Revised version: The price of Bitcoins remained stagnant following the weak U.S. job reports, with fear and greed indices retreating further into the danger area

Weak US jobs data

“Bitcoin (BTC) experienced a significant drop in value, from $56,800 to $99,000, following the publication of a weak private payroll report by the company, the American economy, which had only 99,000 jobs available in August, the lowest increase in over two years. The figure was significantly lower than the median estimate of 144k.”

On September 4th, Wednesday, data from the Bureau of Labor Statistics showed a decrease in job openings to approximately 7.7 million in July, marking the lowest figure since early 202

Consequently, it’s possible that the Bureau of Labor Statistics (BLS) might release a subpar Non-Farm Payroll Report on Friday. The consensus among economists is that the data will indicate the unemployment rate holding steady at 4.3%, with the economy creating approximately 164,000 jobs

Translation: It appears that the Federal Reserve is expected to reduce interest rates later this month, which is why the U.S. Dollar Index has dropped to $101.18 and the yield curve has inverted

Translating in a clear and concise manner: In reference, these financial indicators should exhibit bullish characteristics for Bitcoin and altcoins like Ethereum (ETH) and Solana (SOL). For instance, stocks and cryptocurrencies reached their peak performance when the Federal Reserve began reducing in 2020

The job market is experiencing its worst conditions in three years

— Michaël van de Poppe (@CryptoMichNL) September 5, 2024

Crypto fear and greed index slips

The decline in Bitcoin’s price can be attributed to a wave of apprehension sweeping across the cryptocurrency sector. Notably, the widely monitored Crypto Fear & Greed Index dipped into the ‘fear’ zone at 34, marking its lowest point in more than a month

One possible explanation for this apprehension could be the persistent worry about an economic downturn (or recession) in the U.S., stemming from a string of below-par economic data

Moreover, institutional investors’ appetite for Bitcoin has decreased noticeably, as spot Bitcoin Exchange-Traded Funds (ETFs) have seen continuous asset outflows for the last seven days. During this period, these funds have reportedly lost approximately $802 million worth of assets, based on data from SoSoValue. Similarly, Ethereum ETFs have registered net outflows totaling $562 million since their launch

Bitcoin’s weak technicals

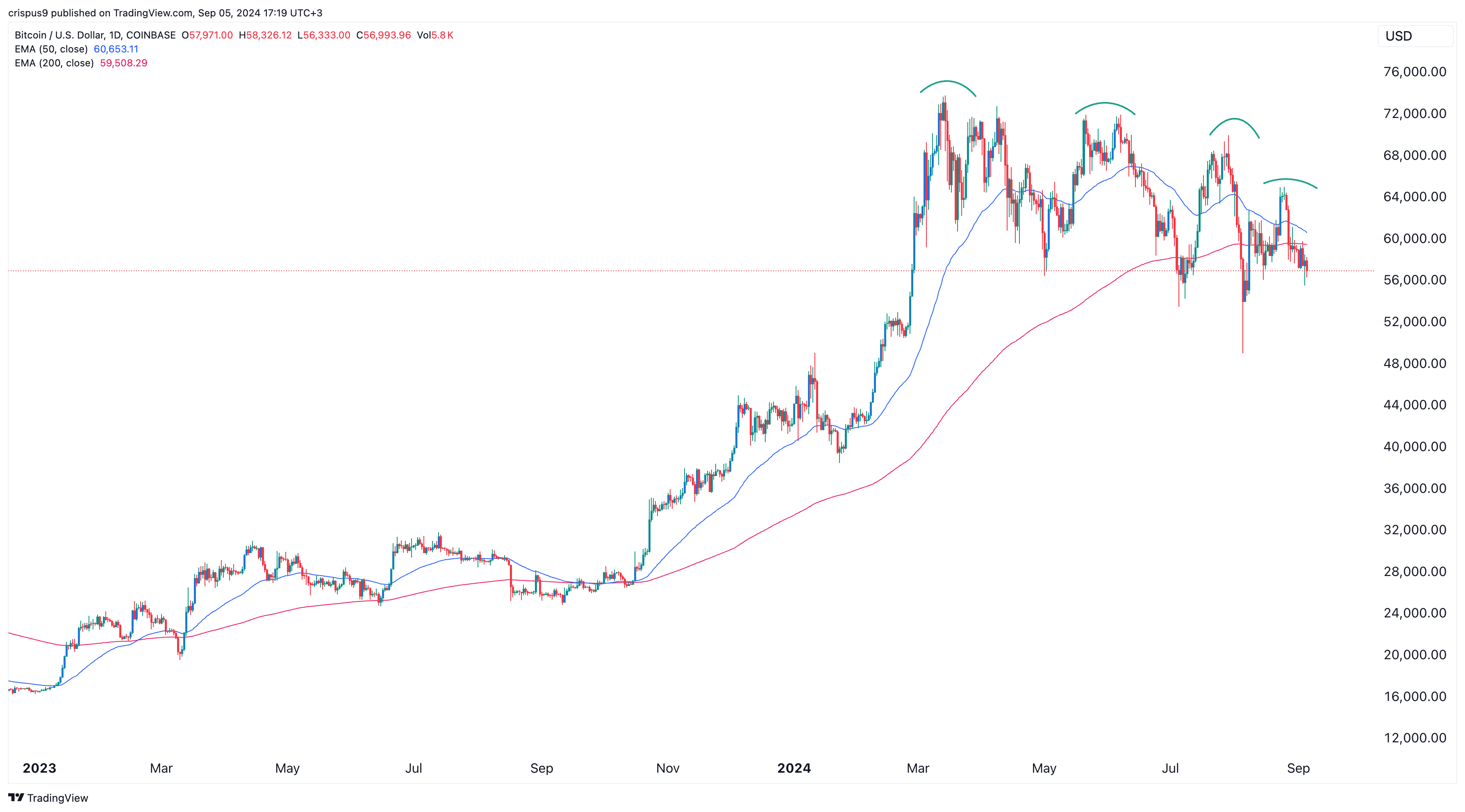

The bitcoin market has displayed some technical warning signals, and the situation could potentially worsen. It has created a sequence of lower highs at $73,800, $72,000, and $70,000. Additionally, it shows indications that it may form a ‘death cross’ as the 50-day Exponential Moving Average (EMA) and the 200-day EMA are about to intersect with each other

In simpler terms, the “Golden Cross” and “Death Cross” are significant patterns observed in technical analysis of financial markets. The Bitcoin reached a record high of $73,800 after forming a Golden Cross pattern in October 2023. Conversely, it plummeted by more than 67% when it formed a Death Cross pattern in January 2022

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-05 18:29