As a seasoned analyst with over two decades of experience in global financial markets, I must say that the recent surge in Bitcoin’s price is nothing short of remarkable. The confluence of factors driving this bullish trend is truly fascinating, from central bank policies to institutional adoption and even national-level investment.

The cost of Bitcoin climbed up to an essential barrier point, as traders adopted a more optimistic stance following the accommodative interest rate announcement.

Bullish catalysts for Bitcoin

For the first time since August 9th, the value of Bitcoin (BTC) surged to the significant level at $64,000. This move propels it into a technical bull trend, as it rose more than 20% from its lowest price this month.

The current pricing trends are primarily a result of the Federal Reserve’s decision on Wednesday, where they reduced interest rates by half a percentage point and indicated potential for further reductions throughout this year.

After the Bank of Japan decided not to lower interest rates, despite the high inflation rate in the country persisting, this decision seemed to speed up or accelerate whatever was happening. If the Bank of Japan had cut rates, there would have been concerns about unwinding the Japanese yen carry trade, which could have caused a drop in most assets during August.

In recent times, institutional investors as well as countries have been consistently purchasing Bitcoin and related ETFs. Over the past five trading days, these Bitcoin ETF purchases amounted to more than $567 million.

MicroStrategy has continued buying coins, bringing its total holdings to over 252,000. Its Bitcoin holdings have made it an unrealized profit of over $5.95 billion.

MicroStrategy has purchased approximately 7,420 Bitcoins for around $458.2 million, equating to roughly $61,750 per Bitcoin. This transaction has given them a Quarter-to-Date (QTD) Bitcoin Yield of 5.1% and Year-to-Date (YTD) yield of 17.8%. As of September 19, 2024, they hold a total of 252,220 Bitcoins, which were acquired for approximately $9.9 billion, with each Bitcoin costing around $39,266. The symbol for MicroStrategy is $MSTR.

— Michael Saylor⚡️ (@saylor) September 20, 2024

At the moment, the government of El Salvador possesses approximately 5,800 coins, adding to their collection this past week. On the other hand, Bhutan’s coin reserve exceeds $800 million, which is a significant amount given that the country’s GDP stands at only $3 billion.

Bitcoin experienced an increase in value as the Fear & Greed Index shifted from the “Fear” region to the more balanced “Neutral” level at 46. Historically, cryptocurrencies tend to perform favorably when this index rises.

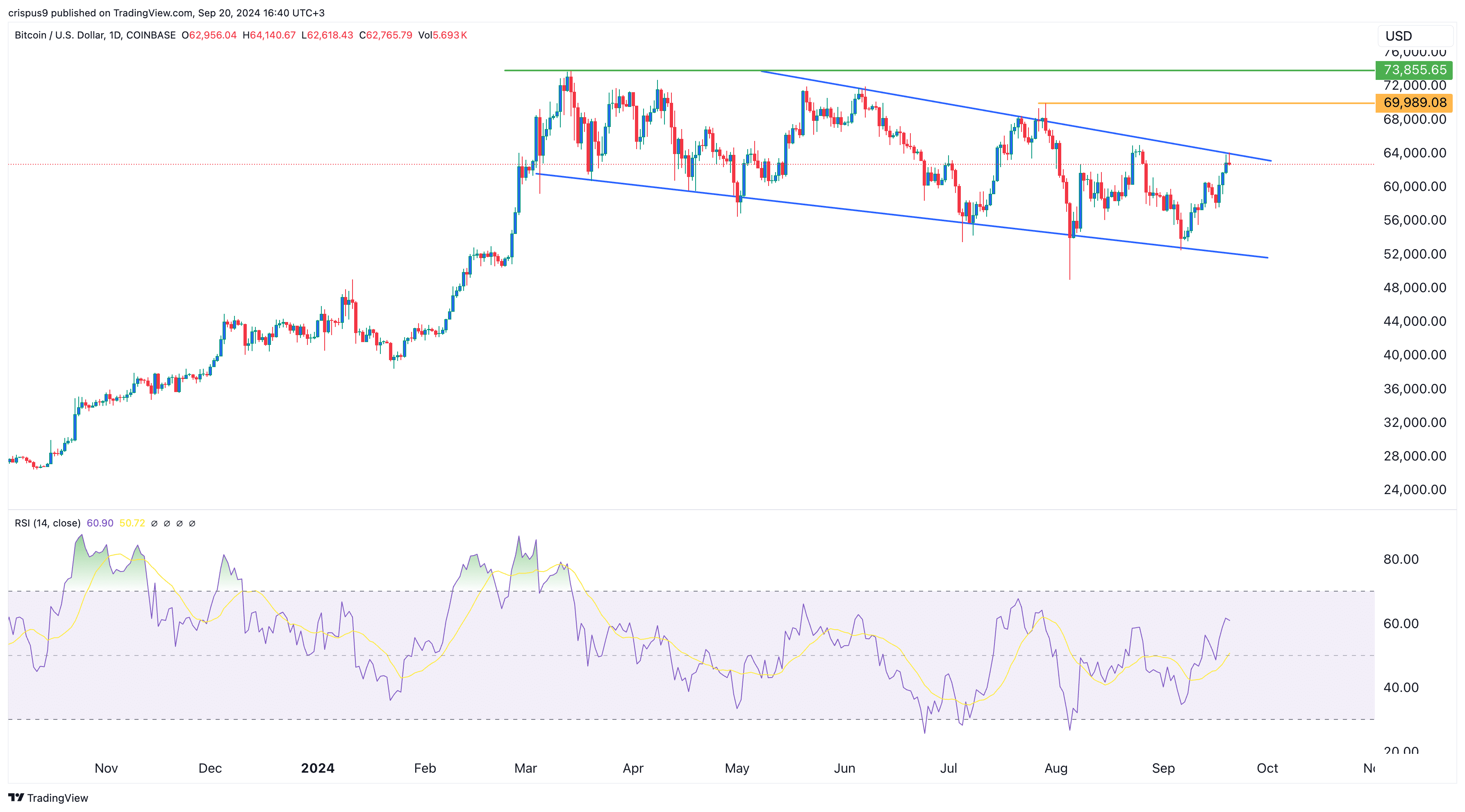

Bitcoin hits a key resistance

On a day-to-day scale, Bitcoin has climbed to a significant barrier at around $64,000. This price point aligns with a downward trendline that links the highest peaks since June 7th. Previously, it encountered strong resistance whenever it tried to surpass this level in July and August.

If bulls fail to push the coin’s value beyond that point, there’s a possibility of a sudden downturn. This potential setback could be triggered by the approaching Triple Witching event on Wall Street, where options worth approximately $5.1 trillion expire on September 20th. Historically, such events have been followed by a decline in stock prices the following week. Given this pattern, it’s plausible that Bitcoin might experience a similar price dip under these circumstances.

Conversely, if Bitcoin bounces back robustly beyond this resistance level, the chances increase for it reaching $70,000 – a significant psychological milestone and its peak in July. A fully bullish breakout will only be evident if it surpasses its all-time high.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-20 17:22