As a seasoned researcher with years of experience in the crypto markets, I have seen my fair share of bull runs and bear markets. The current sell-off of Celestia (TIA) has caught my attention, not just because it’s hovering at its lowest point since November 2023, but also due to the upcoming token unlock event.

This week, the price of Celestia has persistently dropped and currently stands at its lowest level since November 2023, just before a significant release of tokens.

On September 10th, the value of Celestia (TIA) fell to $4.15, marking a decrease of more than 80% from its peak in February. This significant drop has resulted in a market capitalization exceeding $868 million, a decrease from the $3.2 billion it held earlier this year.

The decline of Celestia occurred during a period when Bitcoin (BTC) and other alternative coins experienced a slowdown in their upward trend. Bitcoin has plummeted more than 23% from its peak this year, whereas Ether has tumbled by approximately 43%.

The main difficulty facing Celestia is the upcoming release of tokens for unlocking, which could increase the number of tokens in circulation, potentially diluting the holdings of existing investors. Currently, out of a total supply of 1 billion tokens, approximately 209 million are already circulating. This leaves over 859 million tokens yet to be released and entered into the market.

As per TokenUnlocks, approximately 174 million tokens valued at over $175 million, representing around 16.4% of the total token supply, are set for release on October 31. These tokens will be distributed among early seed investors, initial key contributors, and investors from Series A and B funding rounds.

Last year, on Halloween, was the last time Celestia’s token unlock happened, and it’s anticipated that the final unlock will occur in October of 2027.

Increasing the availability of tokens (or coins) through unlocking mechanisms usually leads to greater dilution because more units are now in circulation. This circumstance could potentially influence the staking reward percentage for Celestia, currently set at 9.96% as reported by StakingRewards.

As a researcher examining Celestia’s earnings structure, I can say that its income primarily comes from transaction fees, block rewards, and fees for data availability sampling. It’s important to note that as more tokens get added to the staking pools, the anticipated yield is expected to decrease over time.

Even as the Celestia network expands its influence in the modular data sector, TIA‘s token value has decreased concurrently. Interestingly, the data suggests that the Celestia platform’s market share has grown to approximately 40%, while Ethereum Blobs maintains a 58% share.

Celestia sits at a key support

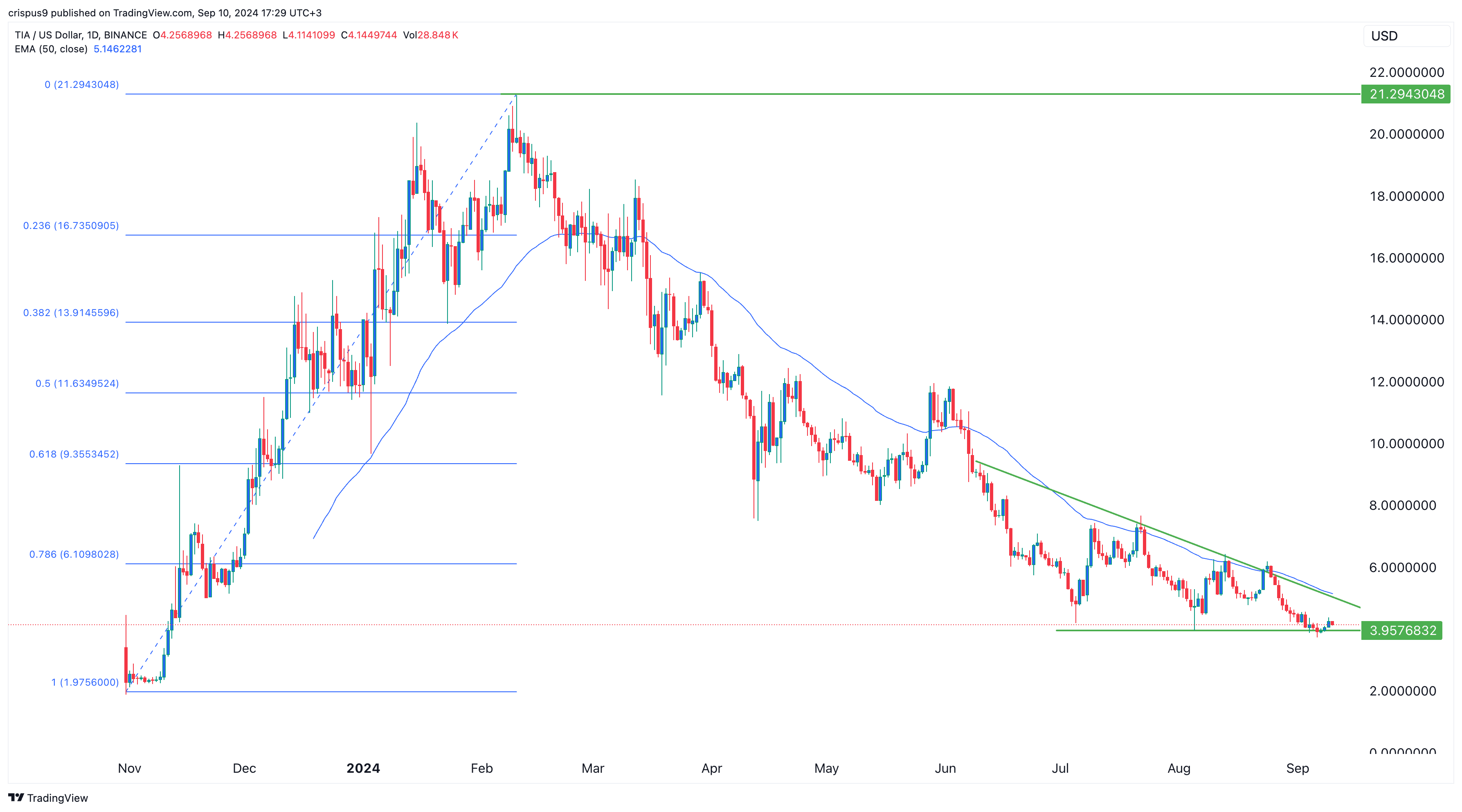

Celestia’s token is experiencing a significant decline, going from a high of $21.30 in February to $4.12 currently. This drop has taken it below the 78.6% Fibonacci Retracement level and also under the 50-day moving average.

3.95 dollars has proven to be a robust support point for TIA, a level it hasn’t managed to surpass since July. This significant figure marks the bottom edge of a descending triangle formation, often interpreted as a bearish indicator due to its prevalence in technical analysis.

If Celestia falls below its crucial support level, there’s a possibility it could hit a new all-time low.

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2024-09-10 18:10