As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of bull and bear cycles. However, the current state of Bitcoin and its exchange-traded funds (ETFs) has piqued my interest more than ever before.

This week saw a reversal in the trend as Bitcoin ETFs experienced inflows totaling over $403.8 million, ending a two-week period of outflows. Analysts anticipate that increased institutional interest throughout 2021 will counteract the bearish sentiment often associated with September and potentially bolster Bitcoin’s performance.

On September 13th, as reported by SoSoValue, Bitcoin Spot ETFs experienced their largest one-day influx since July 22nd, accumulating approximately $263.07 million. The majority of this activity was handled by Fidelity, ARK Invest, and 21Shares’ funds, accounting for more than half of the day’s transactions.

-

Fidelity’s FBTC continued its 5-day inflow streak, bringing in $102.1 million.

ARK Invest and 21Shares’ ARKB, $99.3 million.

Bitwise BITB, $43.1million.

Franklin Templeton EZBC, $5.2 million.

Grayscale’s GBTC turned positive for the first time since Jul. 19, raking in $6.7 million.

VanEck’s HODL, $5.1 million.

Valkyrie’s BRRR’s, $1.7 million marked its first inflow day after four days of no flows.

BlackRock’s IBIT, Invesco’s BTCO, WisdomTree’s BTCW, and Grayscale’s Bitcoin mini trust saw zero flows.

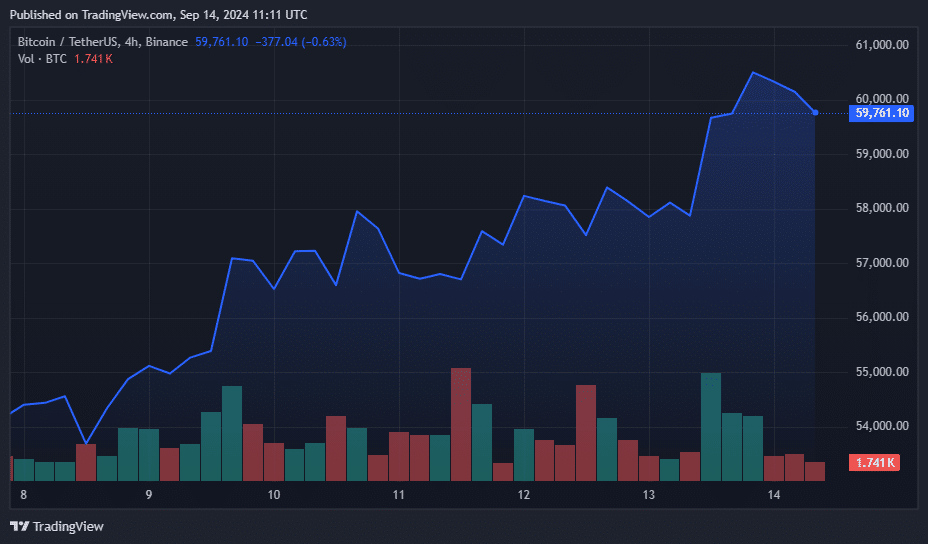

Investment products tied to Bitcoin (BTC), known as Bitcoin ETFs, ended a two-week trend of outflows after BTC regained its value to reach approximately $60,000. The highest and lowest points during the day were $60,655 and $57,668 respectively.

At press time, the crypto asset was trading 11% higher than its weekly low of $53,860 on Sept. 8.

This time is different

historically, Bitcoin tends to experience losses during the month of September, with an average decline of about 4.69% over the past eleven years as indicated by CoinGlass data.

However, financial analyst Rajat Soni posits that the increasing institutional investment, fueled by this cycle’s approval of spot Bitcoin ETFs, might potentially reverse the current trend.

Soni highlighted that Bitcoin (BTC) has been steadily holding above $50,000 for approximately six months. Remarkably, it last closed above this price point in the year 2021. At that time, the market was predominantly influenced by individual investors who are known to react emotionally, leading to heightened market volatility.

On this occasion, Soni posits that institutional investors may offer a sturdier base, reducing the likelihood of Bitcoin dipping below its crucial threshold. This perspective is mirrored by various crypto specialists whom we spoke to recently.

In this instance, Soni stated that things are not the same as before; institutional investors have arrived and are prepared to purchase whatever retail investors choose to offload.

In other words, Soni advised against selling because investors might end up buying back at a significantly higher price, as big institutions are eagerly waiting to purchase any coins that become available for sale.

It seems that institutional interest is not just limited to Bitcoin itself, but also extends to stocks related to Bitcoin mining. According to analysts at H.C. Wainwright, the approval of exchange-traded funds (ETFs) that deal directly with Bitcoin, coupled with rising demand for AI-enhanced power systems, has ignited investor enthusiasm for shares in Bitcoin mining companies.

This optimistic view is also reinforced by aggressive price predictions from prominent figures within the industry. For instance, Michaël van de Poppe anticipates that Bitcoin could potentially reach anywhere between $300,000 and $600,000 during this specific market phase.

Upon writing, Bitcoin was hovering above $59,650, up 9.7% over the past week.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-14 16:40