As a seasoned analyst with years of experience navigating the volatile world of cryptocurrencies, I must admit that yesterday’s events were a stark reminder of the market’s inherent unpredictability. The four-month high net outflow for Bitcoin exchange-traded funds, particularly from heavyweights like Fidelity’s FBTC and Grayscale’s GBTC, is a red flag that cannot be ignored.

Reformat and simplify the reading experience for U.S. citizens who are invested in the crypto market: Witness a four-day uptick on Thursday, Aug. 6.

Here’s a possible way to rephrase your statement: According to the data provided by Farside Investors, Bitcoin (BTC) ETFs saw $287.8 million in net outflows yesterday, they continue their five-day downward momentum. This amount of outflows has not been seen since May 1, as it was not until May 1 that this amount of outflows was first created.

Here’s a possible way to rephrase your sentence in a more approachable manner:

Additionally, it’s worth noting that ARK 21Shares ARKB and Bitwise’s BITB ETFs experienced a combined outflow of approximately $33.6 million and $25 million, according to Farside Investors. Furthermore, EZBC, HODL, BRRR, and BTCO funds also contributed to the bearish trend by recording outflows of $8.4 million, $3.3 million, $2.5 million, and $2.3 million respectively.

The largest spot BTC fund with over $20.9 billion in total inflows, BlackRock’s iShares Bitcoin Trust ETF, remained neutral along with BTCW and Grayscale’s mini BTC fund.

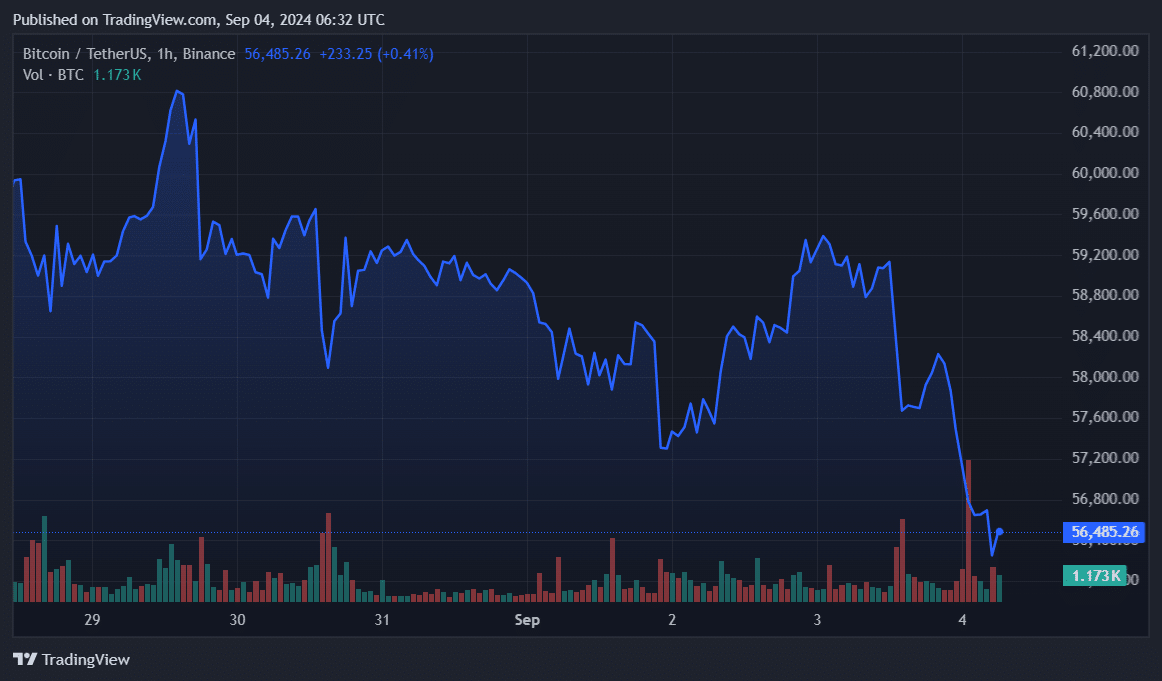

Bitcoin dropped 4.6% in the past 24 hours and is trading at $56,330 at the time of writing. The leading cryptocurrency briefly touched a one-month low of $55,670 earlier today.

On August 3rd, Ethereum (ETH) ETFs continued to show a bearish trend, with a total withdrawal of approximately $47.s redistributing $47.6 million. Fars Fars Fars Investors, the provider, reported this outflow. Specifically, Grayscale’s ETHE had an outflow of $52.3 million, while Fidelity’s FETH saw inflows of $4.9 million.

The remaining spot ETH funds stayed neutral.

Etherium’s price dropped approximately 5.5% within the last 24 hours, with its current value being around $2,370 at the moment this text was penned.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-09-04 10:17