As an analyst with a decade-long career in the financial industry and a keen interest in both traditional markets and cryptocurrencies, I find myself intrigued by the current state of affairs. The recent downturn in Bitcoin’s price below $60,000 has sparked concerns among investors, while gold’s steady upward momentum presents an attractive alternative.

In times of market turbulence, Gold’s lower price fluctuations offer a competitive advantage, as stated by Maruf Yusupov, one of the founders of Deenar – a digital currency backed by gold, in an interview with crypto.news.

The cause behind the current Bitcoin surge isn’t hard to understand, as it’s primarily due to speculation about the possible reduction in Interest Rates by the U.S. Federal Reserve.

Yusupov added.

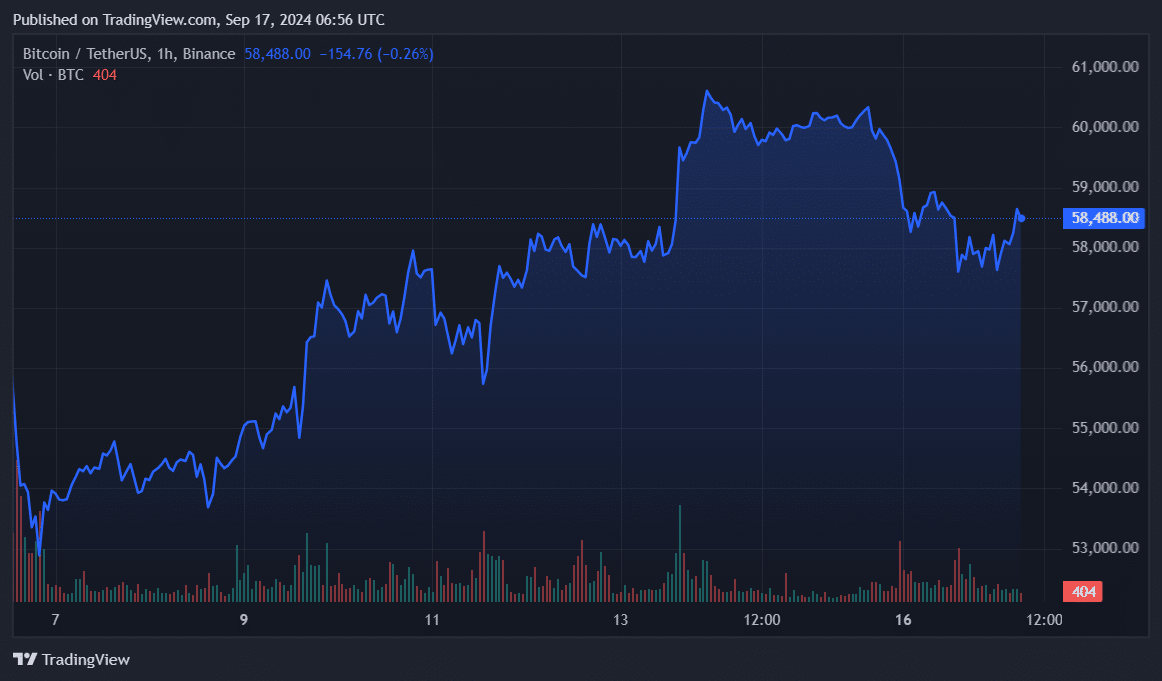

On September 15, the price of Bitcoin (BTC) dropping below $60,000 sparked concerns about further declines among investors. Conversely, gold’s consistent rise in value has made it a more attractive investment choice due to lingering apprehensions about overall uncertainty, as stated by Yusupov.

Gold experienced a 0.04% increase over the previous day and currently stands at $2,584 according to Trading Economics data. Yesterday, it hit an all-time high of $2,589, while Bitcoin was battling in the $58,000 area – a 22% drop from its own all-time high of $73,750.

Because Gold’s price stability makes it less volatile, it has become a popular choice for people seeking a reliable investment option to protect themselves from market uncertainties.

Yusupov said.

According to an article from crypto.news, the combined value of Bitcoin spot exchange-traded funds (ETFs) has exceeded $61 billion, accounting for about a quarter of the total assets managed by gold ETFs, which stand at approximately $257 billion, in just six months.

Significantly, the latest turbulence affecting the entire financial market and conflicting opinions about the U.S. Federal Reserve’s interest rate reduction have led to a rise in withdrawals. Interestingly, even BlackRock, known for its large investments, has opted to follow this withdrawal trend.

While we can’t definitively say that conventional investors are shifting towards gold yet, the current market trends seem to suggest this could be the case.

Yusupov argues.

In the last 24 hours, Bitcoin experienced a minor decrease of 0.24%, currently valued at approximately $58,500 per coin. At present, the total market capitalization of all cryptocurrencies is around $2.13 trillion, as reported by CoinGecko, indicating a drop of 1.2%.

The negative trend unfolds as opinions about the potential 50-basis-point interest rate reduction by the U.S. Federal Reserve are divided.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

2024-09-17 10:14