As a seasoned researcher who has witnessed the ebb and flow of the crypto market for many years, I find myself intrigued by Cardano’s current situation. The Chang upgrade was indeed a significant milestone, yet it seems the market isn’t showing the same enthusiasm at the moment. The technical indicators suggest that we are in a bearish phase, but they also hint at an oversold condition that might lead to a stabilization or recovery.

Despite the successful completion of the much-anticipated Chang upgrade on the Cardano Layer-1 blockchain, the cryptocurrency’s price has nonetheless declined.

The Chang hardfork brings significant modifications to the Cardano platform, such as on-chain voting, selection of Delegate Representatives, advanced smart contract functionalities, and a new governance system with cost-model enhancements. Now, ADA holders have the option to cast their votes directly on governance matters or assign their voting authority to trusted representatives.

Currently, as I am typing this, the value of Cardano (ADA) has decreased by 2.7%. It’s being traded at approximately $0.3335 according to information from crypto.news. The daily trading volume for this cryptocurrency was roughly around $307.4 million, and its market capitalization was about $11.75 billion.

Just within the past day, Cardano experienced liquidations totaling approximately $731,460, with long positions accounting for around $698,320 and short positions at roughly $33,140. This indicates significant selling pressure as the token continues to trend downward, suggesting that sellers are more active in the market.

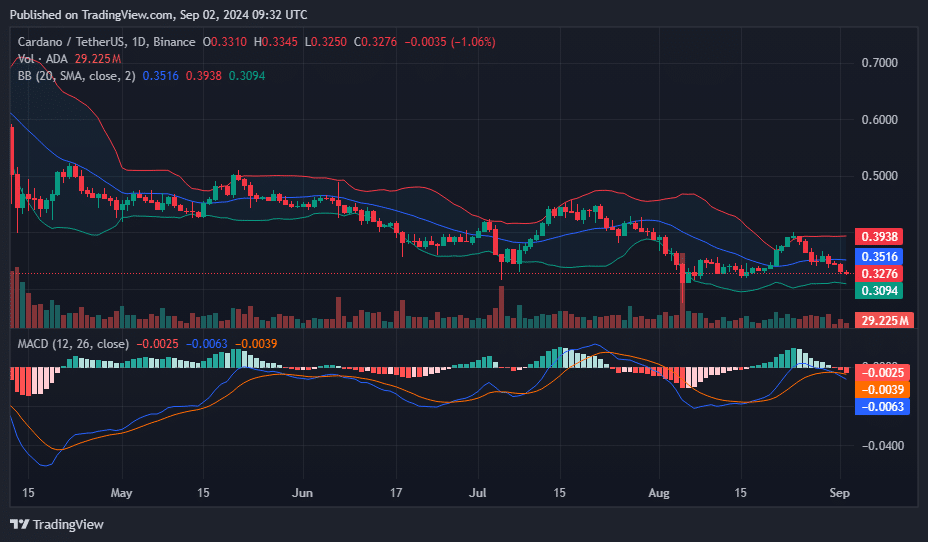

As a researcher observing the cryptocurrency market, it appears that Technical indicators point towards bearish control, as Cardano (ADA) is trading close to the lower boundary of its Bollinger Bands. This proximity to the lower band suggests a possible oversold condition, which could potentially lead to price stabilization or a minor recovery. However, it’s important to note that market volatility leaves ample room for further potential price declines.

The Moving Average Convergence Divergence (MACD) is suggesting a significant selling pressure, as the MACD line is found beneath the signal line, hinting at an ongoing downtrend. On the other hand, the Relative Strength Index (RSI) currently reads 38.56, which is below the neutral level of 50, implying a continued selling trend, but it hasn’t yet reached the oversold zone.

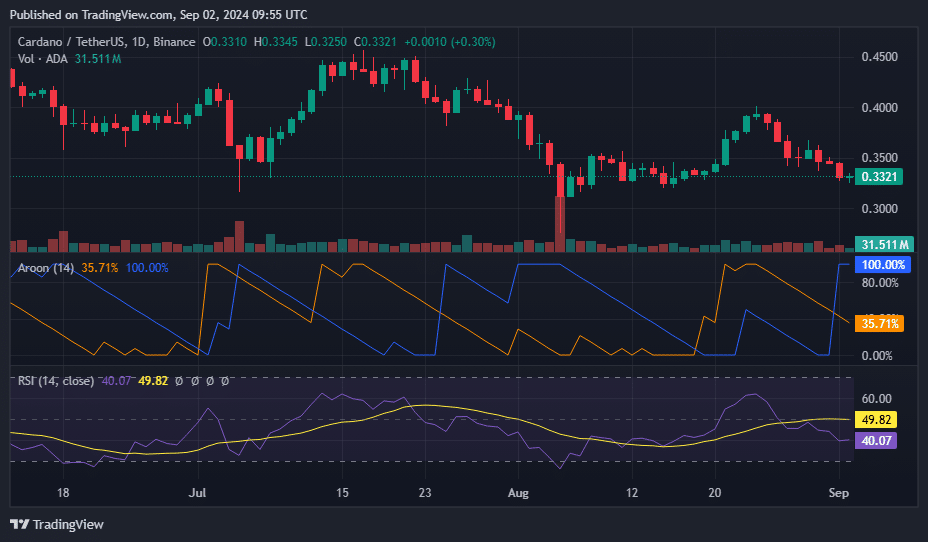

Additionally, the Aroon indicator suggests a mostly bearish pattern, as the Aroon Down is at a maximum of 100%, signifying robust downward pressure, contrasted by a comparatively low Aroon Up of 35.71%, implying insufficient upward thrust.

As per Crypto Yapper’s analysis, the recent losses in Cardano seem to be following a Falling Broadening Wedge pattern across several months. This pattern is distinguished by two sloping lines that descend but also diverge, suggesting both lower lows and higher highs, with volatility escalating as time goes on.

If ADA manages to rise above the upper boundary of the Falling Broadening Wedge pattern, this could signal a significant price surge, as the trend might be reversing upward. The recent increase in trading volume suggests that a potential breakout is imminent, making this level an important one for traders to keep a close eye on.

Read More

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- USD MXN PREDICTION

- EUR CNY PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- Capcom has revealed the full Monster Hunter Wilds version 1.011 update patch notes

2024-09-02 14:39