As a seasoned crypto investor with battle-scars from the 2017 bull run and the subsequent bear market, I can’t help but feel a mix of excitement and trepidation when analyzing the current Bitcoin landscape. The recent dip in Bitcoin price, while disappointing in the short term, is not entirely unexpected given the political climate and the aftermath of the Trump-Harris debate.

On September 11th, the value of Bitcoin fluctuated, with traders considering the recent debate between Donald Trump and Kamala Harris.

Bitcoin exchange reserves have dived

Bitcoin (BTC) has dipped back down to around $56,700 from its weekly peak at $58,000, whereas tokens tied to former U.S. President Donald Trump, such as MAGA (TRUMP), have experienced a drop of over 10% in the past day.

Kamala Horris (KAMA) token by a smaller margin as traders estimated that Harris had a better night than Trump. Polymarket’s odds flipped in her favor, with a 50% chance of winning in November.

If Donald Trump wins the presidential election, it is believed that Bitcoin and other digital currencies could thrive given his pro-cryptocurrency stance. He has suggested that he might appoint a new head to replace Gary Gensler, maintain control of Bitcoins in government custody, and actively advocate for the U.S. becoming a leading hub for cryptocurrencies.

Over the past two days, there has been an increase in investments into Bitcoin ETFs, suggesting that investors are taking advantage of the price drop by buying more. Specifically, they invested around $116 million on September 10th and approximately $28 million the day before.

A possible factor fueling Bitcoin could be the persistent decrease in Bitcoins held on exchanges. As per CoinGlass, these reserves have dipped to approximately 2.35 million BTC, which is the lowest in years. This figure is significantly lower than the peak of over 2.71 million BTC seen this year.

A decrease in Bitcoin reserves is a good sign since it suggests that numerous owners are not offloading their assets. However, there was an increase in reserves during July and early August due to the German government and Mt. Gox selling off their Bitcoin holdings.

The quantity of Bitcoin held in reserve is decreasing, with the level of stablecoins like Tether (USDT, currently boasting a market cap of more than $118 billion) and USD Coin (USDC, hitting an all-time high of $35.2 billion) on the rise.

The decrease in Bitcoin holdings alongside an increase in stablecoins indicates that investors may be holding back, preparing to make purchases.

Bitcoin technical risk remain

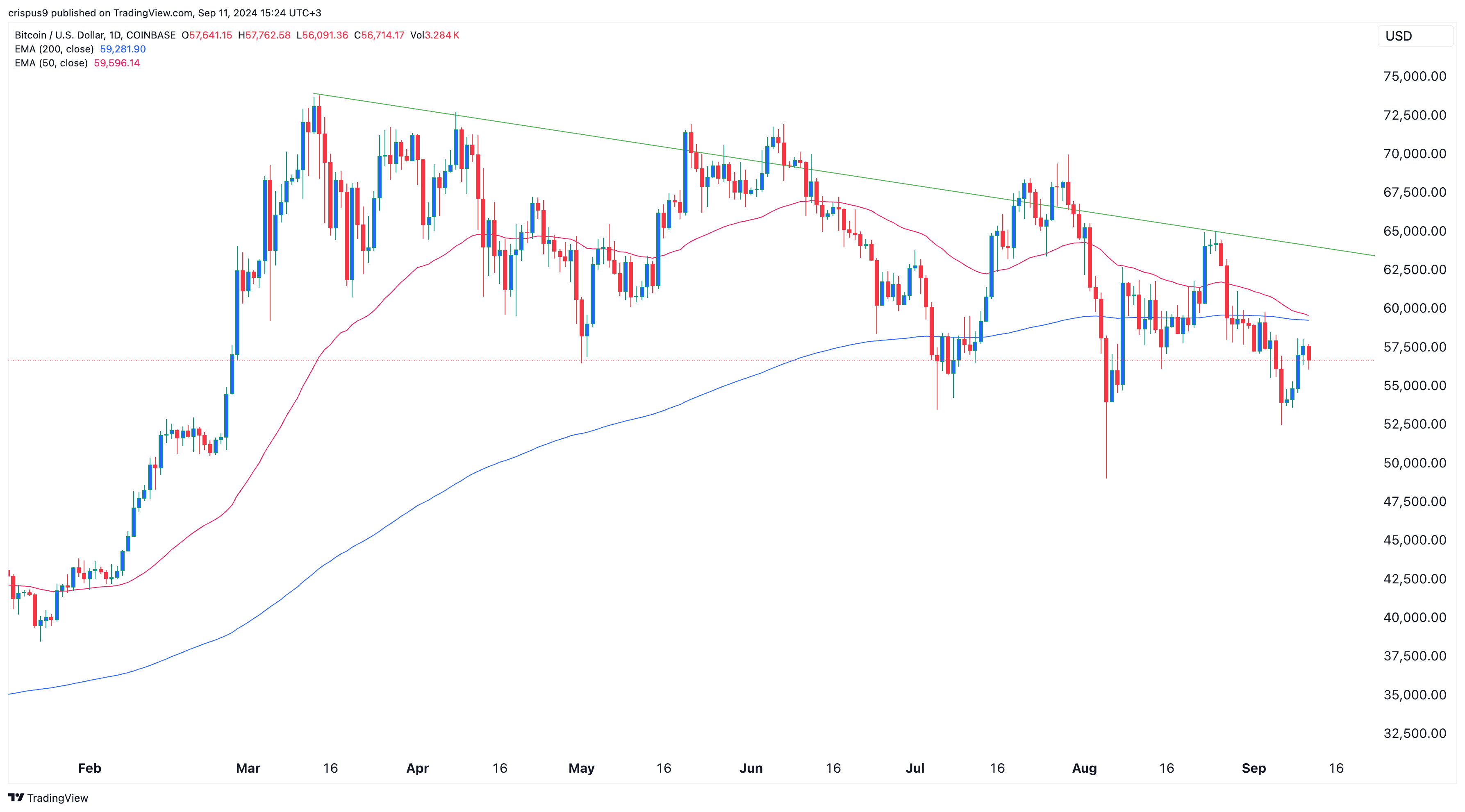

Still, Bitcoin faces some major risks ahead. The most important risk is that the spread between the 50-day and 200-day Exponential Moving Averages has continued to narrow, meaning that a death cross may happen.

historically, financial assets often plummet significantly when this particular pattern emerges; for instance, the last “death cross” in Bitcoin’s market resulted in a steep 65% drop in 2022.

Bitcoin encounters significant barriers, evident in the downward sloping line linking its peak values since March of this year. In order for a convincing bullish surge to occur, it must surpass these obstacles as well as the year-to-date high of approximately $73,800.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-09-11 16:07