As a seasoned crypto investor with over a decade of experience navigating market cycles and learning from my fair share of mistakes, I’ve seen it all—the meteoric rises, crushing falls, and everything in between. The recent drop in POPCAT has caught my attention, and after analyzing various indicators, I can’t help but feel a sense of deja vu.

Over the past ten days, POPCAT’s value has plummeted by more than 30%. However, it seems this downward trend might continue, as a thorough examination of various factors suggests potential future drops may be imminent.

Table of Contents

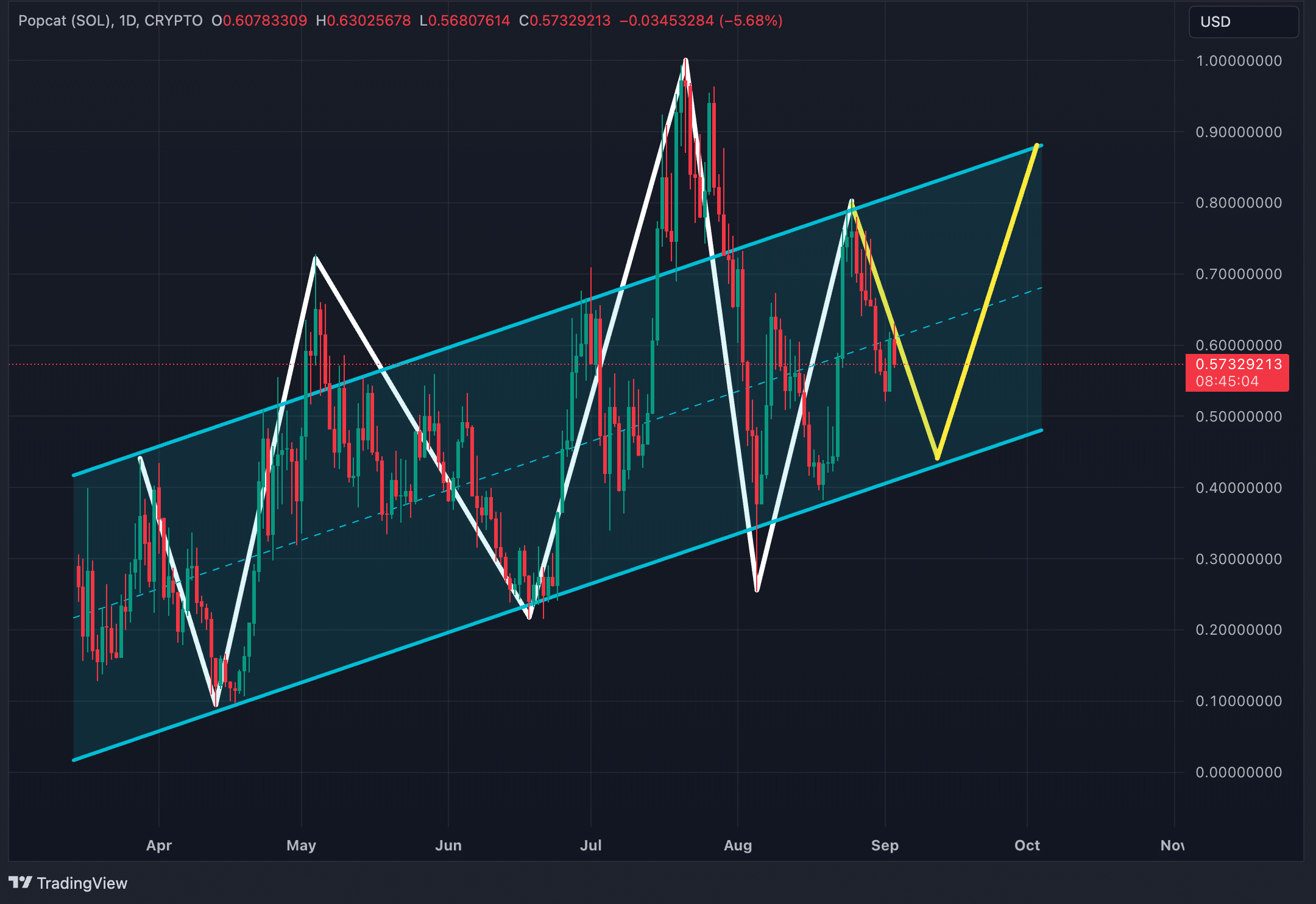

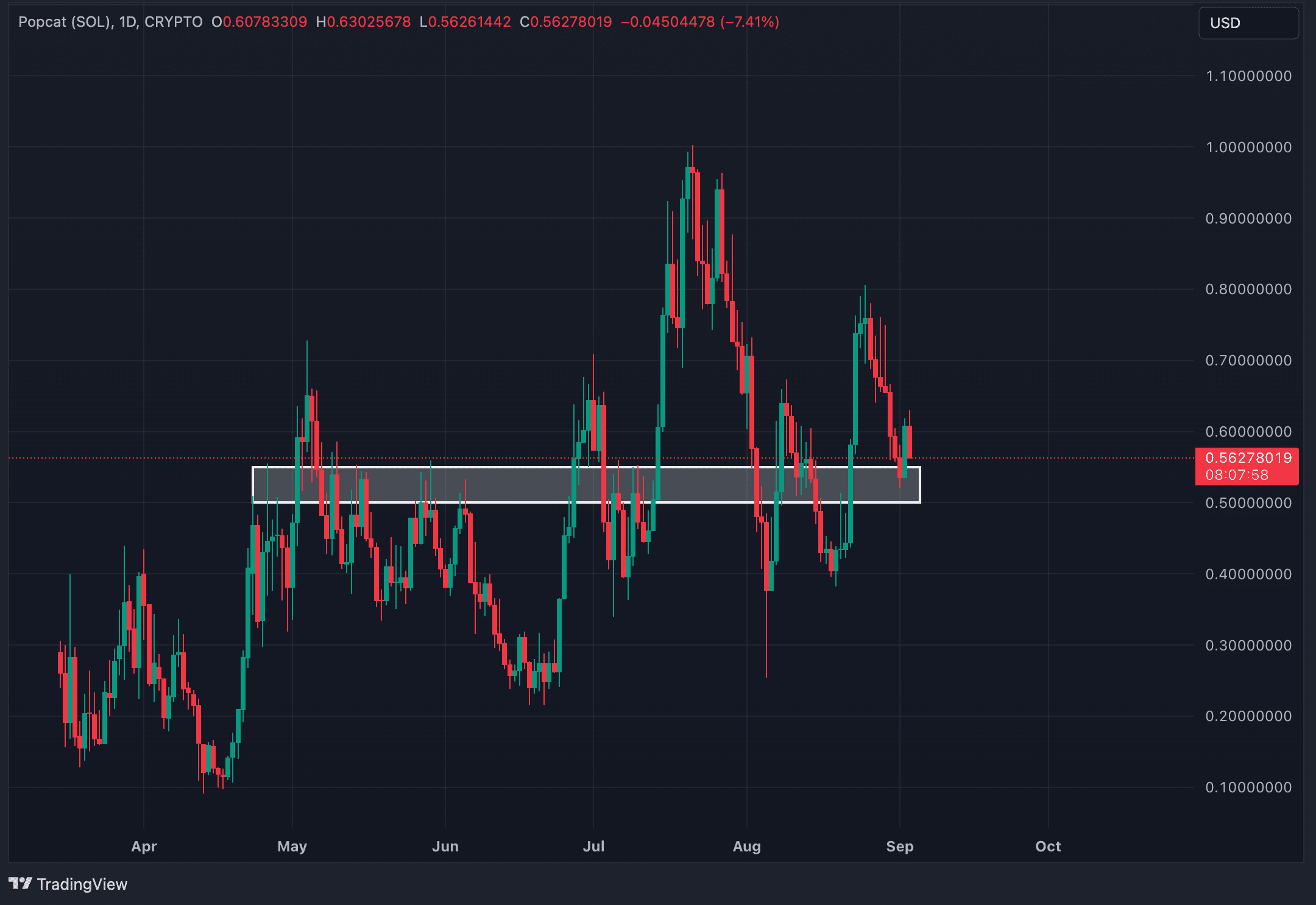

Inside POPCAT’s parallel channel

POPCAT respects a parallel channel that defines its movement. While there have been moments when the price broke above or below the channel, it continues to adhere to this pattern over time. The white lines on the chart offer a simplified representation of the price movements within the channel.

As we progress, the dashed lines illustrate a potential course for POPCAT’s future. In the near term, there might be a dip down to approximately $0.43, which would signify a fall of more than 23% from the current position. Following this drop, the price could potentially surge towards around $0.87 by October or November.

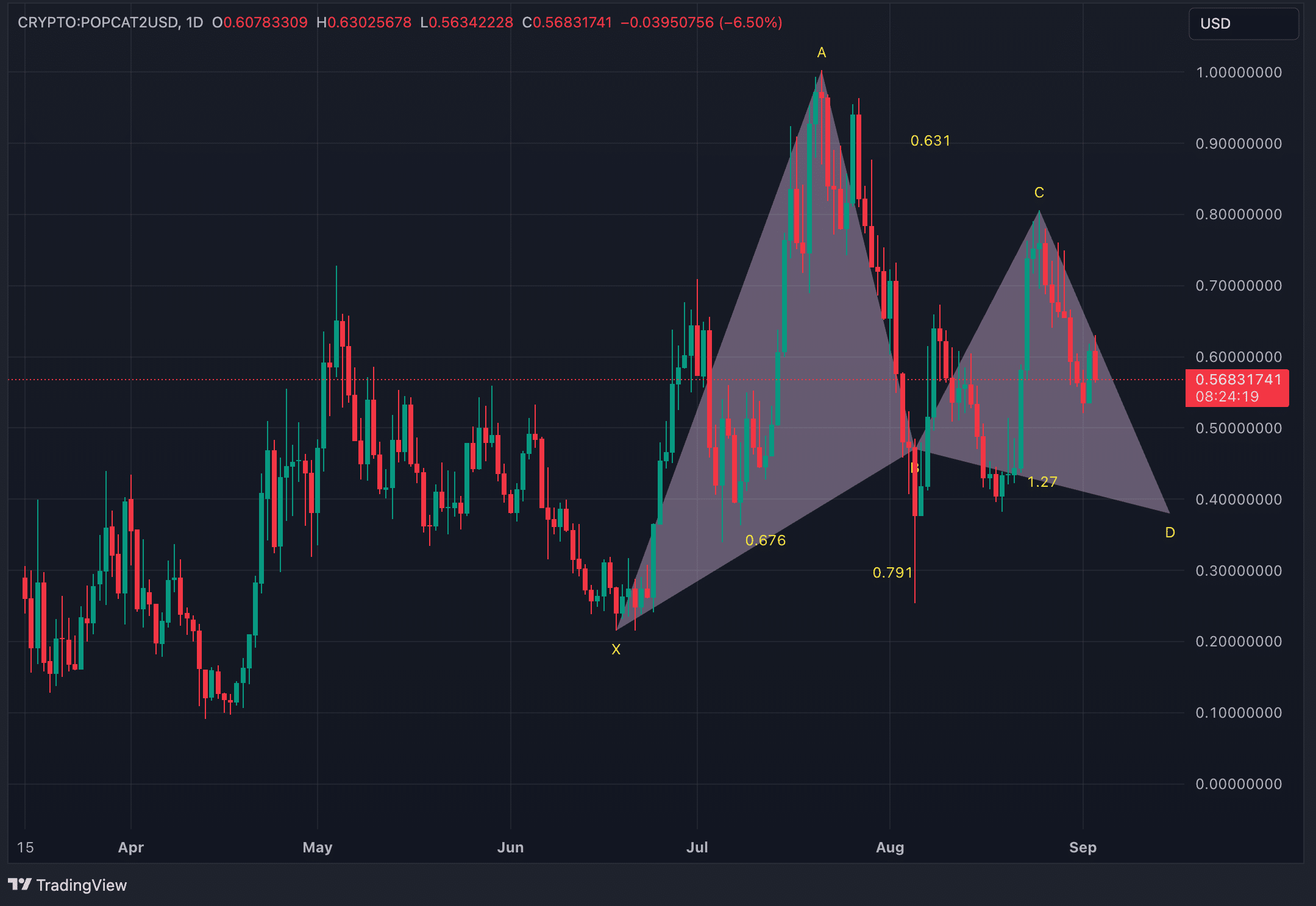

Gartley harmonic pattern on the verge of completion

Evidence suggesting that POPCAT may experience another decline includes the emergence of a Gartley harmonic pattern on its daily chart. This pattern, which is a specific price configuration based on Fibonacci ratios, typically marks potential reversal points with an 85% success rate. It’s composed of five distinct points: X, A, B, C, and D, signifying a pullback followed by a resumption of the primary trend direction.

In the case of POPCAT, the pattern has formed with the final point D yet to be completed. If the Gartley pattern completes as expected, the price could drop to approximately $0.38. This target lies slightly below the lower boundary of the established parallel channel.

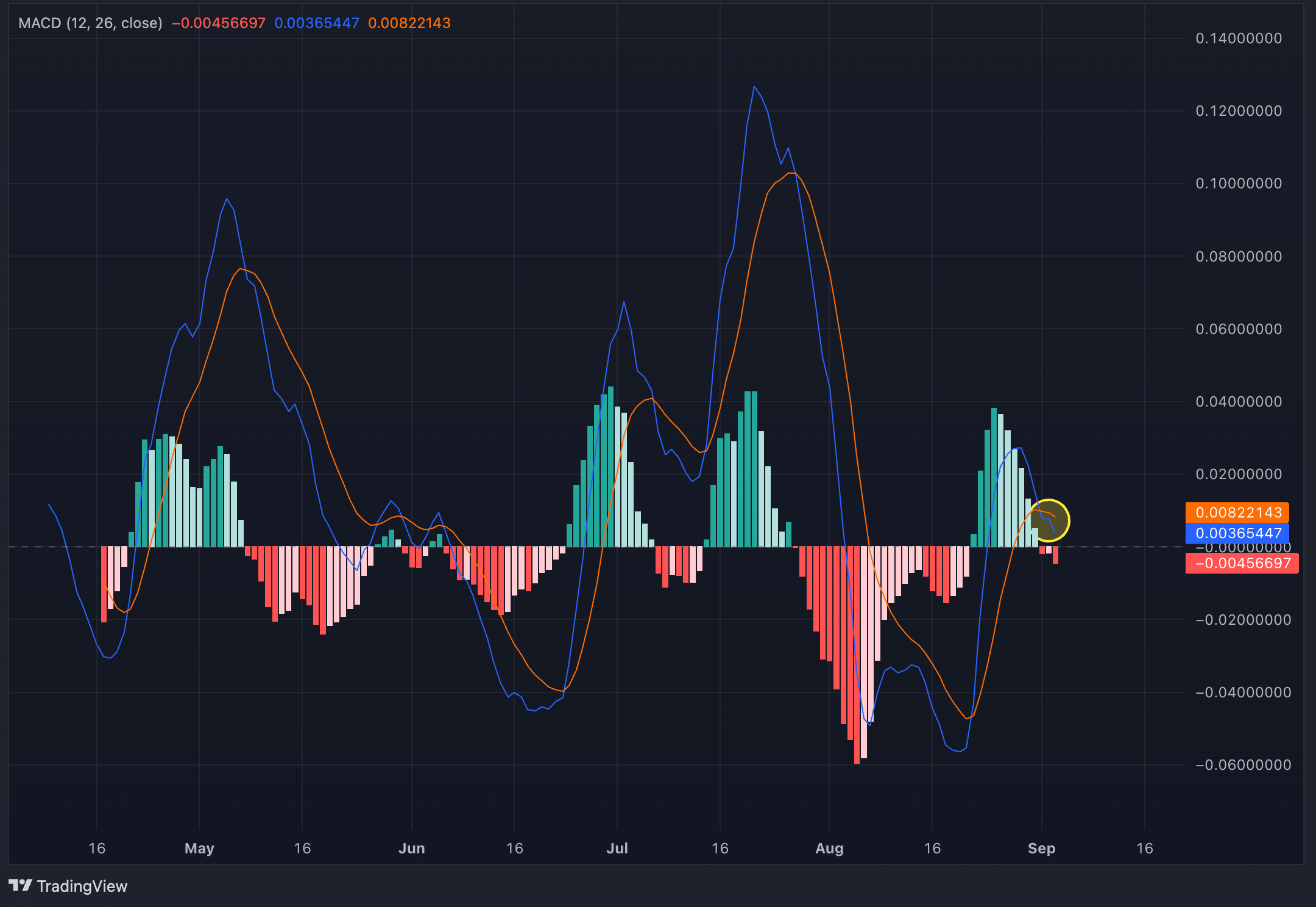

MACD Reversal

“A potential continued decrease in POPCAT might be indicated by the recent bearish crossover observed in the Moving Average Convergence Divergence (MACD) indicator. The MACD is a technical analysis tool that uses two lines, the MACD line and the signal line, to display the momentum and direction of a trend by examining their relationship.”

As a researcher studying financial markets, I observe that a ‘crossover’ happens when the Moving Average Convergence Divergence (MACD) line dips beneath the Signal Line. This event is interpreted as a bearish sign, analogous to the “death cross” in moving averages. Essentially, this crossover signals a transition from a bullish momentum to a bearish one.

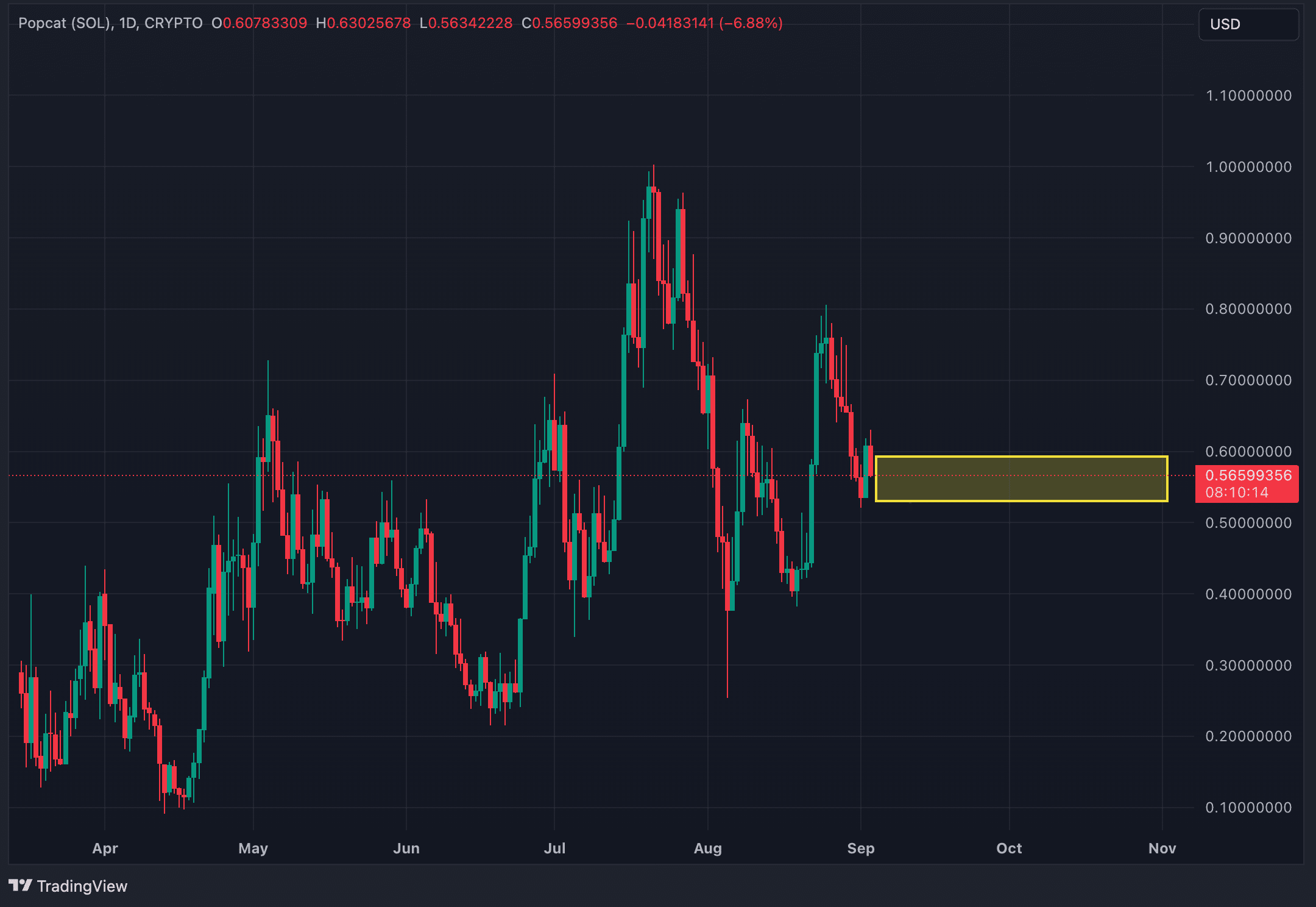

Counterpoints: Limited downturn possibility

Although multiple signs point towards an ongoing slump for POPCAT, there are also signs that might halt or even reverse the current dip.

Initially, a significant cluster of Fibonacci Golden Ratio pockets can be seen in the price range between approximately $0.53 and $0.593. This grouping includes the Fibonacci retracement from the low on August 19 to the high on August 25, as well as the high on July 1 to the low on August 5, and the low on July 5 to the high on July 21. Furthermore, other Fibonacci 50% retracement levels coincide within this price range, adding robustness to the support in this area. The price of POPCAT is expected to maintain its current downward trend as long as it remains above $0.53. However, if it fails to surpass $0.593, we cannot definitively state that the decline has ended.

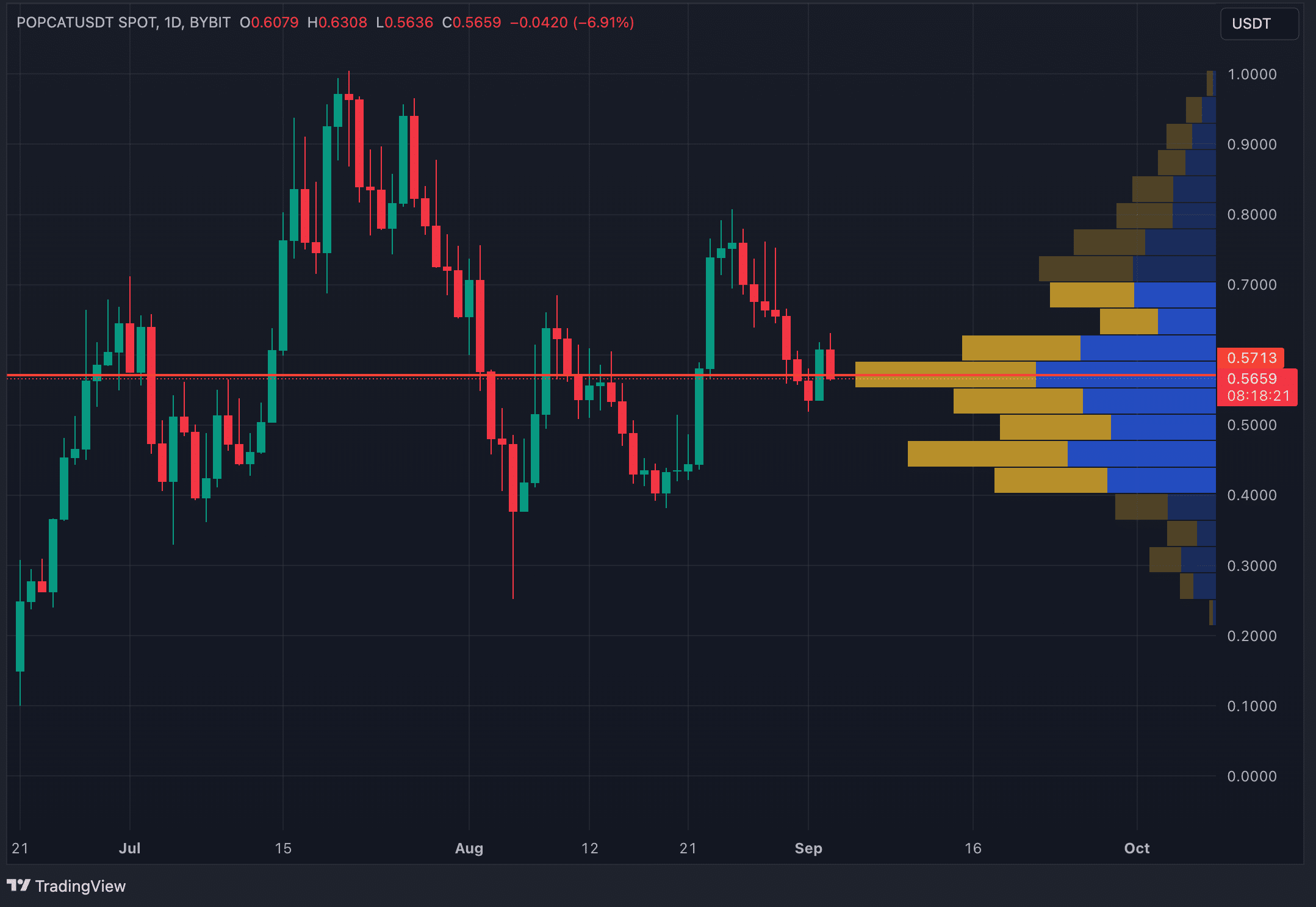

Furthermore, it’s worth noting that the historical volatility range for POPCAT between $0.50 and $0.55 has been quite significant, serving as either support or resistance on no less than 38 instances. This region coincides with the golden pocket confluence, making it even more crucial as a potential bottom for the ongoing downtrend.

Lastly, the Visible Range Volume Profile (VRVP) adds another layer of support in the $0.55 to $0.593 area. The VRVP is a tool that displays trading activity at various price levels and highlights areas with high trading volumes as major zones of support or resistance. In this case, the volume bar in the $0.55 to $0.593 range is the biggest and suggests strong buyer interest. However, if POPCAT drops below $0.40, the volume profile thins out considerably, indicating little to no support below that level, which could lead to even steeper declines if breached.

Strategic considerations

Currently, the situation with POPCAT is puzzling. While some signals point towards a potential decline continuing, other factors indicate that the downward trend might be over and an upturn could be imminent, suggesting optimistic prospects.

According to our analysis, which aligns with what’s been discussed in past articles, the expected change in monetary policy, particularly the predicted interest rate cuts in September, along with the traditionally poor performance of cryptocurrencies in September, might make the current support zones for POPCAT irrelevant. Considering this perspective, a tactical move would be to sell short on POPCAT, aiming to reach the $0.43 price point.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-09-04 12:37