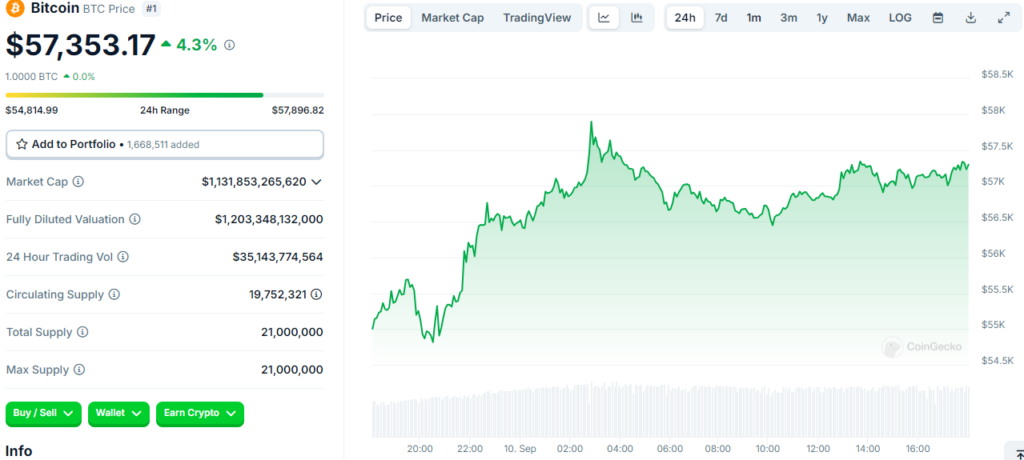

As a seasoned crypto investor with over a decade of experience navigating the volatile and dynamic world of digital assets, I find myself cautiously optimistic following this week’s market developments. The recent surge in Bitcoin, surpassing $57,000, coupled with gains in other cryptocurrencies, has certainly piqued my interest.

On Tuesday mornings, Bitcoin experienced a resurgence, exceeding $57,000, as U.S.-based Bitcoin exchange-traded funds (ETFs) halted their eight-day streak of outflows. This upturn in Bitcoin was mirrored by increases in other digital currencies.

Solana (SOL) and Toncoin (TON) both experienced notable rises, increasing by 4% and 4.4%, respectively. Ethereum (ETH), the second-largest cryptocurrency, was trading at $2,360, marking a 1.5% increase. However, Ethereum has slid by 12% over the past two weeks.

On the 9th of September, Bitcoin ETFs experienced a total investment of approximately $28.72 million. Fidelity’s Bitcoin ETF garnered the largest share with about $28.5 million in investments, while Grayscale’s Bitcoin Trust recorded an outflow of around $22.7 million, as reported by SoSo Value.

Contrarily, the landscape for Ethereum Exchange-Traded Funds (ETFs) showed a blend of results. Notably, Grayscale’s Ethereum Trust (ETHE) witnessed substantial withdrawals amounting to $22.6 million, resulting in a combined outflow of $5.1 million for Ethereum spot ETFs.

For five days in a row now, there have been net withdrawals. However, it’s worth noting that Fidelity’s Ethereum Fund (FETH) and the Bitwise Ethereum ETF (ETHW) experienced inflows of approximately $7.6 million and $1.8 million respectively during this period.

Vishal Sacheendran, who leads Binance‘s Regional Markets division, highlighted Bitcoin’s robustness, pointing out its capacity to bounce back and the traditionally strong performance of October for this digital currency. Despite experiencing ups and downs, Bitcoin has consistently demonstrated its resilience, with favorable returns in nine out of the last eleven years and an average increase of 22.9% in October, according to Sacheendran.

Illia Otychenko, an analyst at CEX.IO in the market research field, pointed out some technical markers for Bitcoin. Bitcoin has just rebounded from its significant support level, the 50-week Simple Moving Average (SMA), and is currently attempting to maintain its position above the 0.382 Fibonacci retracement line.

Otychenko additionally highlighted a possible positive trend indicated by the NVT (Network Value to Transactions) Golden Cross, suggesting increased network activity despite recent price drops. Meanwhile, Greg Cipolaro, NYDIG’s Global Head of Research, emphasized that Bitcoin’s immediate triggers are scarce at present, with greater attention being paid to broader economic conditions and monetary policies rather than crypto-specific occurrences.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-09-10 16:04