As a seasoned cryptocurrency researcher with over a decade of experience in the digital asset market, I find the recent surge of TIA, the native token of Celestia, particularly intriguing. With my fingers perpetually glued to the keyboard tracking market trends and news, I’ve witnessed numerous projects rise and fall. However, the potential of Celestia has always caught my attention, given its innovative modular blockchain network.

In simple terms, the digital currency known as TIA (Token Issuance Algorithm), which is used on the decentralized blockchain platform Celestia, experienced a 14% increase in value following the announcement of their second funding phase.

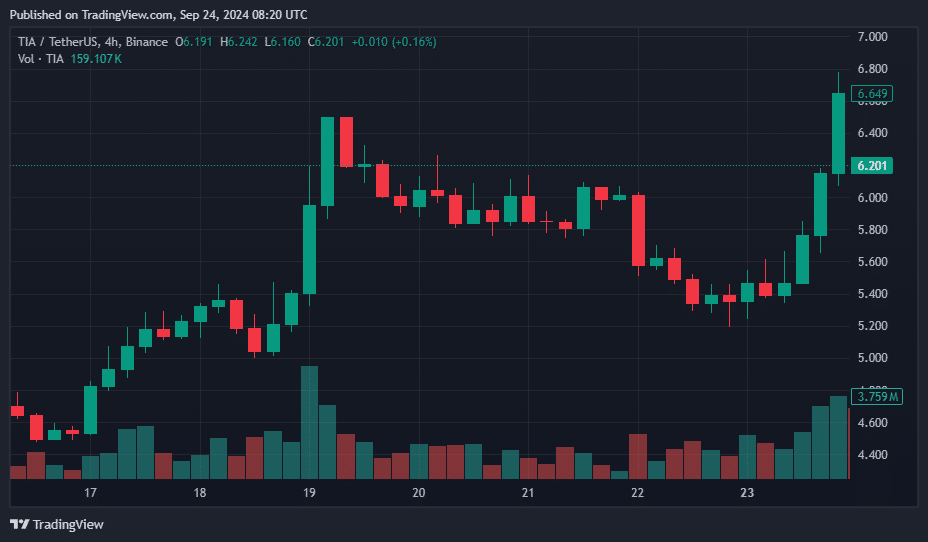

Currently, Celestia (TIA) is being traded at $6.2, reaching an intraday peak of $6.86 – a jump of more than 40% since its weekly low. The token’s trading volume for the day has nearly doubled compared to the previous day, amounting to $410 million.

Currently, with a market cap of $1.34 billion, TIA has solidified its rank as the 65th biggest cryptocurrency, as reported by CoinGecko. Lately, thanks to a surge in price, it’s also been recognized as a top trending coin on the crypto data platform.

Regardless of the recent surge, TIA needs a 69.8% increase to surpass its historical peak of $20.85, which it reached in February.

The surge in TIA‘s price can be attributed to a significant event: The Celestia Foundation has increased its investment by an additional $100 million, bringing their total funding to $155 million. This fundraising round occurred at the same time that Celestia’s core development team revealed their technical roadmap. These positive developments have been noted by traders as promising signs for the project.

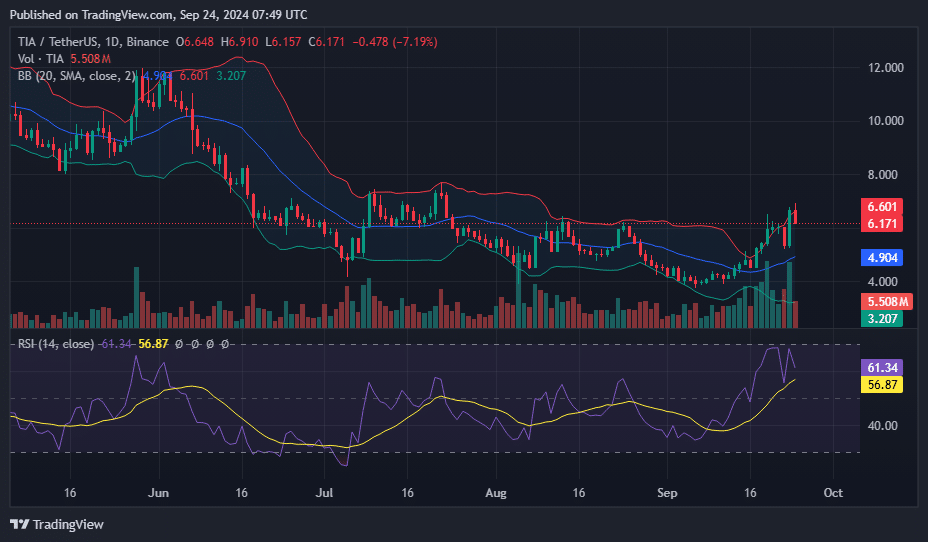

Eyes on $6.60 resistance level

Currently, TIA‘s price stands at $6.171, slightly undermining the upper Bollinger Band at $6.601. This implies that the token may have faced resistance close to the upper band, causing a significant decline, with the price now being close to the middle band.

The Relative Strength Index RSI is at 56.87, retreating from overbought levels, which points to weakening bullish momentum. However, the RSI is still above the neutral zone, signaling that there is room for potential upward movement if buyers step in.

Should TIA manage to recover and surpass the $6.60 barrier, it might continue climbing, aiming for $7 next. However, if it fails to uphold its current support, a possible drop may ensue, with the middle Bollinger Band at approximately $4.994 acting as an initial safety net. Investors should be mindful of potential price stabilization or increased volatility close to these crucial points.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-09-24 12:07