.

On August 8, long positions (bulls) in Solana resulted in over $39 million being forcedly sold off due to market conditions, while short positions (shorts) saw a total of $21 million in forced sales.

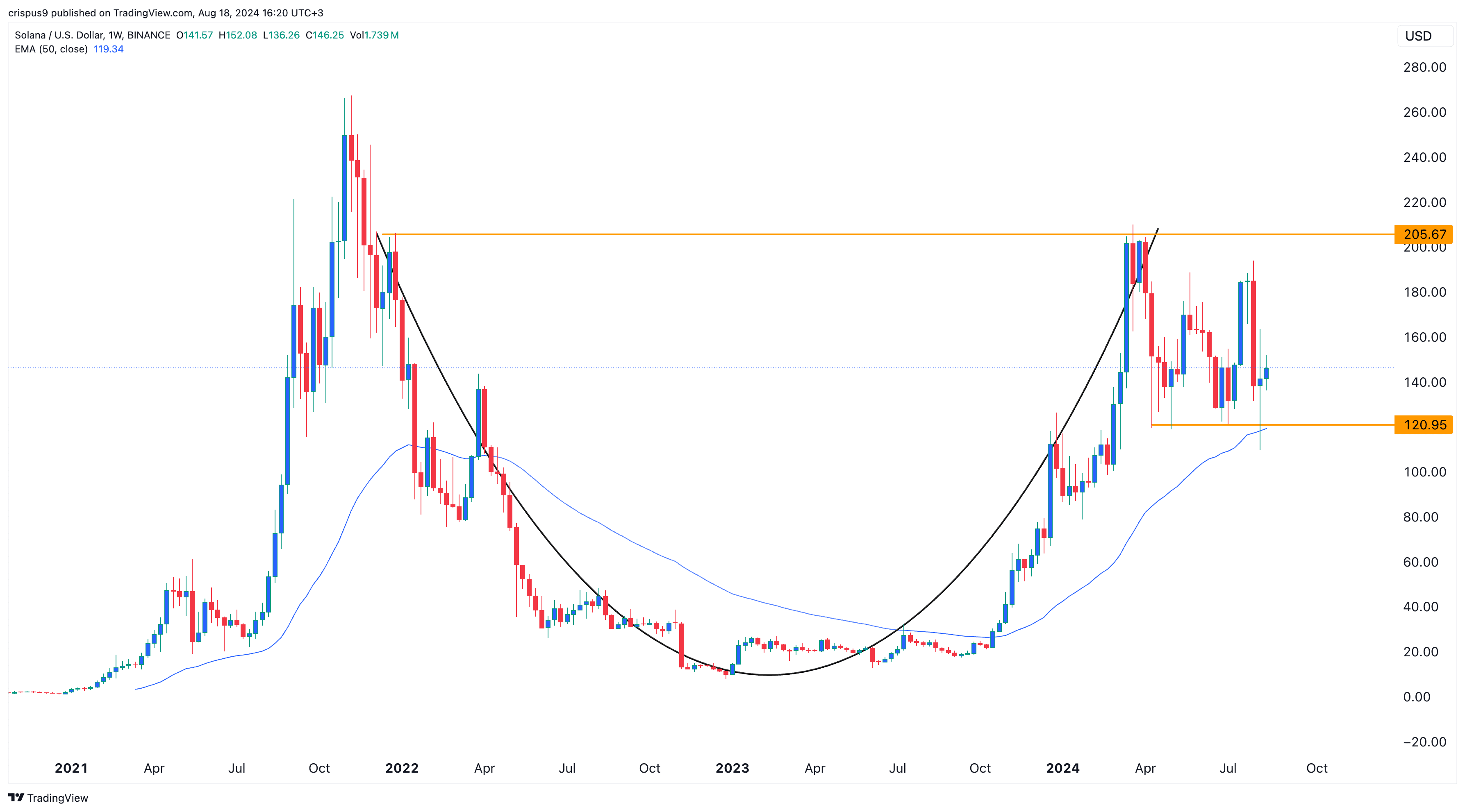

Solana has bullish technicals

From a favorable perspective, Solana has shown robust resistance at its 50-week moving average – a level it previously struggled to drop below in the current month.

The coin has additionally created a pattern known as a “Doji,” marked by a tiny body and extended upper and lower wicks. This pattern is widely recognized as a significant reversal indicator within the trading market.

Moreover, Solana appears to be shaping up like a “cup and handle” formation, which is typically indicative of a strong uptrend. Consequently, there’s a good chance that Solana’s bullish momentum will persist in the upcoming weeks as investors aim for the significant resistance level at around $180.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-18 19:30