As a seasoned crypto investor with years of experience navigating the volatile cryptocurrency market, I find myself watching Toncoin (TON) with a mix of intrigue and concern. Despite its strong on-chain metrics – such as an impressive increase in activated wallets and a rise in daily burns – it’s hard to ignore the bearish trend that has gripped the token.

Despite robust on-chain performance indicators, the Toncoin token continued to be affected by a prolonged downtrend, potentially leading to the ominous ‘death cross’ chart formation.

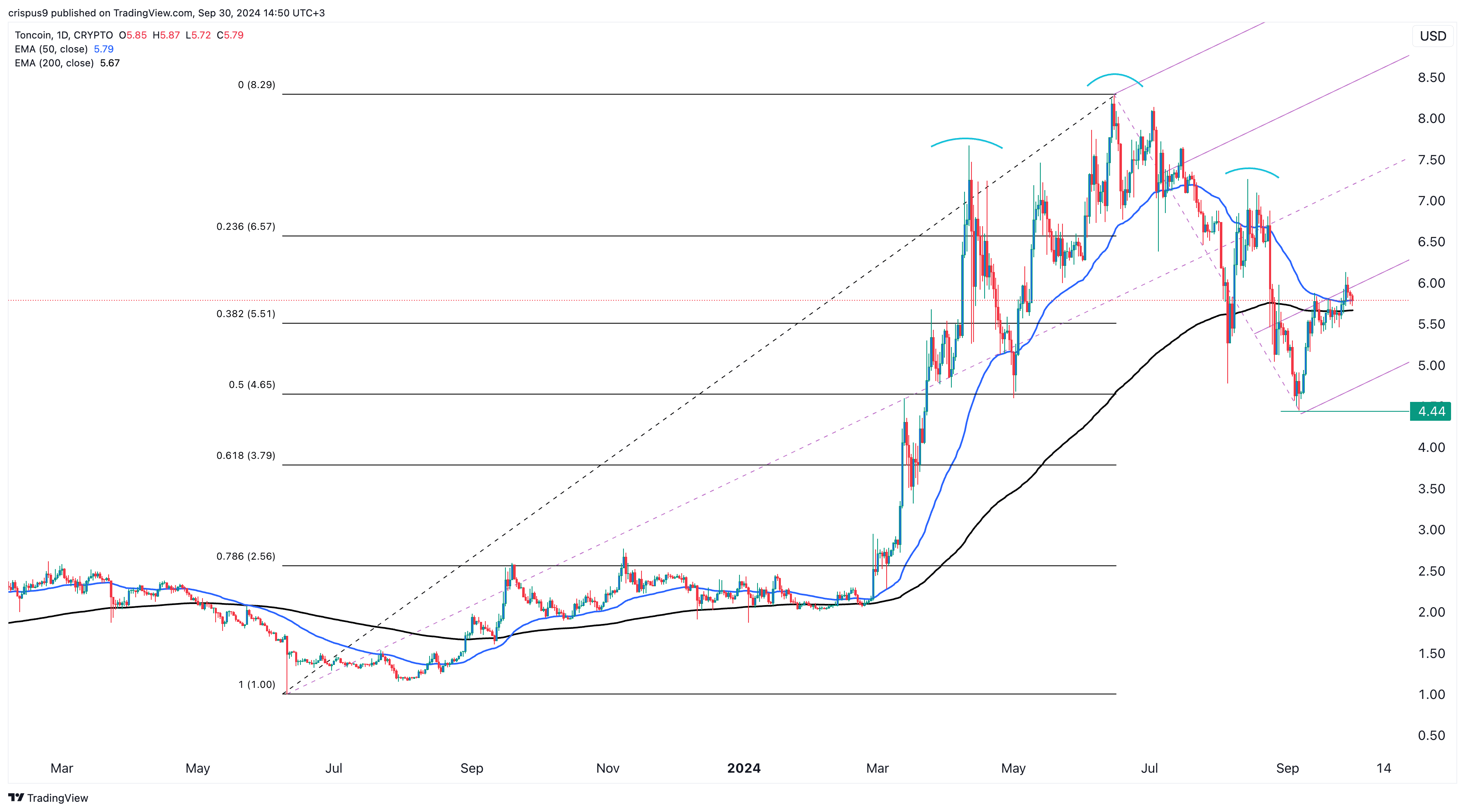

Toncoin (TON) was trading at $5.81 on Monday, Sep. 30, down by over 30% from the year-to-date high.

Strong on-chain metrics

It was found that the count of active wallets linked to the blockchain reached more than 20.8 million, which represents a substantial jump compared to the 1.1 million recorded in January’s lowest points.

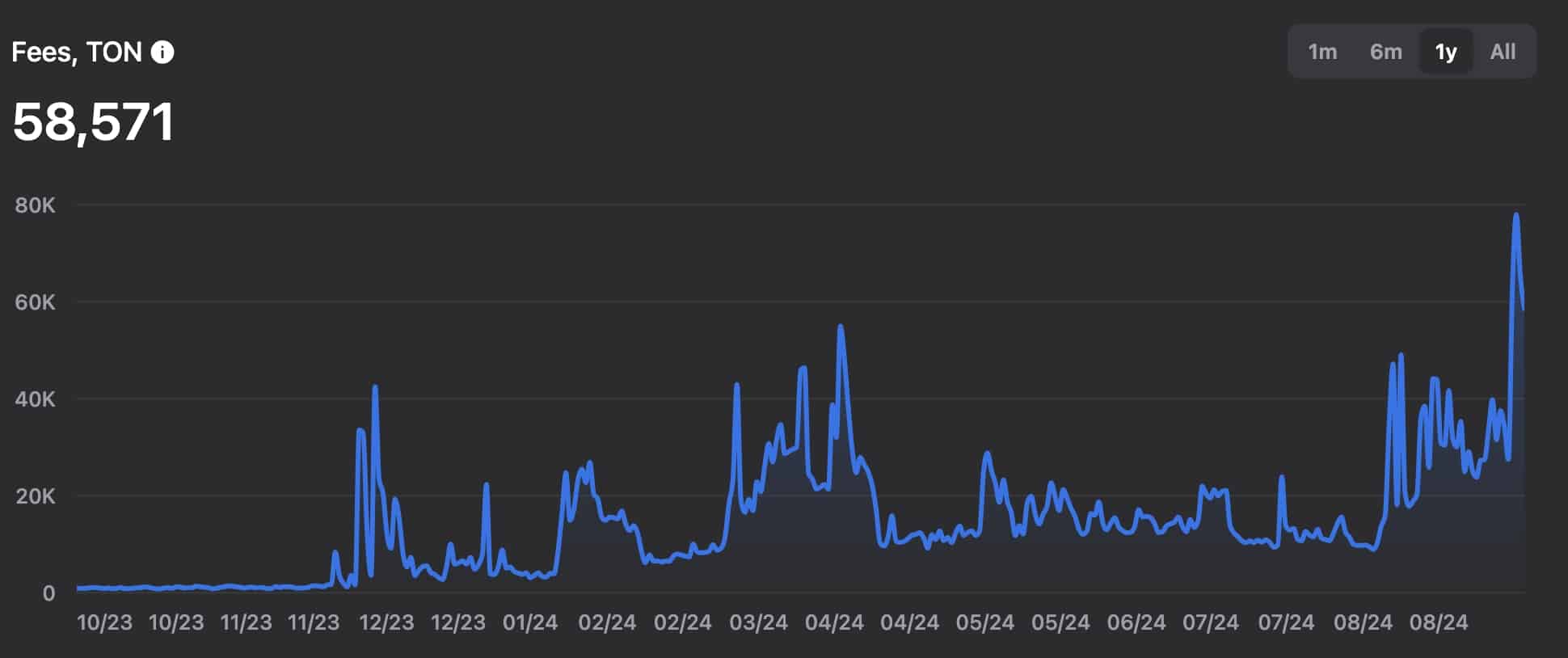

Furthermore, the daily rate at which Toncoins are destroyed has been steadily increasing, peaking at nearly 39,000 as a yearly maximum so far. This destruction process coincides with a significant decrease in the minting of new Toncoins, falling from this month’s high of over 50,000 to just 39,000.

Role in DeFi is fading

It appears that Toncoin’s price might have decreased because it has become less significant within the Decentralized Finance (DeFi) sector. The value locked within its network, which was approximately $765 million in July, is now around $427 million.

As a researcher, I’ve observed an intriguing shift in the Decentralized Finance (DeFi) landscape. From being a prominent top ten player, TON has now found itself ranked 20th among the chains. Remarkably, smaller platforms like Core, Mode, Mantle, and Linea have outpaced it in the past few weeks, signifying a notable transformation within our industry.

The decrease in Toncoin’s value is attributed to two factors: Pavel Durov’s recent arrest in France and the performance of its earnings tokens through tapping. Similarly, Hamster Kombat experienced a significant drop of nearly 60%, reaching this low after its latest airdrop launch last week.

In a similar vein, Notcoin (NOT) plummeted by 71%, whereas Catizen (CATI) sank by 50% from their peak values. Remarkably, the majority of recently debuted Telegram’s earn-to-tap tokens have reached all-time lows.

As a researcher, I’ve noticed that Toncoin’s futures open interest dipped to approximately $260 million on September 30, marking a decline from the year-to-date peak of over $360 million. This decrease brings us back to levels last seen on September 12, suggesting a potential decrease in demand for Toncoin futures.

Toncoin price analysis

As an analyst, I’m observing a significant downtrend in Toncoin’s token value, with a decline of more than 30% from its highest point this year. Currently, the 50-day and 200-day Exponential Moving Averages (EMA) are approaching a potential ‘death cross’ formation. Notably, the last time such a pattern emerged in May of last year, it led to a drop exceeding 50%. This trend suggests caution for potential investors.

Additionally, TON exhibits a head-and-shoulders formation and a rounding top pattern. At present, it stays beneath the initial support line drawn by the Andrew’s pitchfork indicator and the 23.6% Fibonacci retracement level.

If Toncoin doesn’t manage to surpass its 50-day and 200-day moving averages, there’s a possibility that it could experience a bearish drop towards its September low of $4.45.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-09-30 21:38