As a seasoned analyst with over two decades of experience in the tech and crypto industries, I have witnessed numerous market cycles and trends that have shaped the trajectory of various projects. The recent surge of Bittensor (TAO) has piqued my interest, given its strong correlation with Nvidia’s stock performance.

The decentralized AI project Bittensor soared to the summit of the weekly top performers, propelled by the rise in Nvidia’s share prices.

As an analyst, I’m excited to report that this week, Bittensor (TAO) has taken the lead among the top 100 cryptocurrencies with a substantial 31% surge in price. Currently, TAO holds the 41st position by market cap, boasting a value exceeding $2.51 billion. In the last 24 hours alone, its price has risen by 8.87%, currently trading at approximately $313.59.

TAO’s recent increase in value is largely due to the significant rise (a jump of 13.5%) in Nvidia Corporation’s stock price on September 13, which closed at $119.08. This substantial boost propelled Nvidia’s market capitalization to an impressive $2.92 trillion, as reported by MarketWatch.

This year, a surge of 140.5% in Nvidia stocks has propelled AI-oriented cryptocurrencies like TAO, causing them to rise as well. This upward trend has boosted the overall market cap of AI-related cryptocurrencies by approximately 0.8% within the past 24 hours. As per CoinGecko’s data, the current total market cap for AI tokens is now at around $23.9 billion.

AI-related stocks often follow the trajectory of Nvidia’s share price. On September 4th, for example, stocks such as Artificial Superintelligence Alliance (FET) and Render (RNDR) experienced double-digit declines following a 9.5% drop in Nvidia’s stock. Conversely, these AI stocks rose in February after Nvidia reported robust Q4 2023 earnings, and there was also a surge of anticipation prior to its Q2 2024 report.

TAO primed for liftoff

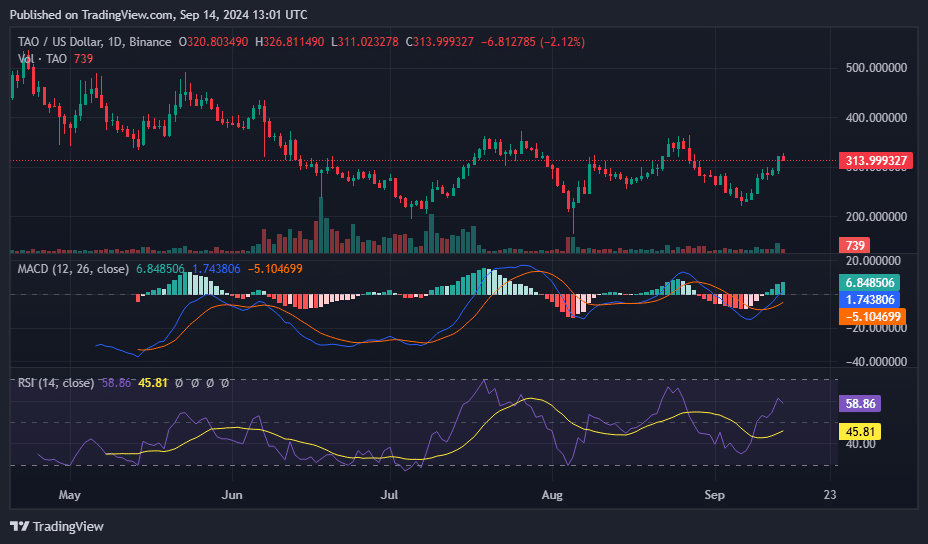

The 1D TAO/USD price chart from Sep. 14, signals a strong bullish trend, suggesting a potential for upward movement.

The Moving Average Convergence Divergence (MACD) has moved above its own signal line, and this is shown by larger, green bars on the histogram. These are optimistic indicators suggesting a potential increase in price movement.

As a crypto investor, I’m observing that the Relative Strength Index is sitting comfortably at 59, suggesting that the asset is in a favorable trading range. It’s not yet nearing the overbought territory, which gives us more room for potential growth.

This situation allows for future expansion without an imminent risk of decline due to being overpriced, suggesting a positive trend for the token’s near-term price movement, and anticipating more increases in the coming days or weeks.

Market experts on X share a consistent optimistic outlook. Analyst Marco Polo suggests that at present, TAO‘s value fluctuates between approximately $268 and $357. He anticipates a strong price surge when TAO surpasses the $357 threshold.

1W TAO breaks past $400, and it seems we’re off to a run! I think there’s a decent possibility that TAO could reach between 3k – 5k, given our potential shift in liquidity from BTC and the evolving AI storyline.— Roman (@Roman_Trading) September 13, 2024

In the meantime, analyst Ramon also holds a positive viewpoint, yet he spots a potential resistance level slightly higher, approximately around the $400 price point.

Ramon expects that TAO might reach between $3,000 and $5,000 during this bull market, contingent on Bitcoin‘s liquidity shifting elsewhere and the robustness of the overall artificial intelligence storyline. This prediction is bolstered by recent advancements, such as Apple announcing their generative AI at the iPhone 16 launch event.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-14 18:32