As an experienced analyst with over two decades in the financial markets, I must admit that watching Sui (SUI) soar to new heights is nothing short of exhilarating. The integration of native USDC and the Cross-Chain Transfer Protocol seems to be the catalyst for this impressive rally, which has propelled the token into the top 30 crypto assets by market cap.

Yesterday, Sui experienced a notable price surge after integrating USDC natively onto its platform.

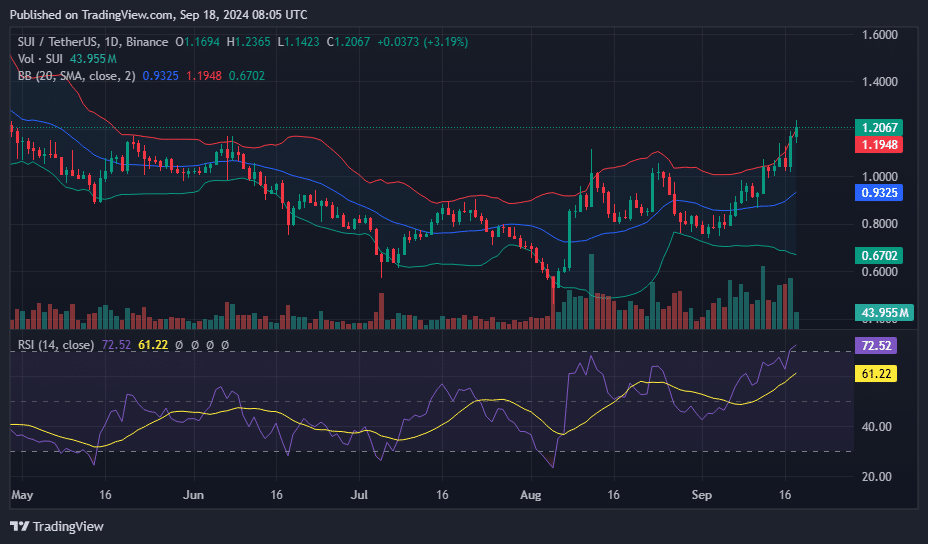

Currently, as I’m typing this, SUI was continuing its upward trend by approximately 10% compared to the previous day. It is being traded at around $1.2, according to crypto news data. Over the last week, the token experienced a significant surge of about 35%, climbing from $0.88 on September 11th to reach a six-month high of $1.22 earlier today.

After the recent increase in price, I find myself observing that the market capitalization of SUI has exceeded $3.2 billion, placing it as the 30th largest cryptocurrency. The impressive daily trading volume hovers around $673 million.

One of the main reasons behind SUI’s price surge could be its upcoming integration of native USDC and the Cross-Chain Transfer Protocol, which is expected to boost liquidity and cross-chain transactions.

As a crypto investor, I’m excited about the upcoming upgrade on the Sui network, which will enable a broader adoption of USDC across various sectors like decentralized finance, gaming, and e-commerce. This expansion could potentially boost the market demand for SUI, making it an even more valuable asset in my portfolio.

A possible rephrase for your statement could be: One more reason possibly contributing to the surge might be the Sui Foundation’s recent announcement about partnering with MoviePass, an American-based movie subscription service.

Rising futures demand and expanding DeFi ecosystem

The bounce-back of the coin coincides with an increasing appetite in the futures market, where the number of outstanding contracts has skyrocketed to an all-time high. As per CoinGlass’s statistics, the total value of these outstanding contracts currently stands at $315 million, shattering the previous record of $290 million and representing a significant jump from approximately $52 million in August.

Currently, it seems that Sui’s network is gaining traction among developers and users, as suggested by data from DeFi Llama. In the past 30 days alone, the total value locked within its decentralized finance sector has surged by over 25%, amounting to more than $741 million. A significant portion of these assets are being held in NAVI Protocol, Scallop Lend, Suilend, and Aftermath Finance.

SUI’s momentum faces key resistance test

On the daily graph, Sui has climbed over its 50-day and 200-day Simple Moving Averages, and it’s formed an inverted head and shoulder structure, which is usually seen as a positive or bullish sign.

The value of SUI currently sits above its upper Bollinger Band at approximately $1.1948, suggesting robust upward movement. Yet, this positioning may hint at the asset being overbought, potentially signaling an upcoming dip or adjustment in pricing.

Even though the asset is currently considered overbought, prolonged market enthusiasm might maintain it in this state for an extended time. The significant resistance level now lies at $1.40, which SUI nearly reached during its surge on April 20th. If the trend continues, another attempt to reach these levels seems possible.

As a crypto investor, I find myself observing that the Relative Strength Index has climbed to 72.52, slightly surpassing the overbought threshold of 70. This could suggest that the asset might be due for some downward movement, as traders might be considering cashing out their profits.

If the price decreases, the middle Bollinger Band at around $0.9325 could act as instantaneous support. A continued fall might then test the lower support level at approximately $0.6702.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-18 12:09