As a seasoned researcher with extensive experience in the crypto market, I find myself deeply intrigued by the recent developments surrounding FTX and its clients’ compensation plan. It appears that the community is not satisfied with the proposed payout range of 10% to 25% of the deposited crypto assets, and speculation abounds regarding the timing of these payments.

It seems users found it perplexing when they learned that FTX clients might only recover between 10% to 25% of the original value of their deposited cryptocurrencies. What could have led to this situation?

Sunil Kavuri, one of the creditors, has shared that more adjustments are anticipated within the restructuring proposal they’ve proposed. A particular detail – the level of victim compensation payouts – has sparked discussion and raised queries among the local community.

Table of Contents

What is known about the compensation plan

In case of bankruptcy, the value assigned to crypto assets held within the platform will correspond to the rate at the time of filing. Consequently, the potential payout may fall within a range of 10% to 25% relative to the current market value of the deposited cryptocurrency.

FTX is distributing 18% of the seized assets by the Department of Justice, up to a total of $230 million, among FTX’s shareholders (as an additional provision).

— Sunil (FTX Creditor Champion) (@sunil_trades) September 28, 2024

Shareholders of FTX will additionally gain 18%, up to a maximum of $230 million, from the assets seized by the U.S. Department of Justice. This extra provision serves to enhance the portion held by preferred shareholders.

As a crypto investor, I’ve noticed a growing unease among us regarding the payment terms, with some even labeling it as suspicious or fraudulent. A fellow investor has raised an intriguing point: the payment schedule could be influenced by the fact that a significant number of FTX shareholders are either Sullivan & Cromwell (acting for FTX’s debtors) or Quinn Emanuel’s clients, who are hired by the new management to act as conflict counsel. Both these law firms are currently working on recovering assets from the bankrupt exchange’s clients. This connection is causing some concern among the community, and it’s essential that transparency is maintained to alleviate any doubts.

A large majority of FTX’s shareholders are represented by either Sullivan & Cromwell or Quinn Emanuel in this case. I will also verify if the other bankruptcy professionals working with FTX fall under these two law firms as well.

— Historian on the FTX Scam (@historian_ftx) September 29, 2024

The community speculates on the timing of compensation payments

Efforts are being made to send back money to FTX users who were impacted by its failure. There’s been talk about when these refunds will be issued, but rumors on the internet suggest that FTX cryptocurrency holders might start receiving their payments as soon as September 30th.

However, this was soon refuted — according to the latest data from the bankruptcy case materials under Chapter 11, the court is still studying a compensation plan.

According to the court filing, the next hearing to confirm the restructuring plan is set for October 7th. If this plan gets approved by the court, payments on claims less than $50,000 could potentially start towards the end of 2024. On the other hand, others may receive their compensation during the early months of 2025.

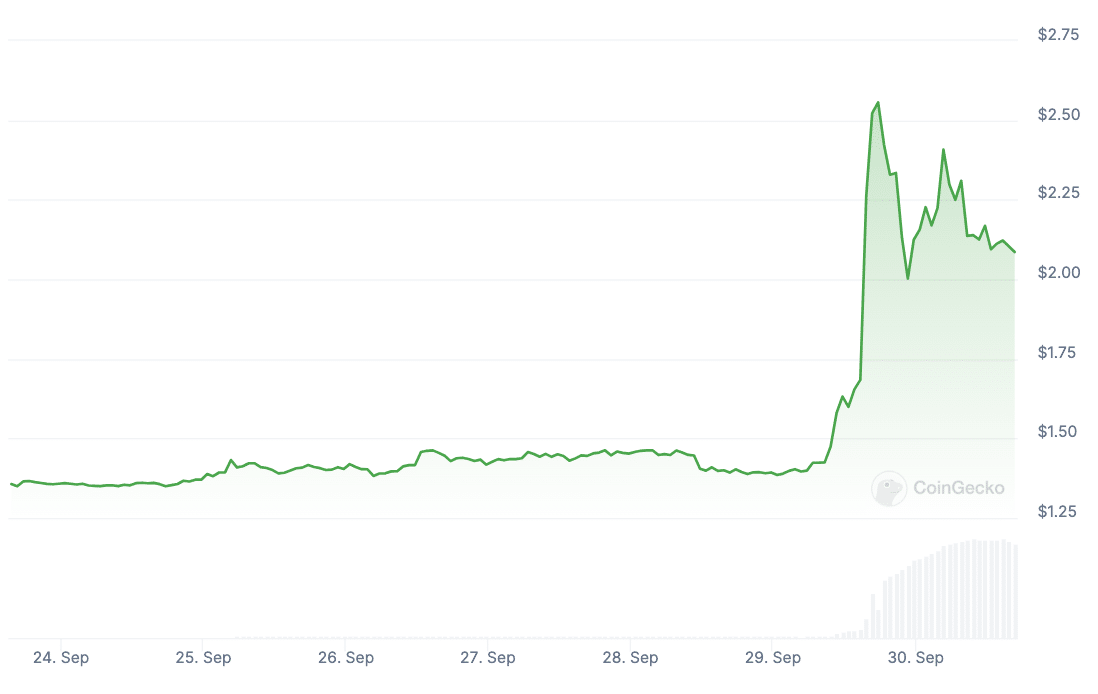

FTT Reacts With Growth

In light of current developments, investor enthusiasm for FTX has grown significantly. With whispers of the once-troubled cryptocurrency exchange starting to repay funds, optimism among investors is on the rise. This positive turn could potentially trigger a flow of around $16 billion back into the market.

On September 29th, the FTX token (FTT) experienced a staggering increase of 113% within just one day. However, as the day progressed, the price adjustment took place, resulting in a drop. At the moment of this writing, the price stood at $2.11.

Where did the client funds go?

Initially valued at $32 billion, FTX reportedly utilized funds from its clients for high-risk ventures via its linked hedge fund, Alameda Research. Probes found that the firm employed client funds to offset losses in various interconnected enterprises as well as to finance questionable investment transactions.

Initially, FTX’s massive financial shortfall became apparent when customers sought their original investments. Following FTX’s bankruptcy filing, a reorganization process was launched to return funds to clients. However, the specific details surrounding the missing funds and their destinations were still under investigation at that time. In all, the exchange is estimated to owe around $9 billion.

Victims are waiting, and the culprits are serving their sentences

The collapse of FTX caused tremors throughout the cryptocurrency market, causing fluctuations in various coin prices. This event also sparked apprehension among users and regulatory bodies regarding the safety and accountability of crypto trading platforms. In response, a reimbursement strategy has been devised, while the exchange’s leading executives are facing consequences, one by one.

According to recent reports, Sam Bankman-Fried faced accusations of fraud, money laundering, and various financial offenses in connection with the administration of FTX and client transactions. These allegations stem from the claim that he utilized customer funds to finance other ventures, such as Alameda Research, a trading firm. In March, it was decided that he would serve a 25-year prison term.

Caroline Ellison, a previous CEO at Alameda Research, was given a two-year prison sentence and ordered to forfeit $11 billion due to fraud and money laundering allegations. However, her active assistance in the investigation of Bankman-Fried lessened the severity of the verdict. The judge highlighted that the fall of FTX represents one of the most notable financial crimes, and Ellison’s cooperation does not absolve her from accountability. She confessed to her wrongdoings and expressed remorse to the affected parties.

As a researcher, I am currently monitoring the legal proceedings following the conviction of the former Alameda CEO. Now, the focus has shifted to other individuals involved in the case, including FTX co-founder and CTO Gary Wang, as well as head of engineering Nishad Singh, who are all awaiting court decisions concerning their own cases.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-09-30 21:52