As a seasoned crypto investor with battle scars from countless market fluctuations and trends, I must admit that witnessing Popcat’s (POPCAT) meteoric rise over the past week has been nothing short of exhilarating. The 95.7% surge in its price within seven days is a testament to the unpredictable yet enthralling nature of this digital frontier.

Last week, I observed a significant upward momentum for Popcat, aligning with a broader positive shift across the cryptocurrency market.

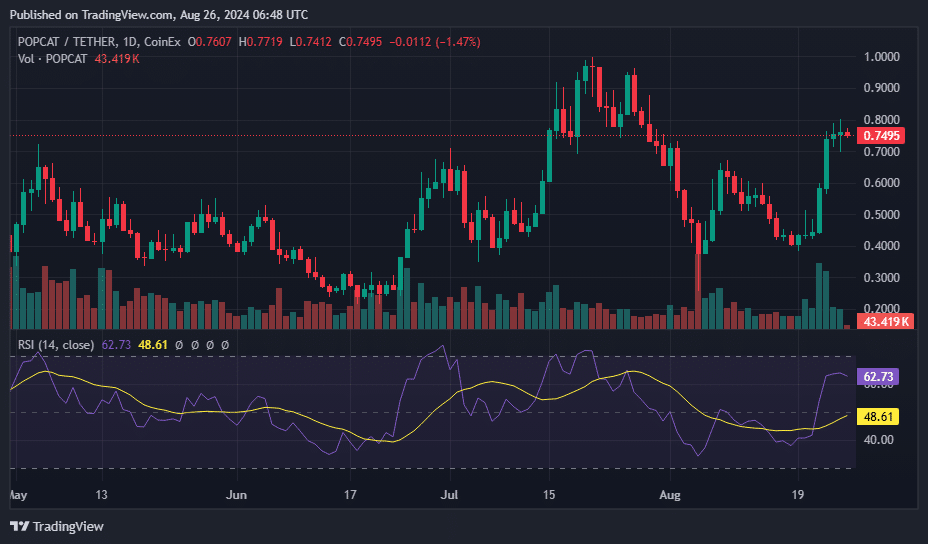

Over the last week, I’ve noticed an impressive surge in the price of Popcat (POPCAT). It started at $0.393 on August 19th and has since skyrocketed by a staggering 95.7%. This peak hasn’t been seen since July 30th. In just the last 24 hours, this asset has further gained 2.2%, currently trading at $0.75.

Due to a recent increase, Popcat’s market value now surpasses $735 million, placing it at number 102 among all cryptocurrencies in terms of market capitalization. Each day, its trading volume amounts to around $76.4 million.

The primary factor contributing to this price surge is the introduction of Popcat perpetual contracts on Binance Futures, allowing traders a maximum leverage of up to 75 times, according to the latest statement from the platform.

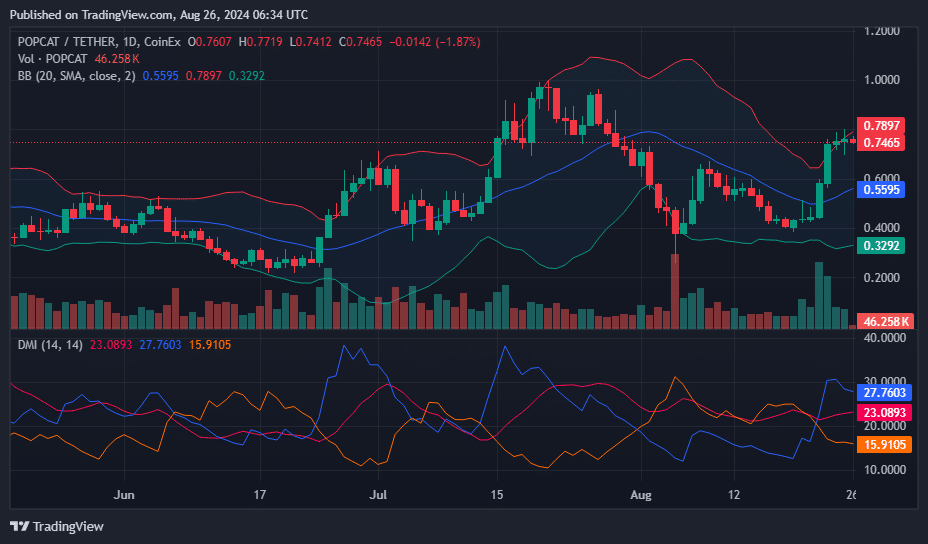

Currently, the price of Popcat stands higher than the middle Bollinger Band, which is at $0.5595. This suggests a positive trend or ‘bullish’ movement starting from lower levels. Yet, it’s worth noting that it hasn’t reached the upper Bollinger Band ($0.7897), indicating there might be more room for price increase before hitting substantial resistance.

In simpler terms, the gap between the lower and upper Bollinger Band, currently at $0.3292 and $0.7897 respectively, suggests that the market is experiencing moderate volatility. Even though the current price is close to the upper band, it hasn’t yet touched it. This could mean that while prices have rebounded from lower levels, they haven’t quite reached an overbought state, leaving room for potential further increases.

Currently, the Plus Directional Index (or +DI) stands at 27.7603, surpassing the Minus Directional Index (or -DI) at 15.9105. This indicates that there’s more active buying force compared to selling force in the market right now.

In simpler terms, the configuration of DMI (Directional Movement Index) indicates that the market’s positive outlook continues, as the positive DI (Directional Indicator) is stronger than the negative DI. This aligns with the bullish signal from the Bollinger Bands. Consequently, traders may consider seeking buy opportunities, expecting a possible approach towards the upper boundary of the Bollinger Bands, currently around $0.7897, unless unexpected changes in market conditions alter the current trend.

The RSI value currently sits at 62.73, exceeding the neutral level of 50 but falling short of the usual overbought level of 70. This suggests a powerful uptrend without crossing into the overbought zone, implying that while the market is strong, there could be further room for price growth before reaching an overextended state.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-26 10:26