As a seasoned analyst with years of experience navigating the tumultuous crypto market, I must say that the situation at WazirX is nothing short of intriguing. The recent hack and subsequent fallout have been a rollercoaster ride for users and investors alike.

On the WazirX platform, a sum of $12 million USD (approximately INR 100 crores) has been allocated for covering legal fees and expenses related to the ongoing investigation into the recent cyber attack that caused approximately 45% of user funds to be lost on the exchange about a month ago.

As a researcher, I’ve uncovered that since the multi-sig wallet hack on July 18, which led to the theft of approximately $230 Million in crypto assets, WazirX has received four legal demands from various parties for the return of their funds. Recently, CoinSwitch, a fellow Indian cryptocurrency exchange, declared their intention to take legal action against WazirX, seeking the recovery of an investment worth about Rs 80 crore that they had made on the platform.

Furthermore, WazirX boasts approximately 16 million active users up until the hack on July 18, with around 4.4 million of those having cryptocurrency holdings. Under heavy user demand, WazirX implemented a two-phase system that allowed for only 66% INR withdrawal per user at a time, and offered a six-month window during which users could fully withdraw their crypto holdings.

These details are part of the 52 pages long affidavit filed by WazirX’s parent company Zettai Pte Limited in the Singapore High Court for a moratorium under the Singapore’s Insolvency, Restructuring and Dissolution Act 2018. WazirX shared the affidavit with their customers on Wednesday via email and The Crypto Times team also had a sneak peek into it.

What is in the WazirX Affidavit?

We present to you highlights of the 52 page affidavit submitted by WazirX through Zettai in Singapore High Court.

Hostile and Frustrated Users

Based on Zetta’s affidavit, it appears that some disgruntled and aggressive users of WazirX may choose to take legal action against the platform in an attempt to retrieve their assets. Applying for a moratorium could provide these users with additional time to do so.

According to the affidavit of WazirX, as of August 24, 2024, the platform has received over 9,700 emails and messages related to withdrawals. It’s likely that dissatisfied and hostile users may initiate lawsuits against everyone associated with the platform’s operations (past and present). From July 21, 2024, to August 2, 2024, the platform has received 4 legal notices. Resolving these lawsuits would require a significant amount of time and resources, which could hinder efforts to restructure the platform, and such resolution may not be advantageous for most users of the platform.

Socialistic Loss-Sharing Policy

As stated in the affidavit, the recovery strategy provides an automatic 30-day halt to legal actions and winding-up resolutions against Zettai, offering protection during this period. The restructuring intends to evenly distribute the consequences of the hack among unsecured creditors. In this process, users will receive a portion of the available token assets relative to their claims. Certain aspects of the recovery procedure are kept confidential.

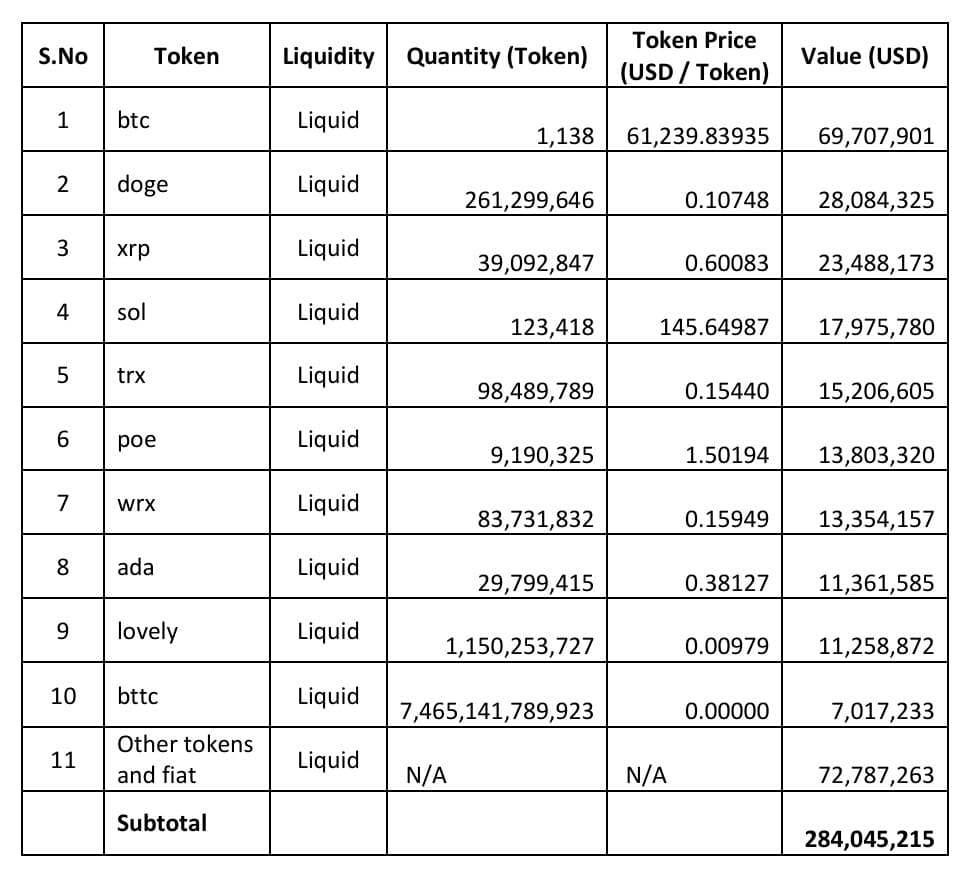

The recovery plan involves distributing the $284 million in remaining assets on a pro-rata basis among affected users based on their account balances. The company aims to distribute these assets fairly among users classified as unsecured creditors. The company is also engaging with 11 potential investors, known as “white knights,” including major cryptocurrency exchanges, to secure capital injections and strategic partnerships for asset recovery and operational costs.

100 Crores for Legal Fees, Investigation Costs etc

WazirX has set aside approximately 12 million dollars for legal expenses, investigation costs, and other necessary expenditures associated with the reorganization process. The company is actively looking into various methods to manage liquidity promptly, offering interim aid to users, while also devising long-term recovery plans. Prior to the hack, the total worth of assets was 570 million dollars, with 284 million dollars still available.

Upcoming Town Hall Session on September 2

1) The affidavit underscores the importance of not filing for bankruptcy since it might deter prospective aid and investments from “white knights.” On September 2, the WazirX team along with their advisors will take part in a public meeting to discuss recent updates. This strategy is aimed at stabilizing the platform, addressing pressing user concerns, and paving the way for long-term recuperation.

Dispute between WazirX and Binance

The dispute between Binance and WazirX centers on the control and ownership of the WazirX platform. Binance initially engaged in a transfer deal with WazirX but later sought to back out, leading to a public conflict over control of the platform’s digital assets.The affidavit also mentions the financial gains of Binance and WazirX, highlighting that both companies reported substantial profits from FY 2019-20 to FY 2021-22.

Due to Binance’s decision to shut down wallets for certain assets contrary to initial statements by CEO Changpeng Zhao, Zettai, a partner of WazirX, was compelled to assume custody of these tokens to keep the platform running smoothly. Subsequently, Zettai brought in Answer Eleven Pte Ltd (Liminal) to safeguard these assets effectively. The disagreement between the parties remains unsettled, with specifics about the situation being kept under wraps.

Conclusion

Although the affidavit outlines investigations, recovery efforts, and WazirX’s acquisition by Binance, users remain puzzled as to why their funds weren’t more securely protected. Criticism online includes claims of dishonesty and requests for the return of the ₹2000 crore worth of stolen cryptocurrency.

Users’ frustration mounts as they raise concerns about WazirX’s openness and efficiency in resolving the fund recovery issue. Doubts are increasing regarding whether users will fully regain their funds. With decreased trading activity and waning interest from prospective investors, WazirX is grappling with these challenges, resulting in continuous uncertainty and unresolved issues for its users.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD MXN PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-08-29 15:33