As a long-term crypto enthusiast who has witnessed the rollercoaster ride of Bitcoin and Ethereum since their early days, I have learned to navigate the market with caution and patience. Having seen Ethereum rise from its humble beginnings to become the backbone of the DeFi revolution, I’ve always believed in its potential for long-term growth.

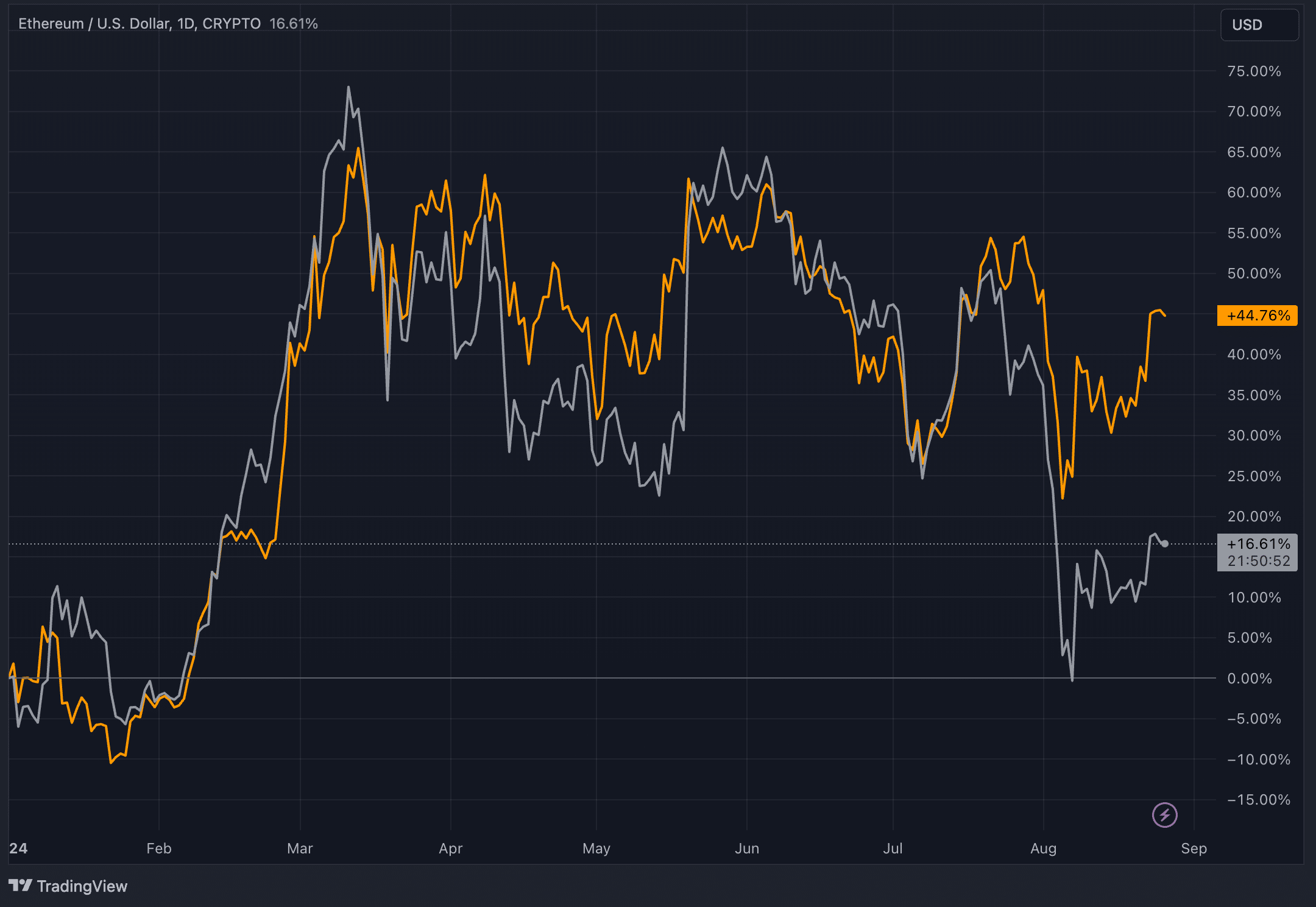

As an analyst, I’ve observed a notable difference in the performance of Ethereum and Bitcoin over various timeframes. Specifically, Ethereum has shown superior price growth since its inception, during halving years, and bull market phases. However, it’s worth noting that Ethereum has consistently lagged behind Bitcoin during bear markets, such as those experienced in 2018-2019 and 2022-2023. Interestingly, for the first time since its inception, Ethereum appears to be significantly trailing Bitcoin in the upcoming halving year of 2024. To add context, this underperformance against Bitcoin has been a consistent trend for the past three years.

Table of Contents

ETH/BTC ratio plummets to 3.5-year low

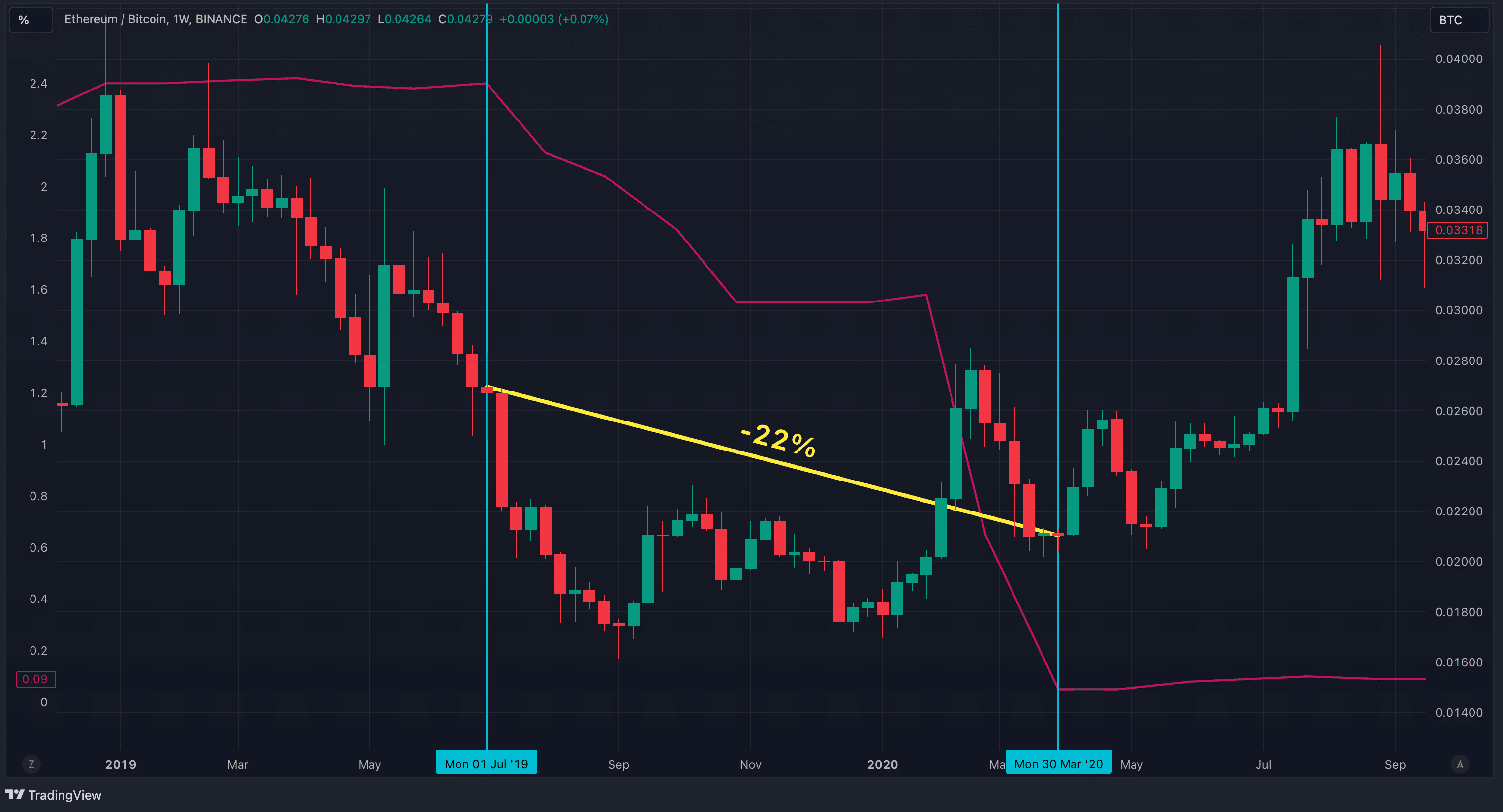

Fractals, which involve the recurrence of identical or similar patterns across various scales, may not guarantee accurate predictions about the future, but they offer insightful perspectives on potential trends that could unfold.

In the past, during halving events, the ratio between ETH and BTC usually weakened around September to December, but then strengthened again in the first quarter of the following bull market year. This pattern might repeat itself in 2024, as Ethereum has breached its support level once more. However, this time the situation looks more pessimistic. Unlike previous halving events where the support line was established recently, the current support at 0.05 has been robust for approximately 3.5 years, indicating a potentially less optimistic future for Ethereum.

As a researcher, I’ve noticed an interesting parallel between the period when the Federal Reserve reduced interest rates in 2019 and a potential scenario in September 2024. In 2019, following the Fed’s rate cuts, there was a decrease of approximately 22% in the Ethereum-to-Bitcoin (ETH/BTC) ratio over the duration of those rate adjustments. This observation could serve as a useful benchmark for future analysis.

In all these scenarios, not only did the ratio decrease but also, with a few exceptions like 2020, Ethereum’s price trended negatively. Yet, the key point isn’t merely if Ethereum’s value increased or decreased; it’s whether investing in Ethereum was the wiser choice compared to other options. Previous events suggest that, under similar conditions, Bitcoin has been the more profitable pick—and 2024 could continue this pattern.

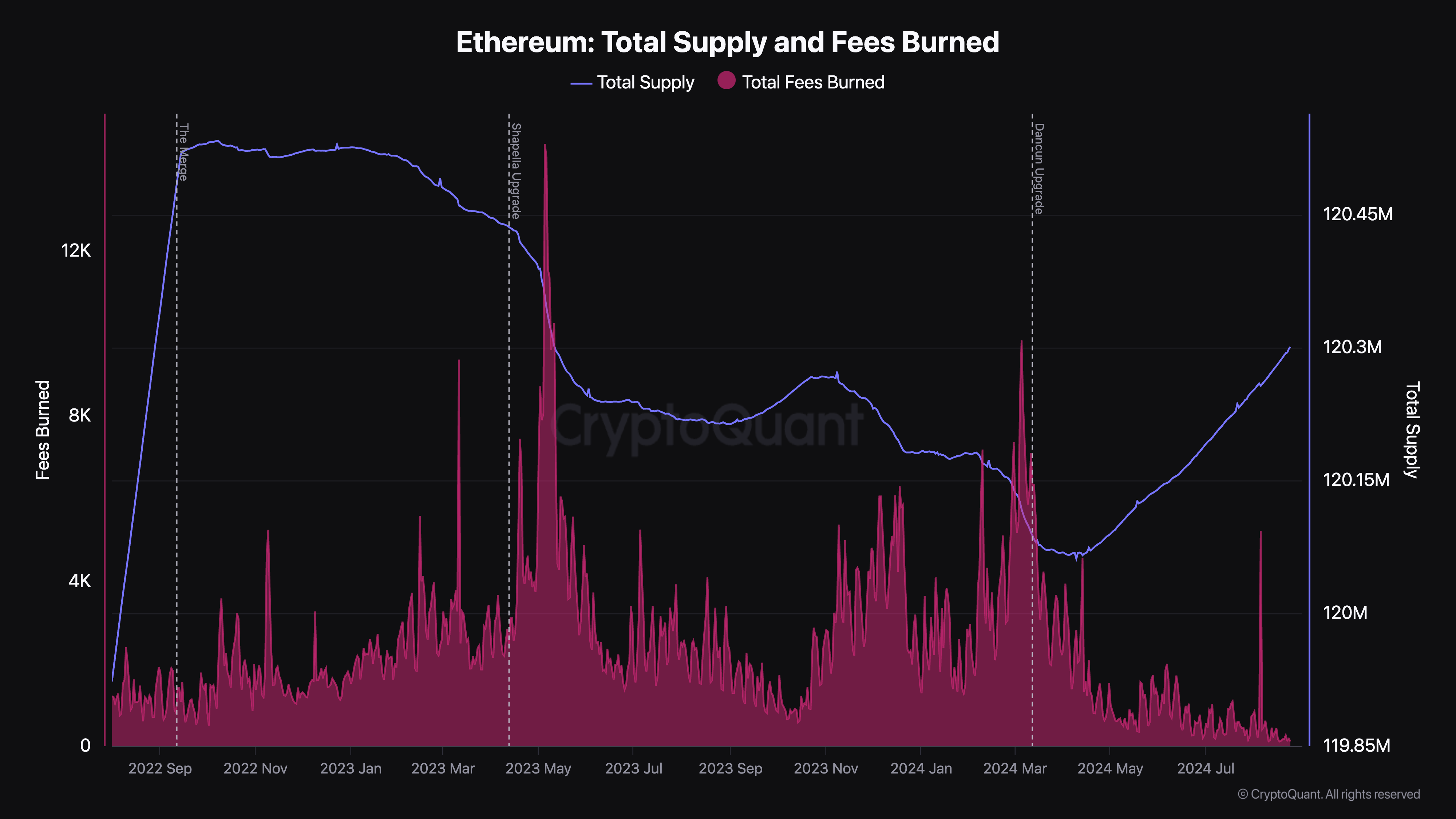

Ethereum supply reverses course and turns inflationary.

After the 2022 Merge, the availability of Ethereum has been gradually diminishing. This reduction in Ethereum’s circulation is facilitated by a process known as “burning,” which was implemented with Ethereum Improvement Proposal (EIP) 1559 in August 2021. In essence, a part of the transaction fees paid in ETH gets destroyed or taken out of circulation. As a result, the overall amount of ETH decreases progressively, particularly during periods when network activity is high and transaction fees are consequently higher.

As a researcher delving into the world of cryptocurrencies, I’ve observed an interesting trend post-2022: the gradual decrease in Ethereum supply. This shift can be attributed to the transformation of Ethereum’s consensus mechanism from proof-of-work (PoW) to proof-of-stake (PoS). In the PoW system, miners were consistently rewarded with new ETH for validating transactions, which in turn increased Ethereum’s total supply. However, following the network’s transition to PoS, the issuance of new ETH has significantly diminished. This is because validators, who now maintain the network’s security, receive substantially lower rewards compared to what miners were earning previously.

In March 2024, the Dencun update represented a significant shift, moving Ethereum from a deflationary to an inflationary state regarding its supply. This update incorporated proto-danksharding and “blobs,” technologies that enhance data storage efficiency and lower transaction costs on secondary networks. Despite enhancing scalability and making transactions more affordable, the Dencun upgrade significantly reduced the rate of ETH being destroyed, a key factor in maintaining Ethereum’s previous deflationary status.

Consequently, the amount of Ethereum circulating in the market has grown significantly by over 213.5K ETH following the Dencun update. To put this into perspective, the current supply of Ethereum is comparable to its level from May 2023.

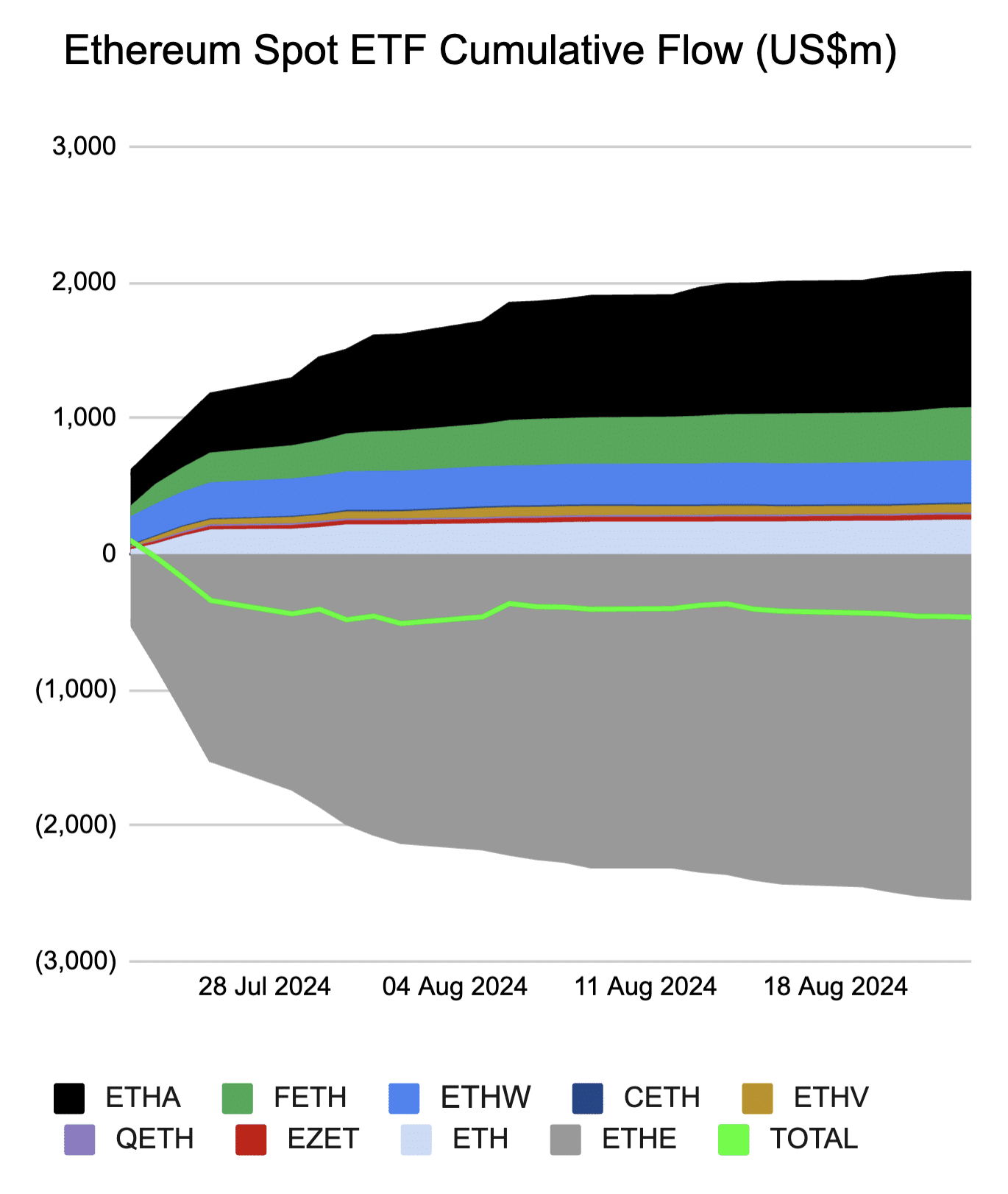

Negative ETF Flows Continue

Initially, there was anticipation that the launch of Ethereum-based ETFs would lead to increased demand and higher prices for ETH. However, the opposite seems to have occurred as ETF withdrawals have become a concern instead. A total of $465 million has been withdrawn since trading started. The primary factor driving this trend is Grayscale’s Ethereum Trust (ETHE), which has experienced significant outflows, eclipsing the positive inflows seen in other Ethereum ETFs. The sheer magnitude of the ETHE withdrawals has created a net negative impact when considering all Ethereum ETFs together.

An Ethereum Exchange-Traded Fund (ETF) contains a specific amount of Ethereum, and each share represents a portion of that total Ethereum. When there’s high demand for ETF shares from investors, the price of these shares might rise above the actual worth of the held Ethereum. In such scenarios, Authorized Participants (APs), significant financial institutions linked to the ETF provider, intervene. APs buy Ethereum on the open market and exchange it with the ETF provider for new ETF shares, which they then sell in the market at a higher price, earning a profit. This action increases the number of ETF shares available, helping to align the share price with the value of the underlying assets.

When the demand for an ETF is low, causing its share prices to drop below the worth of the Ethereum it represents, Arbitrage Providers (APs) can purchase these underpriced ETF shares. They then return these shares to the provider and receive Ethereum in return. Since they can sell this Ethereum on the open market for a higher price, they make a profit from arbitrage. This action decreases the quantity of ETF shares available and assists in bringing the share price closer to the value of the underlying Ethereum.

In simpler terms, when institutions known as Authorized Participants (APs) exchange ETF shares for Ethereum (ETH), they may sell some of that ETH on the open market. This large-scale selling could contribute to the current low price and difficulty in recovery for ETH.

Conclusion

Although the current data may indicate a pessimistic view for Ethereum, it remains a robust asset at its core. The number of active addresses on both its primary network and Layer 2 platforms is consistently growing. Ethereum maintains its position as the leader in the blockchain sector, boasting the highest total value locked (TVL) across decentralized finance (DeFi) platforms. Many projects are under development within its ecosystem, and it continues to undergo regular advancements and updates.

As a crypto investor, I’m finding the present market climate challenging, especially with the persistent ETF withdrawals. It seems that Ethereum might not be the most advantageous investment in the short term, at least until the end of 2024. However, as we move into 2025 and specifically Q1, I’m optimistic about Ethereum’s potential to reclaim its stride and potentially surpass Bitcoin in terms of returns, a pattern we’ve seen play out in past market cycles.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-08-26 10:54