As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself intrigued by the current state of GMX token. While it’s encouraging to see a 44% surge from its yearly low and a market cap over $244 million, the flat performance on Tuesday, Sept. 24, is a bit concerning.

On Tuesday, September 24th, the price of GMX tokens held steady, while many cryptocurrencies continued to stabilize, and trading activity within its system decreased.

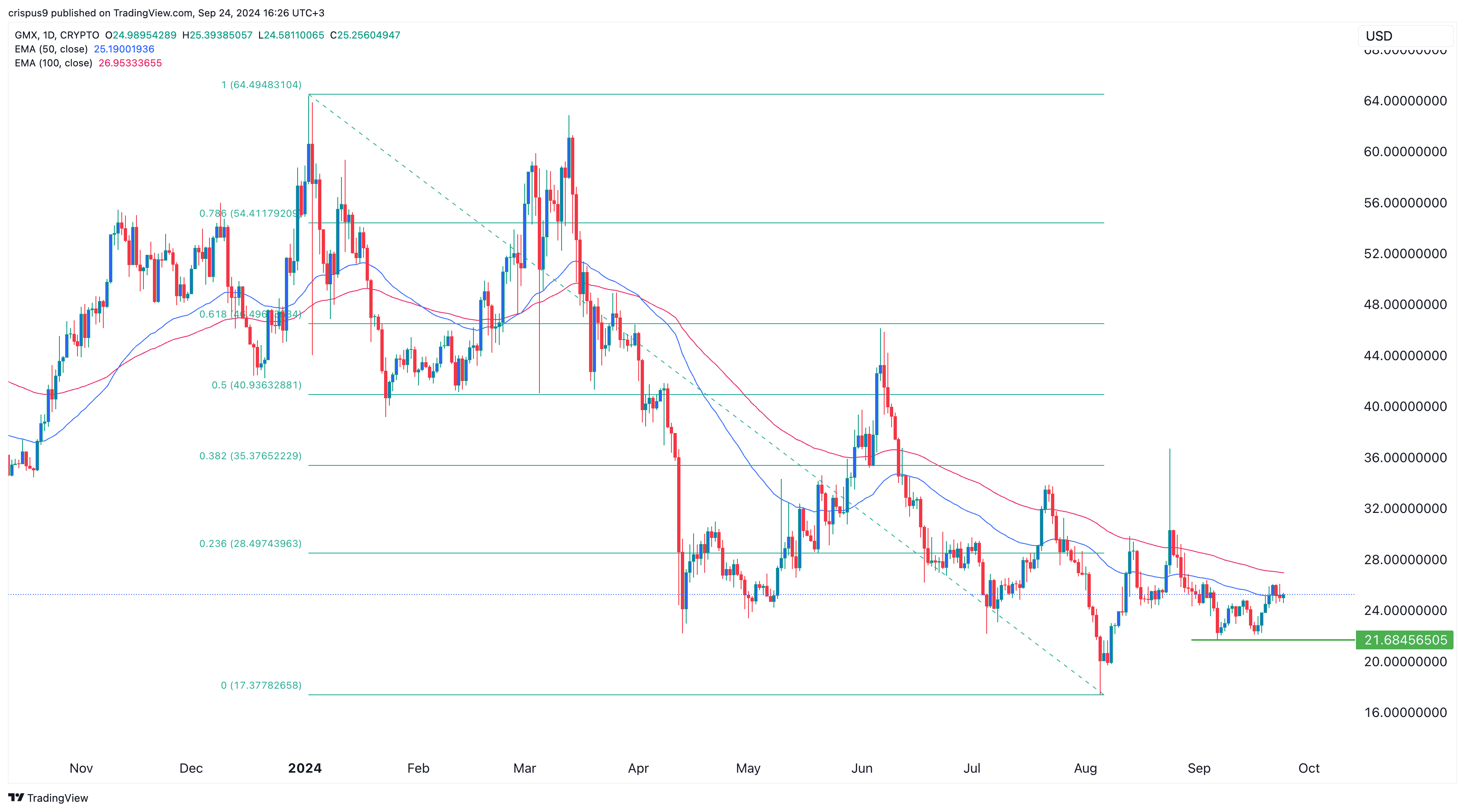

Currently, the stock GMX is being traded at around $25.2, which is slightly above the lowest point this month of $21.55. It has experienced a surge of over 44% from its minimum value this year, resulting in a market capitalization exceeding $244 million.

In recent weeks, the volume for GMX, a prominent figure in the on-chain perpetual futures sector, has noticeably decreased.

According to DeFi Llama’s data, the platform managed approximately $144 million within the last day and about $924 million over the past week. However, it has been surpassed by Hyperliquid, which traded futures tokens valued at more than $7.6 billion during this timeframe.

Additionally, GMX has been outperformed by other decentralized trading platforms such as dYdX, Satori Finance, Orderly Network, and Jojo in terms of performance and popularity.

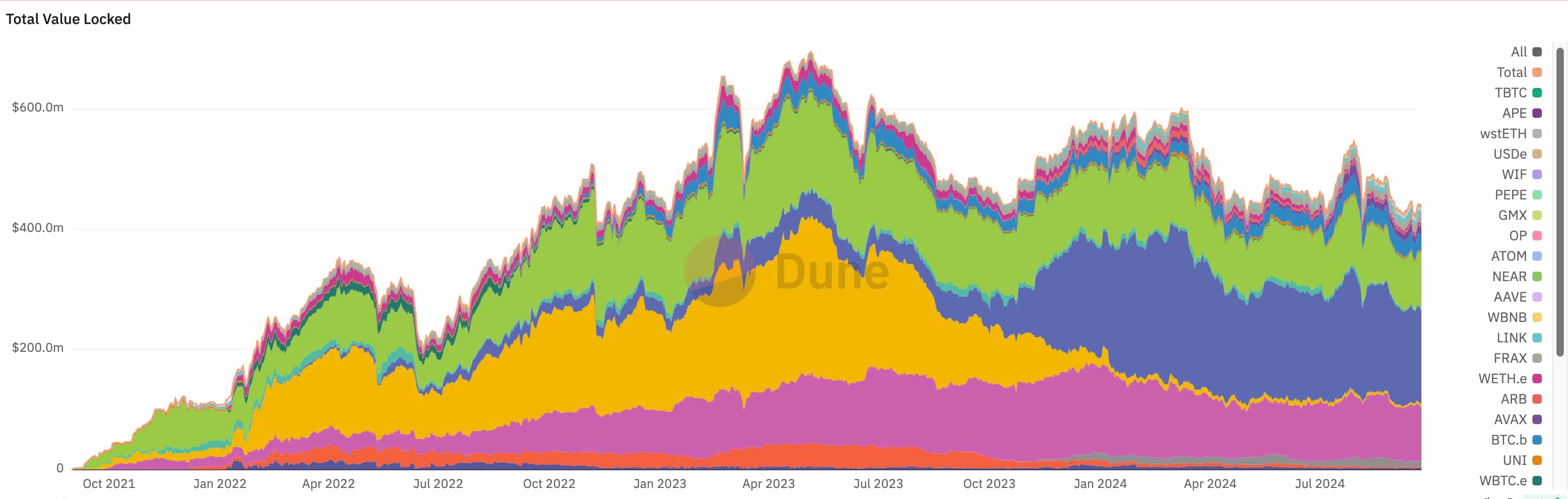

Based on Dune Analytics data, the combined worth of assets secured in GMX across all chains decreased from approximately $692 million in the year 2023 to $440 million.

GMX aims to reclaim a significant portion of the market by unveiling fresh, cutting-edge offerings. Just recently, they rolled out the kin-borrowing mechanism in every market, potentially increasing liquidity by approximately 30% to 40%.

As a researcher delving into blockchain technology, I find myself intrigued by the rumblings that GMX could be imminently operational on Solana (SOL), a chain that’s been making waves across the industry. The team behind GMX is actively developing staking functionalities, which will empower users to earn rewards. Furthermore, there’s been a recent consensus among members to broaden the revenue distribution methods within the network, as decided in July.

As a crypto investor, I’m excited to announce that the buyback process has commenced for GMX. Soon, it will be deployed on Solana, marking a significant step forward in its DeFi journey. The revival narrative for strong DeFi projects is becoming increasingly evident, and GMX stands at the deepest end of the pool when it comes to on-chain liquidity among Perpetual Decentralized Exchanges (DEX). Historically, an increase in market volume has been a positive indicator for GMX’s growth. Therefore, let’s keep our eyes on this promising project!— Jonezee 🫐 (@Jonas_ALA) September 23, 2024

Just like other forward-looking networks, GMX has experienced a decrease in transaction volume over the past few months. The highest transaction volume was recorded at an impressive $321 billion in March, coinciding with Bitcoin (BTC) hitting an all-time high of $73,800. As of September, the monthly transaction volume stands at approximately $291 billion, according to DeFi Llama.

GMX token is still under pressure

Despite surging more than 40% from its lowest point in 2022, the GMX token continues to struggle under pressure. Instead of turning these moving averages into supportive bases for future growth, it has failed to do so.

GMX continues to linger below the 23.6% Fibonacci retracement threshold, signaling that bears continue to dominate. As a result, it’s expected that the GMX token could resume its downward trajectory and potentially revisit this month’s low of $21.68.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-24 16:46